Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bino Ltd produces suits in three separate production departments (viz. Cutting, Sewing and Finishing). Production is serviced by three service centres (viz. Material store,

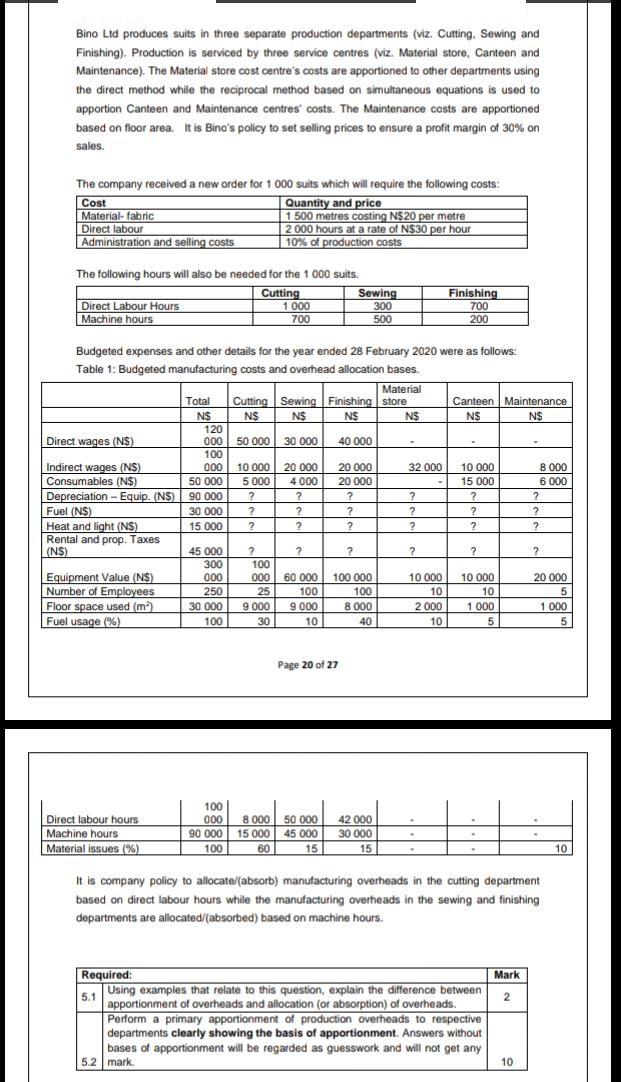

Bino Ltd produces suits in three separate production departments (viz. Cutting, Sewing and Finishing). Production is serviced by three service centres (viz. Material store, Canteen and Maintenance). The Material store cost centre's costs are apportioned to other departments using the direct method while the reciprocal method based on simultaneous equations is used to apportion Canteen and Maintenance centres' costs. The Maintenance costs are apportioned based on floor area. It is Bino's policy to set selling prices to ensure a profit margin of 30% on sales. The company received a new order for 1 000 suits which will require the following costs: Cost Material- fabric Direct labour Administration and selling costs Quantity and price 1 500 metres costing N$20 per metre 2 000 hours at a rate of N$30 per hour 10% of production costs The following hours will also be needed for the 1 000 suits. Sewing Finishing Direct Labour Hours Machine hours Cutting 1000 700 300 700 200 500 Budgeted expenses and other details for the year ended 28 February 2020 were as follows: Table 1: Budgeted manufacturing costs and overhead allocation bases. Material Cutting Sewing Finishing store N$ Total Canteen Maintenance N$ 120 000 100 000 N$ N$ N$ N$ N$ Direct wages (NS) 50 000 30 000 40 000 8 000 6 000 Indirect wages (NS) Consumables (NS) Depreciation - Equip. (NS) Fuel (N$) Heat and light (NS) Rental and prop. Taxes (NS) 10 000 20 000 20 000 32 000 10 000 50 000 5 000 4 000 20 000 15 000 90 000 ? ? ? ? 30 000 ? ? ? ? 15 000 ? 45 000 ? ? ? 300 000 100 000 Equipment Value (NS) Number of Employees Floor space used (m) Fuel usage (%) 100 000 100 9 000 10 60 000 10 000 10 10 000 20 000 250 25 100 10 5 30 000 8 000 9 000 30 2 000 1 000 1 000 100 40 10 Page 20 of 27 100 Direct labour hours 000 90 000 50 000 15 000 45 000 60 8 000 42 000 30 000 15 Machine hours Material issues (%) 100 15 10 It is company policy to allocate/(absorb) manufacturing overheads in the cutting department based on direct labour hours while the manufacturing overheads in the sewing and finishing departments are allocated/(absorbed) based on machine hours. Required: Using examples that relate to this question, explain the difference between Mark 5.1 apportionment of overheads and allocation (or absorption) of overheads. Perform a primary apportionment of production overheads to respective departments clearly showing the basis of apportionment. Answers without bases of apportionment will be regarded as guesswork and will not get any 5.2 mark. 2 10

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Apportionment and allocation of overhead Overheads cost apportionment means distribution of expenses which benefit is taken by more then one de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started