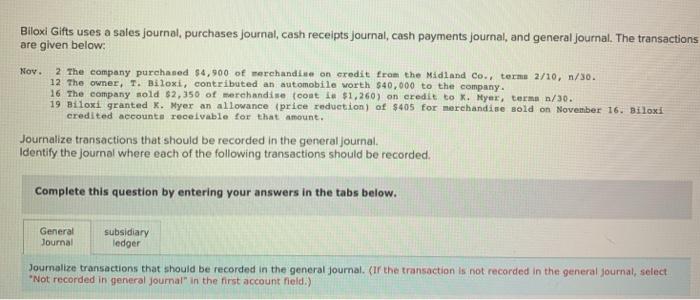

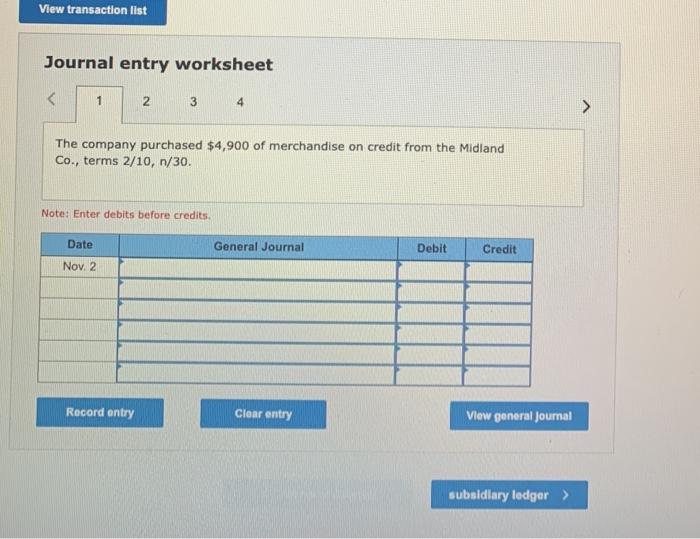

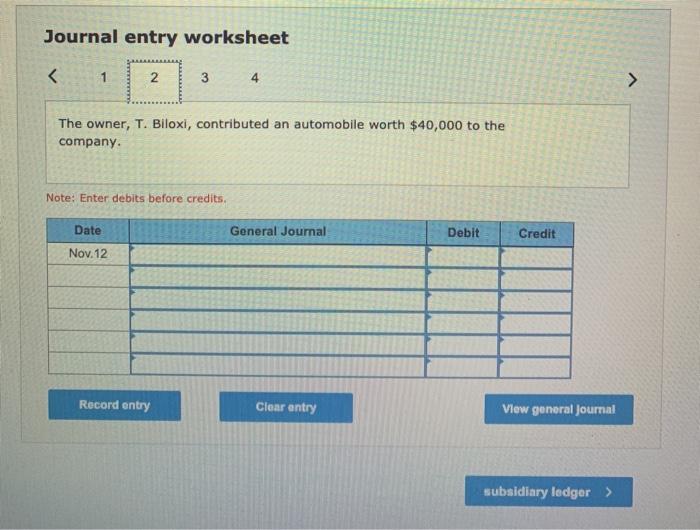

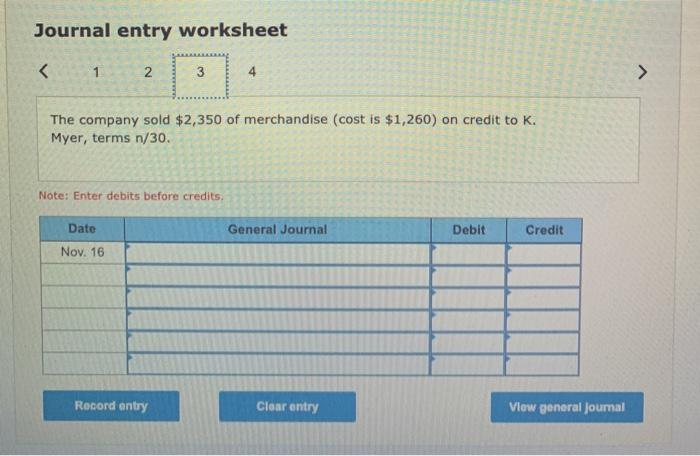

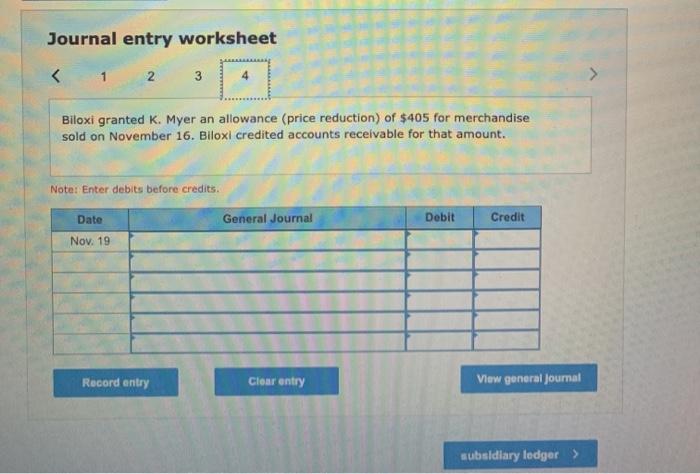

Biloxi Gifts uses a sales journal purchases Journal, cash receipts Journal, cash payments Journal, and general Journal. The transactions are given below: Nov. 2 The company purchased $4,900 of merchandise on credit from the Midland Co., terma 2/10, n/30. 12 The owner, T. Biloxi, contributed an automobile worth $40,000 to the company. 16 The company sold $2,350 of merchandise (cost le $1,260) on credit to K. Nyer, term n/30. 19 Biloxi granted X. Myer an allowance price reduction) of $405 for merchandise sold on November 16. Biloxi credited accounts receivable for that amount. Journalize transactions that should be recorded in the general journal. Identify the journal where each of the following transactions should be recorded. Complete this question by entering your answers in the tabs below. Journal subsidiary ledger Joumalize transactions that should be recorded in the general Journal. (Ir the transaction is not recorded in the general Journal, select "Not recorded in general Journal" in the first account held.) View transaction list Journal entry worksheet 1 2 3 4 The company purchased $4,900 of merchandise on credit from the Midland Co., terms 2/10, n/30. Note: Enter debits before credits. Date General Journal Debit Credit Nov 2 Record entry Clear entry View general Journal subsidiary ledger > Journal entry worksheet 1 N 3 4 > The owner, T. Biloxi, contributed an automobile worth $40,000 to the company. Note: Enter debits before credits. Date General Journal Debit Credit Nov.12 Record entry Clear entry View general Journal subsidiary ledger Journal entry worksheet The company sold $2,350 of merchandise (cost is $1,260) on credit to K. Myer, terms n/30. Note: Enter debits before credits General Journal Debit Credit Date Nov. 16 Record entry Clear entry View general Journal Journal entry worksheet 1 2 3 3 Biloxi granted K. Myer an allowance (price reduction) of $405 for merchandise sold on November 16. Biloxi credited accounts receivable for that amount. Note: Enter debits before credits. General Journal Debit Credit Date Nov. 19 Record entry Clear entry View general Journal subsidiary ledger >