Answered step by step

Verified Expert Solution

Question

1 Approved Answer

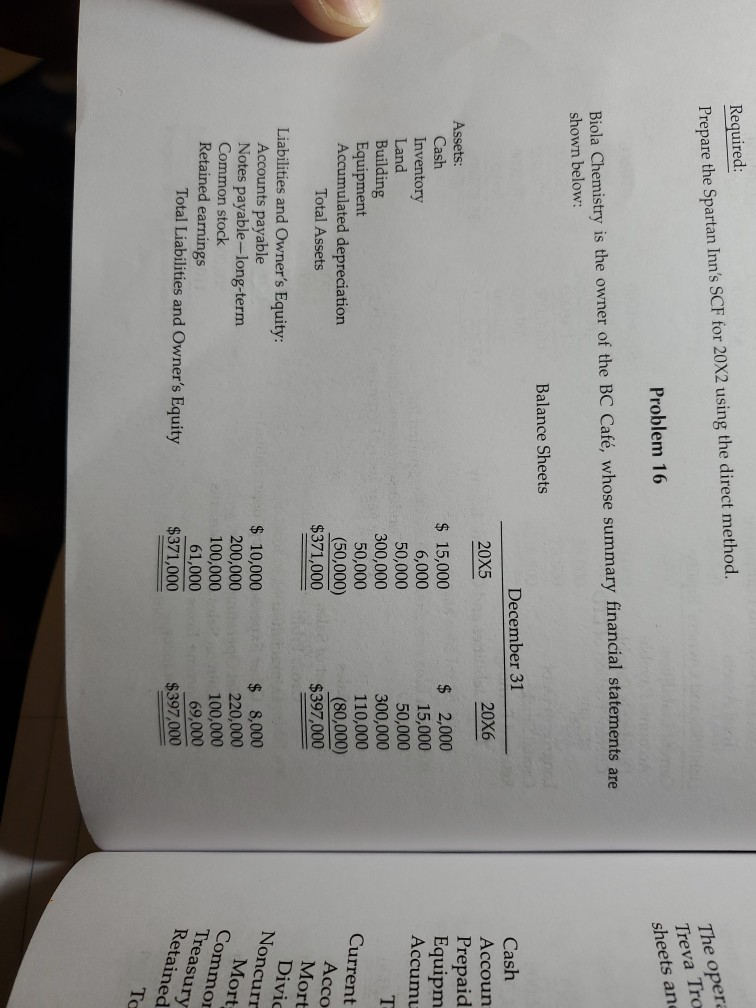

Biola Chemistry is the owner of the BC Cafe, whose summary financial statement are shown below: Required: Prepare the Spartan Inn's SCF for 20X2 using

Biola Chemistry is the owner of the BC Cafe, whose summary financial statement are shown below:

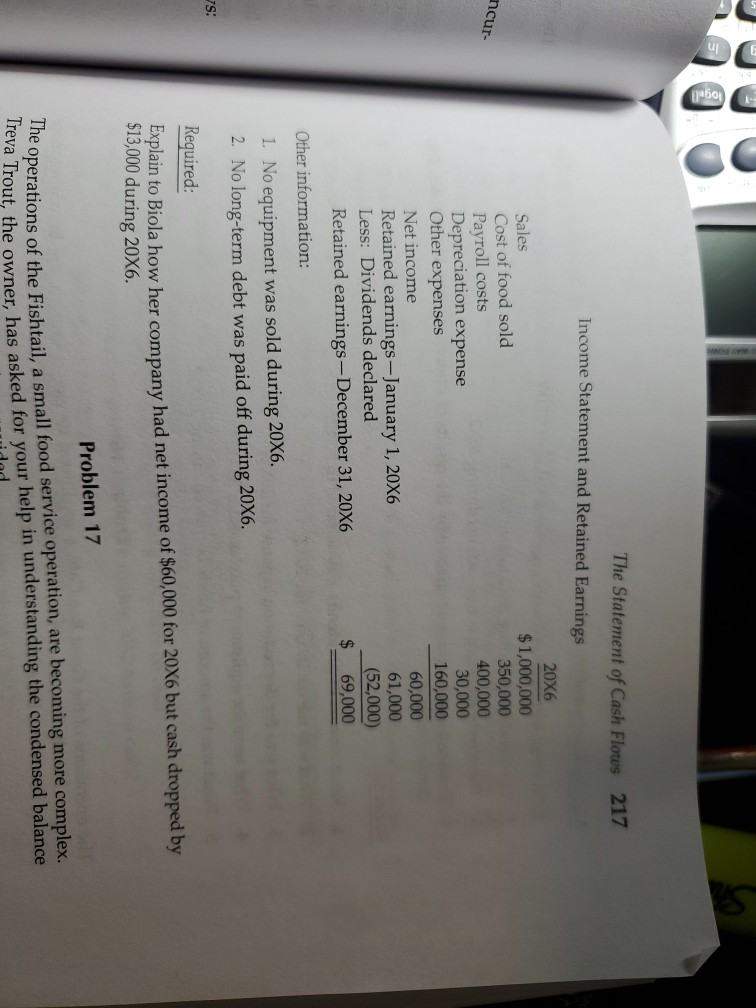

Required: Prepare the Spartan Inn's SCF for 20X2 using the direct method. The opera Treva Tra Problem 16 sheets and Biola Chemistry is the owner of the BC Caf, whose summary financial statements are shown below: Balance Sheets December 31 20X5 20X6 Assets: Cash Inventory Land Building Equipment Accumulated depreciation Total Assets $ 15,000 6,000 50,000 300,000 50,000 (50,000) $ 2,000 15,000 50,000 300,000 110,000 (80,000) $397,000 Cash Accoun Prepaid Equipm Accumu T Current Acco $371,000 Liabilities and Owner's Equity: Accounts payable Notes payable-long-term Common stock Retained earnings Total Liabilities and Owner's Equity $ 10,000 200,000 100,000 61,000 $371,000 $ 8,000 220,000 100,000 69,000 $397,000 Mort Divic Noncurr Mort Commor Treasury Retained 300 ncur- The Statement of Cash Flows 217 Income Statement and Retained Earnings 20X6 Sales $1,000,000 Cost of food sold 350,000 Payroll costs 400,000 Depreciation expense 30,000 Other expenses 160,000 Net income 60,000 Retained earnings - January 1, 20X6 61,000 Less: Dividends declared (52,000) Retained earnings-December 31, 20X6 69,000 Other information: 1. No equipment was sold during 20X6. 2. No long-term debt was paid off during 20X6. 1S: Required: Explain to Biola how her company had net income of $60,000 for 20x6 but cash dropped by $13,000 during 20X6. Problem 17 The operations of the Fishtail, a small food service operation, are becoming more complex. Treva Trout, the owner, has asked for your help in understanding the condensed balance Required: Prepare the Spartan Inn's SCF for 20X2 using the direct method. The opera Treva Tra Problem 16 sheets and Biola Chemistry is the owner of the BC Caf, whose summary financial statements are shown below: Balance Sheets December 31 20X5 20X6 Assets: Cash Inventory Land Building Equipment Accumulated depreciation Total Assets $ 15,000 6,000 50,000 300,000 50,000 (50,000) $ 2,000 15,000 50,000 300,000 110,000 (80,000) $397,000 Cash Accoun Prepaid Equipm Accumu T Current Acco $371,000 Liabilities and Owner's Equity: Accounts payable Notes payable-long-term Common stock Retained earnings Total Liabilities and Owner's Equity $ 10,000 200,000 100,000 61,000 $371,000 $ 8,000 220,000 100,000 69,000 $397,000 Mort Divic Noncurr Mort Commor Treasury Retained 300 ncur- The Statement of Cash Flows 217 Income Statement and Retained Earnings 20X6 Sales $1,000,000 Cost of food sold 350,000 Payroll costs 400,000 Depreciation expense 30,000 Other expenses 160,000 Net income 60,000 Retained earnings - January 1, 20X6 61,000 Less: Dividends declared (52,000) Retained earnings-December 31, 20X6 69,000 Other information: 1. No equipment was sold during 20X6. 2. No long-term debt was paid off during 20X6. 1S: Required: Explain to Biola how her company had net income of $60,000 for 20x6 but cash dropped by $13,000 during 20X6. Problem 17 The operations of the Fishtail, a small food service operation, are becoming more complex. Treva Trout, the owner, has asked for your help in understanding the condensed balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started