Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bitcoin speculators have hoped for a Bitcoin ETF for a long time. On October 19, 2021, ProShares launched a new ETF-ticker BITO-that invests in Bitcoin

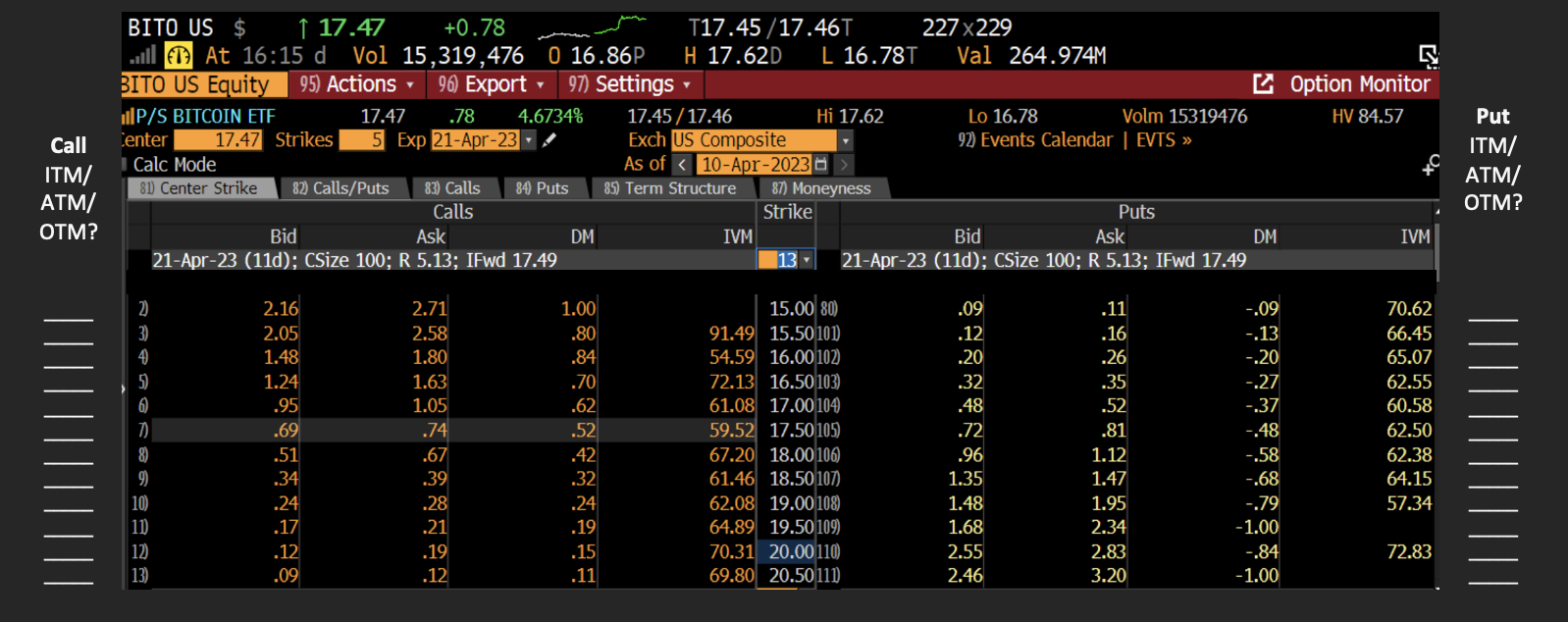

Bitcoin speculators have hoped for a Bitcoin ETF for a long time. On October 19, 2021, ProShares launched a new ETF-ticker BITO-that invests in Bitcoin futures. While this ETF product does not hold actual Bitcoins, it allows investors to speculate on changes in the price of Bitcoin as measured by the CME Bitcoin Reference Rate. Options are available on BITO and this activity examines the possibility of using options to bet on Bitcoin or to hedge its risk. The table below gives you an excerpt of the Bloomberg option chain for BITO for the next monthly expiration on April 21, 2023. The price of BITO when this option chain was taken on April 10, 2023 was 17.47. The column DM stands for the "delta" of the ETF, i.e., the amount of the price increase of the option contract for a $1 increase in the price of BITO. The column IVM is the implied volatility. For each option in the option chain, indicate whether they are in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM) (based on the current price of 17.47). Case 3: Protected Put Angela already owns 100 shares of BITO and she thinks that the ETF will eventually recover in the next year. However, she is worried that volatility and headline risk could hurt her strategy in the short term. She uses a protected put strategy and purchases the put with a $16.50 strike. What is the price that she is paying for the contract? (use the ask price and consider that one contract is for 100 shares) If BITO ends up at $19 on April 21, 2023, what is the combined value of her ETF and put positions (less the premium)? ETF: + Put payoff: - Premium: _ 1= If BITO ends up at $12 on April 21, 2023, what is the combined value of her ETF and put positions (less the premium)? ETF: + P Put payoff: - Premium: Case 4: Covered Call Susan already owns 100 shares of BITO. She does not think that the price of BITO will go above $19 by April 21, 2023. She sells the call option with a strike of $19. How much does she make in premiums? (use the bid price and consider that one contract is for 100 shares) Bitcoin speculators have hoped for a Bitcoin ETF for a long time. On October 19, 2021, ProShares launched a new ETF-ticker BITO-that invests in Bitcoin futures. While this ETF product does not hold actual Bitcoins, it allows investors to speculate on changes in the price of Bitcoin as measured by the CME Bitcoin Reference Rate. Options are available on BITO and this activity examines the possibility of using options to bet on Bitcoin or to hedge its risk. The table below gives you an excerpt of the Bloomberg option chain for BITO for the next monthly expiration on April 21, 2023. The price of BITO when this option chain was taken on April 10, 2023 was 17.47. The column DM stands for the "delta" of the ETF, i.e., the amount of the price increase of the option contract for a $1 increase in the price of BITO. The column IVM is the implied volatility. For each option in the option chain, indicate whether they are in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM) (based on the current price of 17.47). Case 3: Protected Put Angela already owns 100 shares of BITO and she thinks that the ETF will eventually recover in the next year. However, she is worried that volatility and headline risk could hurt her strategy in the short term. She uses a protected put strategy and purchases the put with a $16.50 strike. What is the price that she is paying for the contract? (use the ask price and consider that one contract is for 100 shares) If BITO ends up at $19 on April 21, 2023, what is the combined value of her ETF and put positions (less the premium)? ETF: + Put payoff: - Premium: _ 1= If BITO ends up at $12 on April 21, 2023, what is the combined value of her ETF and put positions (less the premium)? ETF: + P Put payoff: - Premium: Case 4: Covered Call Susan already owns 100 shares of BITO. She does not think that the price of BITO will go above $19 by April 21, 2023. She sells the call option with a strike of $19. How much does she make in premiums? (use the bid price and consider that one contract is for 100 shares)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started