Question

Black Company reported a taxable loss of $80,000 in 20X3, its first year of operations, and taxabie income of $80,000 in 20X4. Black had

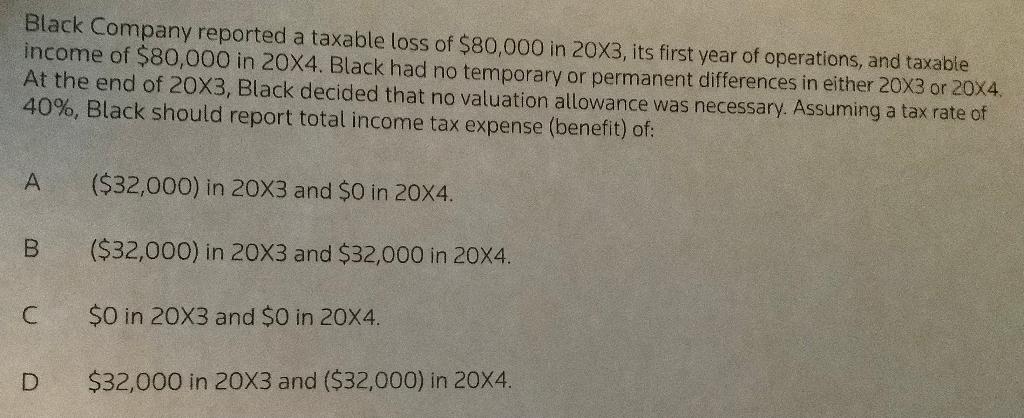

Black Company reported a taxable loss of $80,000 in 20X3, its first year of operations, and taxabie income of $80,000 in 20X4. Black had no temporary or permanent differences in either 20X3 or 20X4. At the end of 20X3, Black decided that no valuation allowance was necessary. Assuming a tax rate of 40%, Black should report total income tax expense (benefit) of: ($32,000) in 20X3 and $0 in 20X4. ($32,000) in 20X3 and $32,000 in 20X4. $O in 20X3 and $0 in 20X4. D. $32,000 in 20X3 and ($32,000) in 20X4.

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Black company had a taxable loss of 80000 in 20X3 and a taxabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

2nd edition

9781305727557, 1285453824, 9781337116619, 130572755X, 978-1285453828

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App