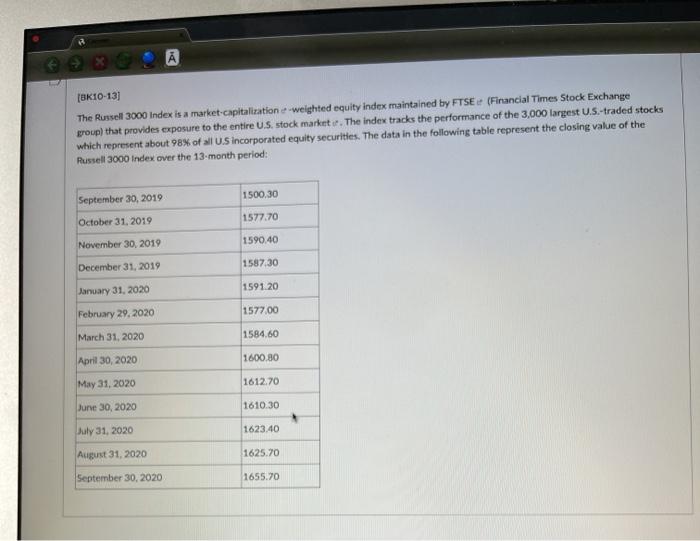

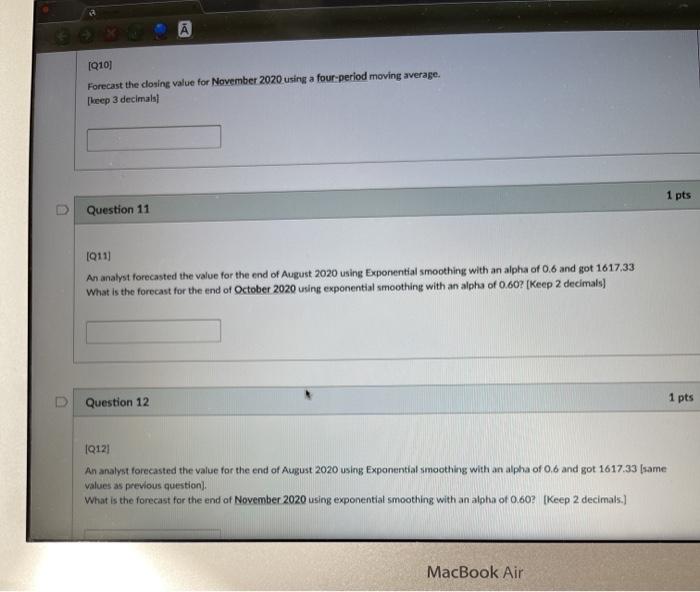

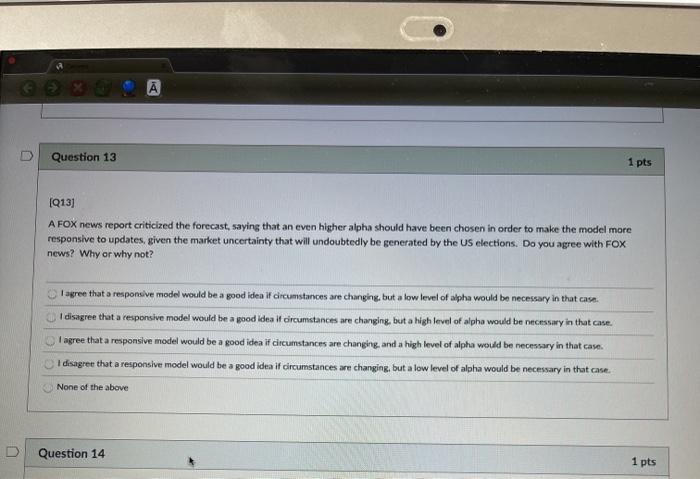

(BK10-13) The Russell 3000 Index is a market capitalization weighted equity index maintained by FTSE (Financial Times Stock Exchange group) that provides exposure to the entire U.S. stock market. The index tracks the performance of the 3,000 largest U.S.-traded stocks which represent about 98% of all US incorporated equity securities. The data in the following table represent the closing value of the Russell 3000 Index over the 13-month period: 1500.30 September 30, 2019 October 31, 2019 1577.70 November 30, 2019 1590.40 December 31, 2019 1587.30 1591.20 January 31, 2020 February 29, 2020 1577.00 March 31, 2020 1584.60 April 30, 2020 1600.80 May 31, 2020 1612.70 June 30, 2020 1610.30 July 31, 2020 1623.40 August 31, 2020 1625.70 September 30, 2020 1655.70 [010] Forecast the closing value for November 2020 using a four period moving average. Theep 3 decimals) 1 pts D Question 11 1911) An analyst forecasted the value for the end of August 2020 using Exponential smoothing with an alpha of 0.6 and got 1617,33 What is the forecast for the end of October 2020 using exponential smoothing with an alpha of 0.60? (Keep 2 decimals) D Question 12 1 pts 1012) An analyst forecasted the value for the end of August 2020 using Exponential smoothing with an alpha of 0.6 and got 1617.33 (same values as previous question), What is the forecast for the end of November 2020 using exponential smoothing with an alpha of 0.60Keep 2 decimals.) MacBook Air Question 13 1 pts [Q13] A FOX news report criticized the forecast, saying that an even higher alpha should have been chosen in order to make the model more responsive to updates, given the market uncertainty that will undoubtedly be generated by the US elections. Do you agree with FOX news? Why or why not? I agree that a responsive model would be a good idea if circumstances are changing, but a low level of alpha would be necessary in that case. I disagree that a responsive model would be a good idea if circumstances are changing, but a high level of alpha would be necessary in that case. I agree that a responsive model would be a good idea if circumstances are changing and a high level of alpha would be necessary in that case I disagree that a responsive model would be a good idea if circumstances are changing, but a low level of alpha would be necessary in that case. None of the above Question 14 1 pts