Question

Black Canary Co. has asked for your assistance in preparing their tax worksheet and to determine their 2020 tax expense and finalize their 2020 Income

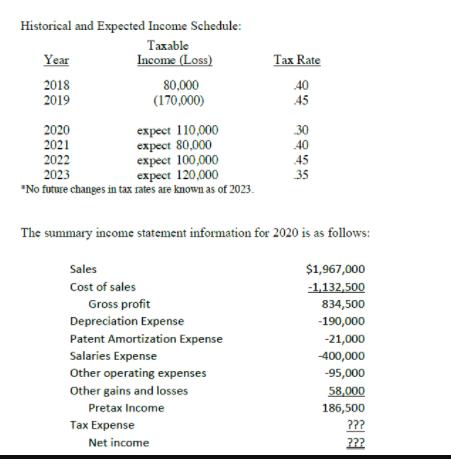

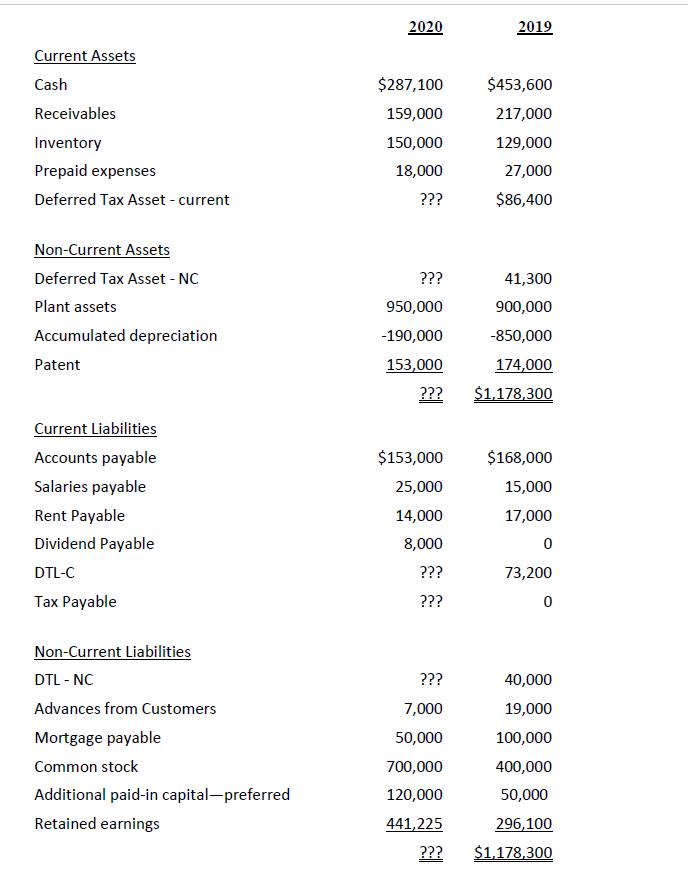

Black Canary Co. has asked for your assistance in preparing their tax worksheet and to determine their 2020 tax expense and finalize their 2020 Income statement. They have also asked that you prepare a statement of cash flows as of 12/31/2020. They have provided you with a historical record of income and an expected future income schedule, the summary pretax income information and an (incomplete) balance sheet below, as well as some notes their accounting clerk made regarding activities over the past fiscal year. Historical and Expected Income Schedule:

Historical and Expected Income Schedule: Taxable Income (Loss) Year 2018 2019 2020 2021 2022 2023 *No future changes in tax rates are known as of 2023. expect 110,000 expect 80,000 expect 100,000 expect 120,000 80,000 (170,000) Sales Cost of sales The summary income statement information for 2020 is as follows: Gross profit Depreciation Expense Patent Amortization Expense Salaries Expense Other operating expenses Other gains and losses Pretax Income Tax Expense Net income Tax Rate 40 45 30 40 45 35 $1,967,000 -1,132,500 834,500 -190,000 -21,000 -400,000 -95,000 58,000 186,500 ??? ???

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Revenue 1000000 Cost of Goods Sold Gross Profit Operating expenses Depreciation 333333 Amortization 100000 Interest expense 17000 Other operating expenses 500000 Total operating expen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started