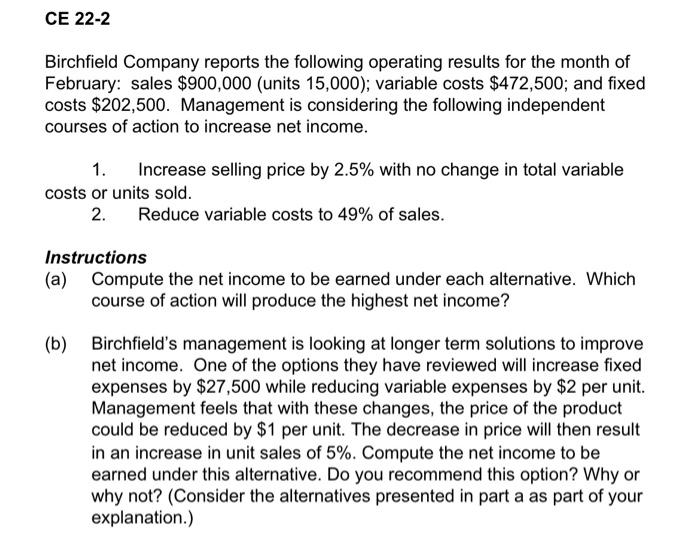

Birchfield Company reports the following operating results for the month of February: sales $900,000 (units 15,000 ); variable costs $472,500; and fixed costs $202,500. Management is considering the following independent courses of action to increase net income. 1. Increase selling price by 2.5% with no change in total variable costs or units sold. 2. Reduce variable costs to 49% of sales. Instructions (a) Compute the net income to be earned under each alternative. Which course of action will produce the highest net income? (b) Birchfield's management is looking at longer term solutions to improve net income. One of the options they have reviewed will increase fixed expenses by $27,500 while reducing variable expenses by $2 per unit. Management feels that with these changes, the price of the product could be reduced by $1 per unit. The decrease in price will then result in an increase in unit sales of 5%. Compute the net income to be earned under this alternative. Do you recommend this option? Why or why not? (Consider the alternatives presented in part a as part of your explanation.) Birchfield Company reports the following operating results for the month of February: sales $900,000 (units 15,000 ); variable costs $472,500; and fixed costs $202,500. Management is considering the following independent courses of action to increase net income. 1. Increase selling price by 2.5% with no change in total variable costs or units sold. 2. Reduce variable costs to 49% of sales. Instructions (a) Compute the net income to be earned under each alternative. Which course of action will produce the highest net income? (b) Birchfield's management is looking at longer term solutions to improve net income. One of the options they have reviewed will increase fixed expenses by $27,500 while reducing variable expenses by $2 per unit. Management feels that with these changes, the price of the product could be reduced by $1 per unit. The decrease in price will then result in an increase in unit sales of 5%. Compute the net income to be earned under this alternative. Do you recommend this option? Why or why not? (Consider the alternatives presented in part a as part of your explanation.)