Answered step by step

Verified Expert Solution

Question

1 Approved Answer

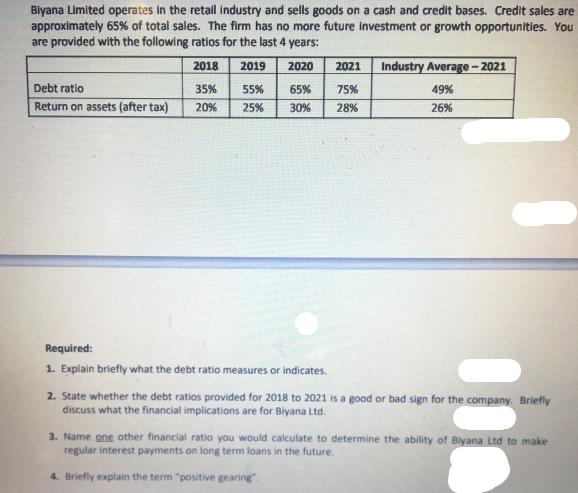

Biyana Limited operates in the retail industry and sells goods on a cash and credit bases. Credit sales are approximately 65% of total sales.

Biyana Limited operates in the retail industry and sells goods on a cash and credit bases. Credit sales are approximately 65% of total sales. The firm has no more future investment or growth opportunities. You are provided with the following ratios for the last 4 years: 2018 2019 2020 2021 Industry Average-2021 65% 75% 35% 20% 55% 25% 30% 28% Debt ratio Return on assets (after tax) Required: 1. Explain briefly what the debt ratio measures or indicates. 49% 26% 2. State whether the debt ratios provided for 2018 to 2021 is a good or bad sign for the company. Briefly discuss what the financial implications are for Biyana Ltd. 3. Name one other financial ratio you would calculate to determine the ability of Biyana Ltd to make regular interest payments on long term loans in the future. 4. Briefly explain the term "positive gearing".

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 The debt ratio measures the proportion of a companys total assets that are financed by debt It is calculated by dividing total debt by total assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started