Question

BioMarin Pharmaceutical Inc. (Ticker: BMRN) recently issued convert- ible debt on May 11, 2020.1 Convertible debt is a bond that can be transformed from debt

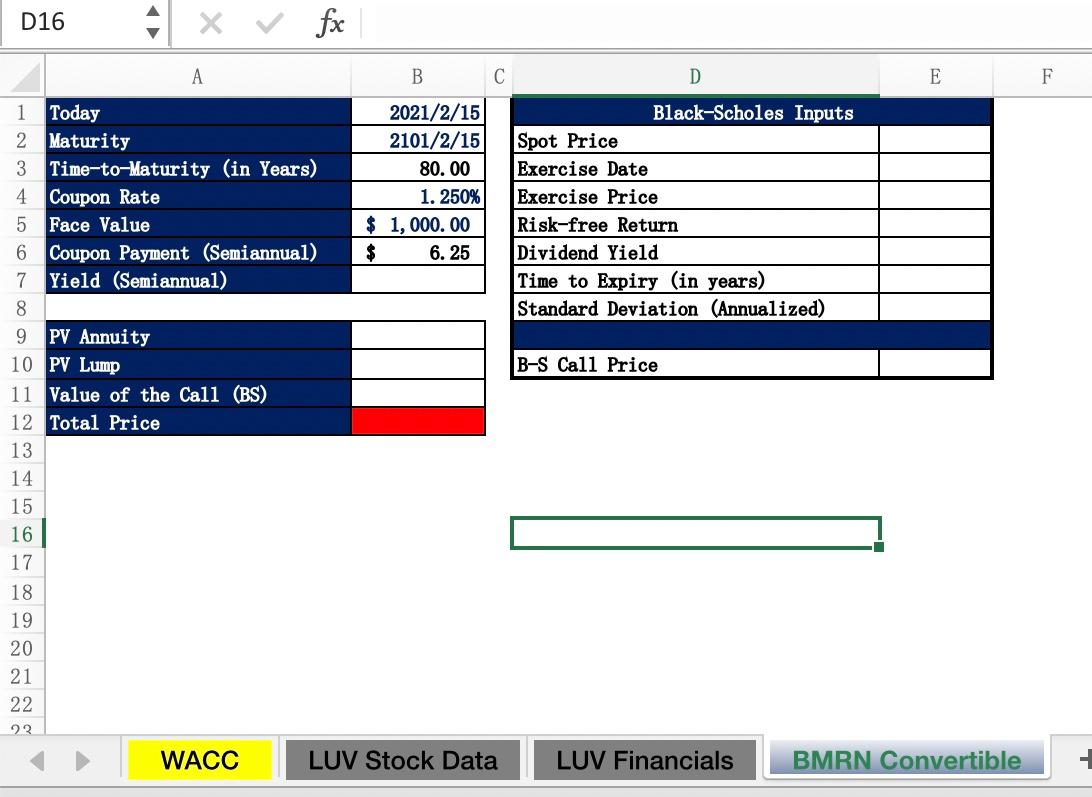

BioMarin Pharmaceutical Inc. (Ticker: BMRN) recently issued convert- ible debt on May 11, 2020.1 Convertible debt is a bond that can be transformed from debt into common equity shares if the bond investor wishes. In this question, we will attempt to value BioMarins convertible debt on a tab called BMRN Convertible. The details of BioMarins debt issuance are as follows: BioMarins debt has a face value of $1,000 and an annual coupon rate of 1.250%. Like most bonds in the United States, BioMarin pays its annual coupons in two semi- annual installments. To value BMRNs convertible debt, go through the following steps:

BioMarin Pharmaceutical Inc. (Ticker: BMRN) recently issued convert- ible debt on May 11, 2020.1 Convertible debt is a bond that can be transformed from debt into common equity shares if the bond investor wishes. In this question, we will attempt to value BioMarins convertible debt on a tab called BMRN Convertible. The details of BioMarins debt issuance are as follows: BioMarins debt has a face value of $1,000 and an annual coupon rate of 1.250%. Like most bonds in the United States, BioMarin pays its annual coupons in two semi- annual installments. To value BMRNs convertible debt, go through the following steps:

(a.) First, calculate the time-to-maturity for BioMarins debt in years. Assume that today is February, 15, 2021.

(b.) Next, find the present value of the semiannual coupon stream that BioMarins bond produces. You can do this by valuing the coupons as an annuity. Assume an annualized discount rate of 0.118%.

(c.) Recall from your basic corporate finance class, that when a bond matures, you receive the face value on the bond as a principal repayment. Find the present value of payment by discounting it a single cash flow. Again assume an annualized discount rate of 0.118%.

(d.) Now calculate the value of the conversion option using the Black-Scholes formula. Use the press release given in Footnote 1 to find the strike price for the call option and the date the option can be executed. Assume that the current value of BioMarins stock is was $87.04 and that the risk-free interest rate is 2.50%. You may also assume that BioMarins implied volatility is 53.81% annualized.

(e.) Add your answers to parts (b.) through (d.) to get the price of BioMarins convertible bond.

D16 A x fx A B C D E F 1 Today 2021/2/15 Black-Scholes Inputs 2 Maturity 2101/2/15 Spot Price 3 Time-to-Maturity (in Years) 80.00 Exercise Date 4 Coupon Rate 1. 250% Exercise Price 5 Face Value $ 1,000.00 Risk-free Return 6 Coupon Payment (Semiannual) $ 6. 25 Dividend Yield 7 Yield (Semiannual) Time to Expiry (in years) 8 Standard Deviation (Annualized) 9 PV Annuity 10 PV Lump B-S Call Price 11 Value of the Call (BS) 12 Total Price 13 14 15 16 17 18 19 20 21 22 23 WACC LUV Stock Data LUV Financials BMRN Convertible D16 A x fx A B C D E F 1 Today 2021/2/15 Black-Scholes Inputs 2 Maturity 2101/2/15 Spot Price 3 Time-to-Maturity (in Years) 80.00 Exercise Date 4 Coupon Rate 1. 250% Exercise Price 5 Face Value $ 1,000.00 Risk-free Return 6 Coupon Payment (Semiannual) $ 6. 25 Dividend Yield 7 Yield (Semiannual) Time to Expiry (in years) 8 Standard Deviation (Annualized) 9 PV Annuity 10 PV Lump B-S Call Price 11 Value of the Call (BS) 12 Total Price 13 14 15 16 17 18 19 20 21 22 23 WACC LUV Stock Data LUV Financials BMRN ConvertibleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started