Answered step by step

Verified Expert Solution

Question

1 Approved Answer

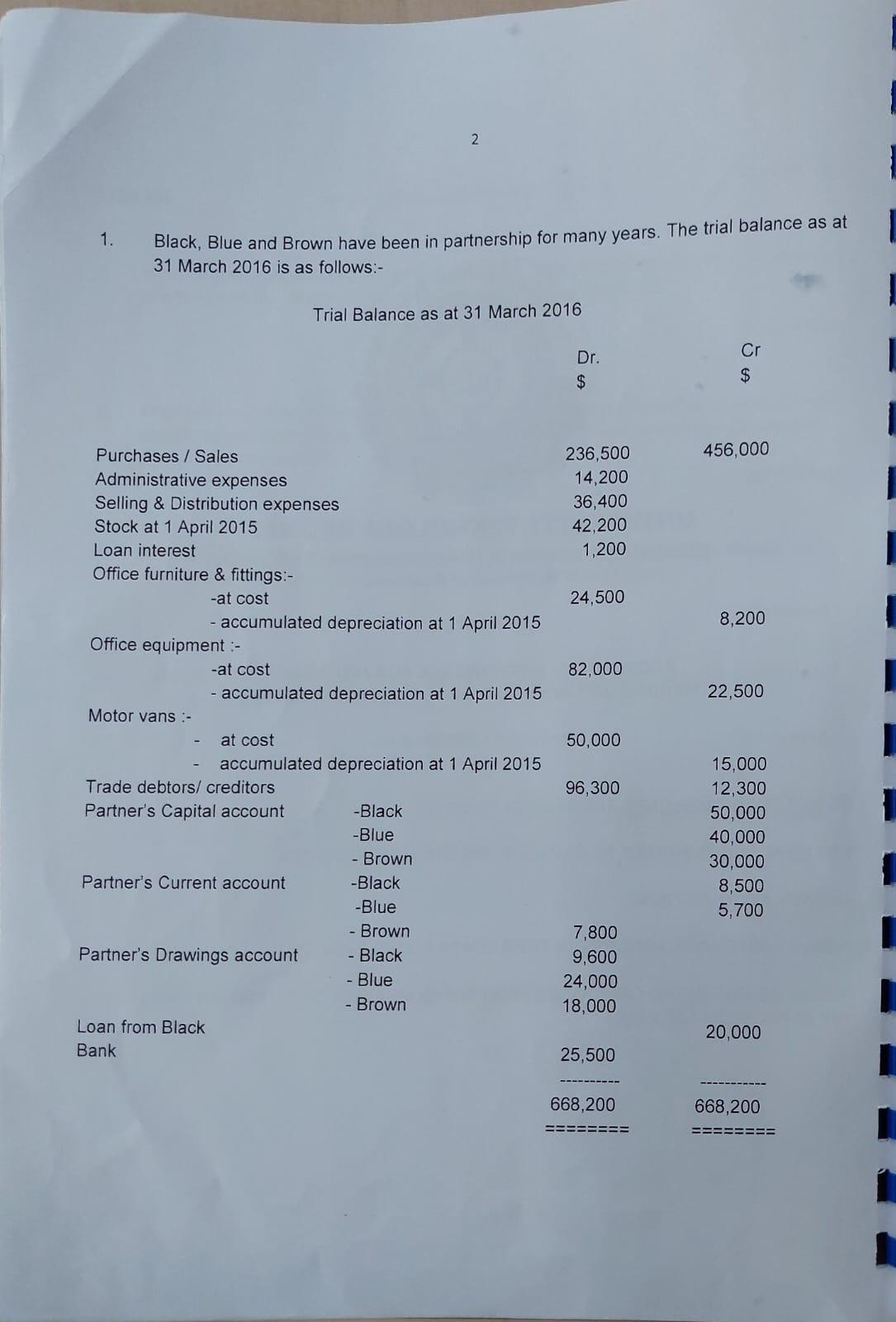

1. Black, Blue and Brown have been in partnership for many years. The trial balance as at 31 March 2016 is as follows:- Office

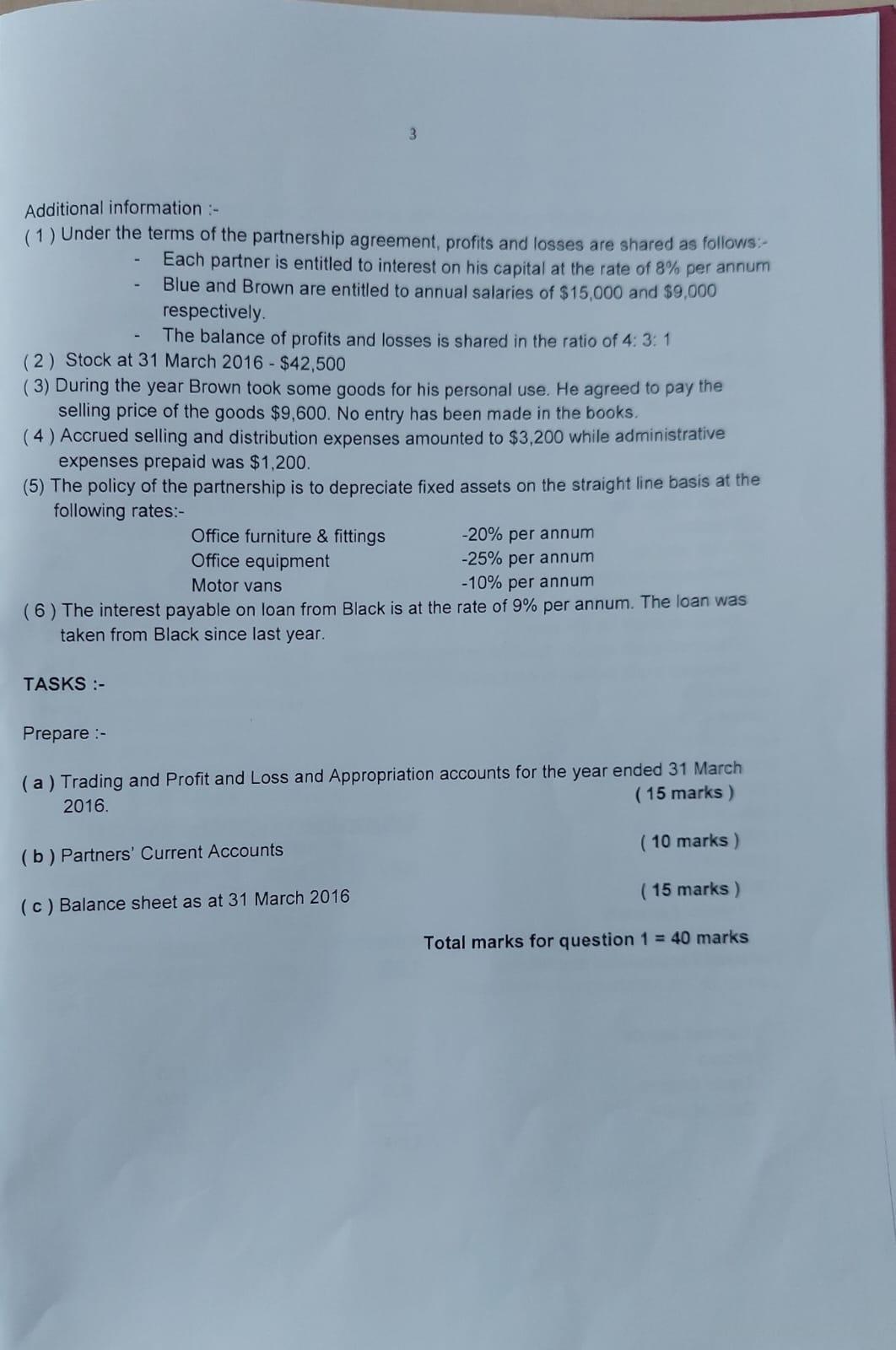

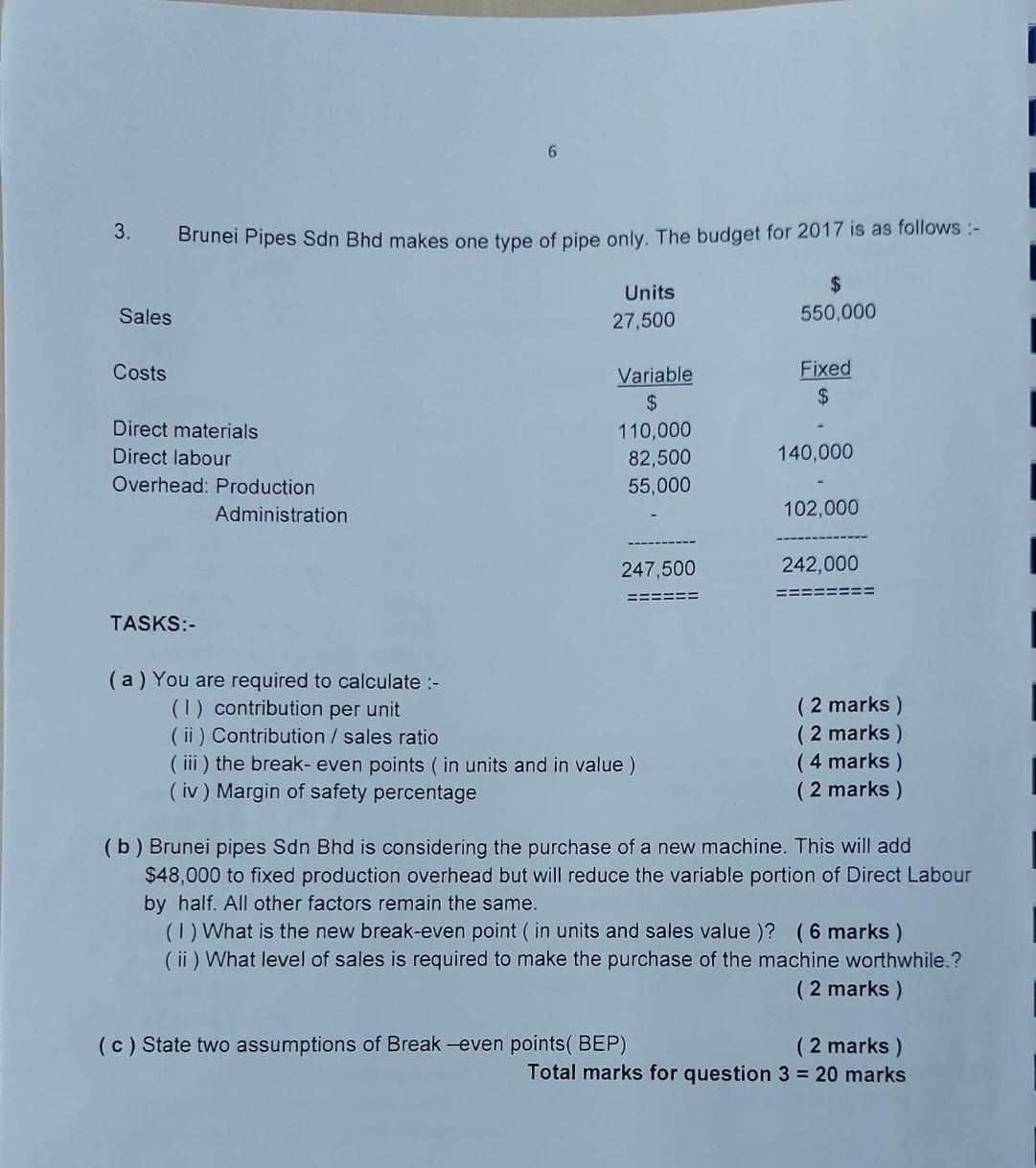

1. Black, Blue and Brown have been in partnership for many years. The trial balance as at 31 March 2016 is as follows:- Office equipment :- Purchases / Sales Administrative expenses Selling & Distribution expenses Stock at 1 April 2015 Loan interest Office furniture & fittings:- -at cost - accumulated depreciation at 1 April 2015 Motor vans Trade debtors/ creditors Partner's Capital account 2 -at cost - accumulated depreciation at 1 April 2015 Partner's Current account Loan from Black Bank Trial Balance as at 31 March 2016 at cost accumulated depreciation at 1 April 2015 Partner's Drawings account -Black -Blue - Brown -Black -Blue - Brown - Black - Blue - Brown Dr. 236,500 14,200 36,400 42,200 1,200 24,500 82,000 50,000 96,300 7,800 9,600 24,000 18,000 25,500 668,200 Cr $ 456,000 8,200 22,500 15,000 12,300 50,000 40,000 30,000 8,500 5,700 20,000 668,200 Additional information :- (1) Under the terms of the partnership agreement, profits and losses are shared as follows:- Each partner is entitled to interest on his capital at the rate of 8% per annum Blue and Brown are entitled to annual salaries of $15,000 and $9,000 respectively. 3 (2) Stock at 31 March 2016 - $42,500 (3) During the year Brown took some goods for his personal use. He agreed to pay the selling price of the goods $9,600. No entry has been made in the books. (4) Accrued selling and distribution expenses amounted to $3,200 while administrative expenses prepaid was $1,200. (5) The policy of the partnership is to depreciate fixed assets on the straight line basis at the following rates:- TASKS :- The balance of profits and losses is shared in the ratio of 4: 3:1 -20% per annum -25% per annum Motor vans -10% per annum (6) The interest payable on loan from Black is at the rate of 9% per annum. The loan was taken from Black since last year. Prepare :- Office furniture & fittings Office equipment (a) Trading and Profit and Loss and Appropriation accounts for the year ended 31 March 2016. (15 marks) (b) Partners' Current Accounts (c) Balance sheet as at 31 March 2016 (10 marks) ( 15 marks) Total marks for question 1 = 40 marks 2. The following are the financial statements of Kamal Plc and Jamal Plc for the year 2015. Profit and Loss account for the year ended 31 December 2015 Kamal Plc Sales Cost of goods sold Gross profit Operating expenses Depreciation Loan interest Profit before tax Taxation Profit after tax Preference dividends paid Ordinary dividends paid Retained profit for the year 4 Fixed assets Freehold property Plant and machinery at cost Less: Accumulated depreciation Current assets Stocks Trade debtors Cash at bank $000 700 180 150 Retained profit brought forward from previous year Retained profit carried to next year 20 20 $000 1,800 1,200 700 800 $000 2,500 1,200 1,300 1,500 1,030 270 50 220 40 180 1,120 1,300 2,400 Balance sheet as at 31 December 2015 Kamal Plc $000 600 3,000 $000 680 180 160 130 Jamal Plc $000 2,800 400 $000 2,500 1,250 1,250 500 500 200 1,200 1,020 230 30 200 130 70 930 1,000 Jamal Plc $000 2,400 2,400 T Current liabilities Trade creditors Provision for taxation Bank overdraft Less: Long term Liabilities Loan Share capital Ordinary shares of $1 each 10% Preference shares of $1 each Retained profit TASKS :- 5 (iii) Net profit ratios (iv) Assets turnover ratios (v) Stock turnover (in times and days) (vi) Debtors collection periods (vii) Creditors payment periods (viii) Current ratios (ix) Acid test ratios (600) (50) (150) (a) Calculate the following ratios for both Companies:- (1) Return on capital employed (ii) Gross Profit ratios 700 3,700 1,400 2,300 800 200 1,300 2,300 ===== (870) (30) 300 2,700 1,000 1,700 700 1,000 1,700 (2.5 marks) (2.5 marks) (2.5 marks) (2.5 marks) (5 marks) (2.5 marks) (2.5 marks) (2.5 marks (2.5 marks) (b) Comment on the performance of the two companies based on the ratios you have Calculated in task (a ) above (15 marks) Total marks for question 2 = 40 marks 3. Sales Costs Brunei Pipes Sdn Bhd makes one type of pipe only. The budget for 2017 is as follows:- $ 550,000 Direct materials Direct labour Overhead: Production TASKS:- 6 Administration Units 27,500 Variable $ 110,000 82,500 55,000 247,500 (a) You are required to calculate :- (1) contribution per unit (ii) Contribution / sales ratio (iii) the break- even points (in units and in value) (iv) Margin of safety percentage Fixed $ (c) State two assumptions of Break-even points (BEP) 140,000 102,000 242,000 (2 marks) (2 marks) (4 marks) (2 marks) (b) Brunei pipes Sdn Bhd is considering the purchase of a new machine. This will add $48,000 to fixed production overhead but will reduce the variable portion of Direct Labour by half. All other factors remain the same. (1) What is the new break-even point (in units and sales value )? (6 marks) (ii) What level of sales is required to make the purchase of the machine worthwhile.? (2 marks) (2 marks) Total marks for question 3 = 20 marks

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Since you have posted a question with multiple subparts we will solve first three subparts fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started