Answered step by step

Verified Expert Solution

Question

1 Approved Answer

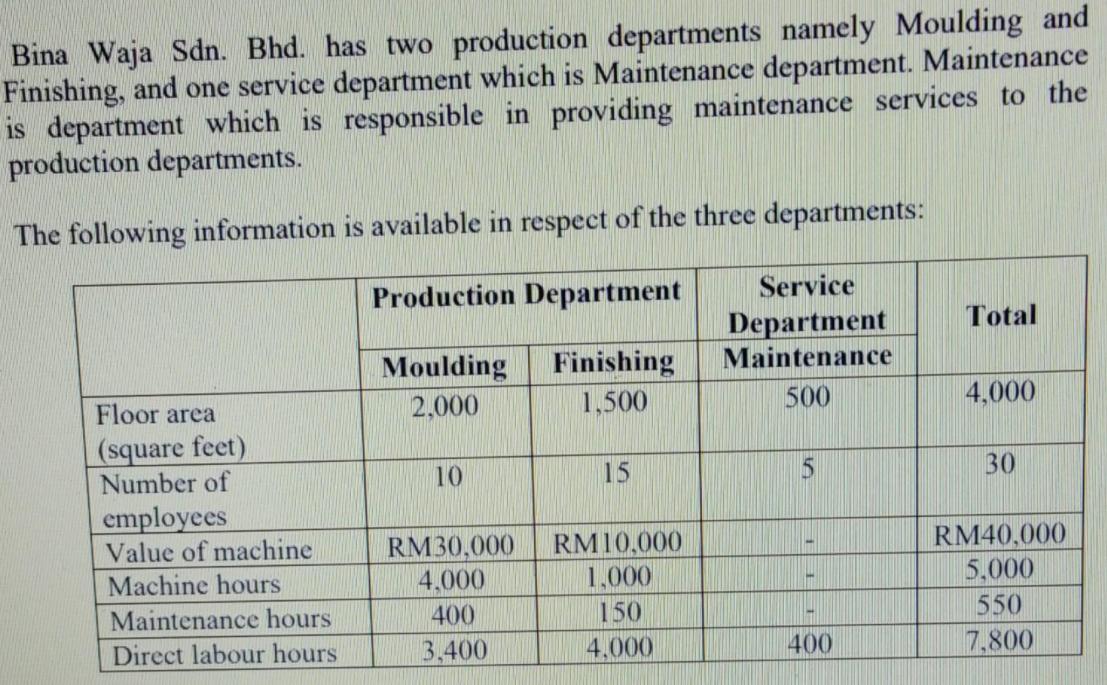

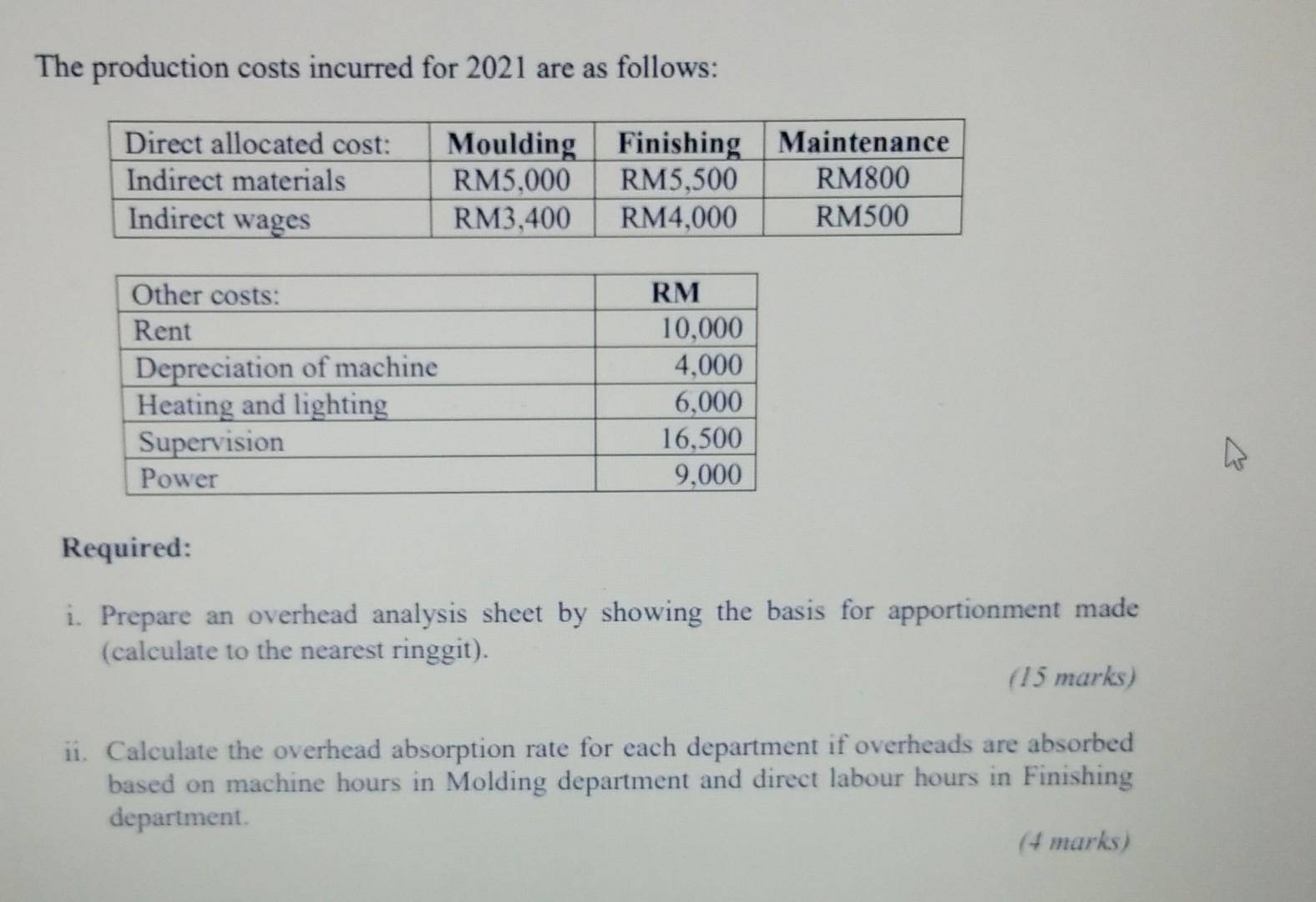

Bina Waja Sdn. Bhd. has two production departments namely Moulding and Finishing, and one service department which is Maintenance department. Maintenance is department which

Bina Waja Sdn. Bhd. has two production departments namely Moulding and Finishing, and one service department which is Maintenance department. Maintenance is department which is responsible in providing maintenance services to the production departments. The following information is available in respect of the three departments: Production Department Service Total Department Maintenance Moulding 2,000 Finishing 1,500 Floor area 500 4,000 (square feet) Number of 10 15 30 employees Value of machine. Machine hours RM30,000 4,000 RM10,000 1,000 RM40,000 5,000 Maintenance hours 400 150 550 Direct labour hours 3,400 4,000 400 7,800 The production costs incurred for 2021 are as follows: Moulding Finishing Maintenance RM5,500 RM4,000 Direct allocated cost: Indirect materials RM5,000 RM800 Indirect wages RM3,400 RM500 Other costs: RM 10,000 4,000 Rent Depreciation of machine Heating and lighting Supervision Power 6,000 16,500 9,000 Required: i. Prepare an overhead analysis sheet by showing the basis for apportionment made (calculate to the nearest ringgit). (15 marks) ii. Calculate the overhead absorption rate for each department if overheads are absorbed based on machine hours in Molding department and direct labour hours in Finishing department. (4 marks) Bina Waja Sdn. Bhd. has two production departments namely Moulding and Finishing, and one service department which is Maintenance department. Maintenance is department which is responsible in providing maintenance services to the production departments. The following information is available in respect of the three departments: Production Department Service Total Department Maintenance Moulding 2,000 Finishing 1,500 Floor area 500 4,000 (square feet) Number of 10 15 30 employees Value of machine. Machine hours RM30,000 4,000 RM10,000 1,000 RM40,000 5,000 Maintenance hours 400 150 550 Direct labour hours 3,400 4,000 400 7,800 The production costs incurred for 2021 are as follows: Moulding Finishing Maintenance RM5,500 RM4,000 Direct allocated cost: Indirect materials RM5,000 RM800 Indirect wages RM3,400 RM500 Other costs: RM 10,000 4,000 Rent Depreciation of machine Heating and lighting Supervision Power 6,000 16,500 9,000 Required: i. Prepare an overhead analysis sheet by showing the basis for apportionment made (calculate to the nearest ringgit). (15 marks) ii. Calculate the overhead absorption rate for each department if overheads are absorbed based on machine hours in Molding department and direct labour hours in Finishing department. (4 marks) Bina Waja Sdn. Bhd. has two production departments namely Moulding and Finishing, and one service department which is Maintenance department. Maintenance is department which is responsible in providing maintenance services to the production departments. The following information is available in respect of the three departments: Production Department Service Total Department Maintenance Moulding 2,000 Finishing 1,500 Floor area 500 4,000 (square feet) Number of 10 15 30 employees Value of machine. Machine hours RM30,000 4,000 RM10,000 1,000 RM40,000 5,000 Maintenance hours 400 150 550 Direct labour hours 3,400 4,000 400 7,800 The production costs incurred for 2021 are as follows: Moulding Finishing Maintenance RM5,500 RM4,000 Direct allocated cost: Indirect materials RM5,000 RM800 Indirect wages RM3,400 RM500 Other costs: RM 10,000 4,000 Rent Depreciation of machine Heating and lighting Supervision Power 6,000 16,500 9,000 Required: i. Prepare an overhead analysis sheet by showing the basis for apportionment made (calculate to the nearest ringgit). (15 marks) ii. Calculate the overhead absorption rate for each department if overheads are absorbed based on machine hours in Molding department and direct labour hours in Finishing department. (4 marks) Bina Waja Sdn. Bhd. has two production departments namely Moulding and Finishing, and one service department which is Maintenance department. Maintenance is department which is responsible in providing maintenance services to the production departments. The following information is available in respect of the three departments: Production Department Service Total Department Maintenance Moulding 2,000 Finishing 1,500 Floor area 500 4,000 (square feet) Number of 10 15 30 employees Value of machine. Machine hours RM30,000 4,000 RM10,000 1,000 RM40,000 5,000 Maintenance hours 400 150 550 Direct labour hours 3,400 4,000 400 7,800 The production costs incurred for 2021 are as follows: Moulding Finishing Maintenance RM5,500 RM4,000 Direct allocated cost: Indirect materials RM5,000 RM800 Indirect wages RM3,400 RM500 Other costs: RM 10,000 4,000 Rent Depreciation of machine Heating and lighting Supervision Power 6,000 16,500 9,000 Required: i. Prepare an overhead analysis sheet by showing the basis for apportionment made (calculate to the nearest ringgit). (15 marks) ii. Calculate the overhead absorption rate for each department if overheads are absorbed based on machine hours in Molding department and direct labour hours in Finishing department. (4 marks)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Overhead Analysis Sheet Overhead Basis of apportionment Moulding RM Finishing RM Maintenance RM Total RM Indirect Material Allocated W1 5000 5500 800 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started