Answered step by step

Verified Expert Solution

Question

1 Approved Answer

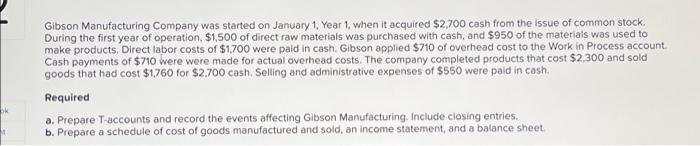

bk Gibson Manufacturing Company was started on January 1, Year 1, when it acquired $2,700 cash from the issue of common stock. During the

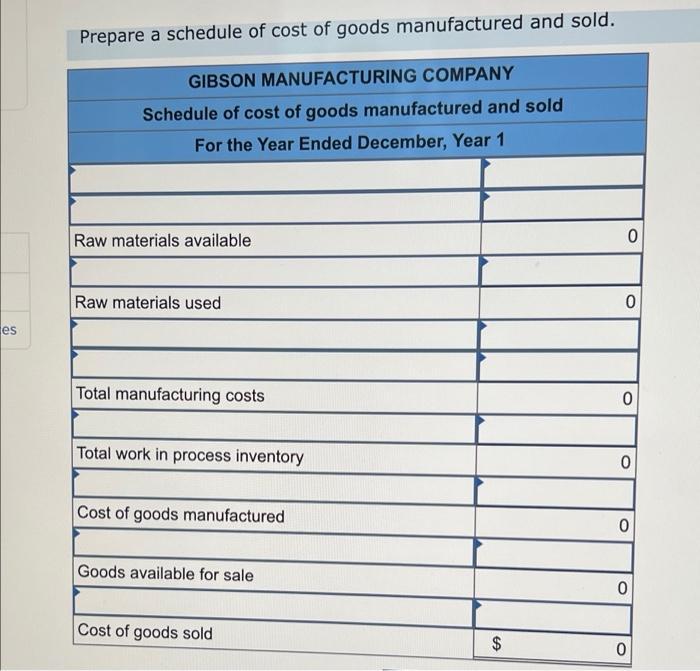

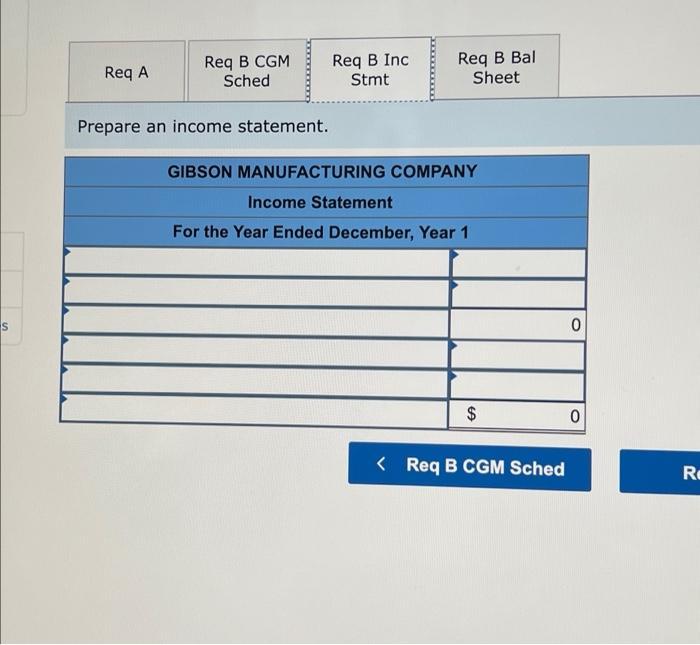

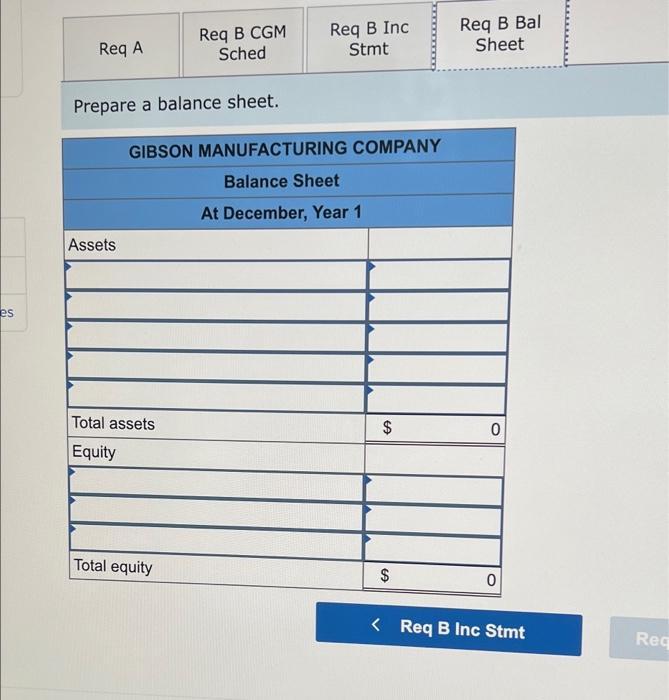

bk Gibson Manufacturing Company was started on January 1, Year 1, when it acquired $2,700 cash from the issue of common stock. During the first year of operation, $1,500 of direct raw materials was purchased with cash, and $950 of the materials was used to make products. Direct labor costs of $1,700 were paid in cash. Gibson applied $710 of overhead cost to the Work in Process account. Cash payments of $710 were were made for actual overhead costs. The company completed products that cost $2,300 and sold goods that had cost $1,760 for $2,700 cash. Selling and administrative expenses of $550 were paid in cash. Required a. Prepare T-accounts and record the events affecting Gibson Manufacturing. Include closing entries. b. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet. es Prepare a schedule of cost of goods manufactured and sold. GIBSON MANUFACTURING COMPANY Schedule of cost of goods manufactured and sold For the Year Ended December, Year 1 Raw materials available Raw materials used Total manufacturing costs Total work in process inventory Cost of goods manufactured Goods available for sale Cost of goods sold $ GA 0 0 0 0 0 0 0 S Req A Req B CGM Sched Prepare an income statement. Req B Inc Stmt Req B Bal Sheet GIBSON MANUFACTURING COMPANY Income Statement For the Year Ended December, Year 1 $ < Req B CGM Sched O 0 Re es Req B CGM Sched Prepare a balance sheet. Req A Assets GIBSON MANUFACTURING COMPANY Balance Sheet At December, Year 1 Total assets Equity Req B Inc Stmt Total equity $ GA $ Req B Bal Sheet 0 0 < Req B Inc Stmt Req

Step by Step Solution

★★★★★

3.46 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started