Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Black Corporation and Tom each own 50% of Tan Corporation's common stock. On January 1, Tan has a deficit in accumulated E & P

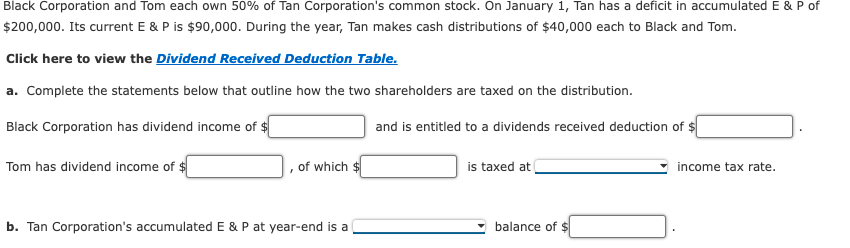

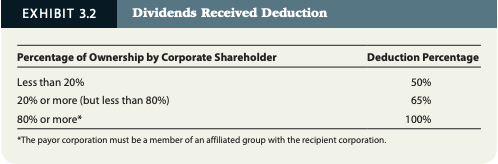

Black Corporation and Tom each own 50% of Tan Corporation's common stock. On January 1, Tan has a deficit in accumulated E & P of $200,000. Its current E & P is $90,000. During the year, Tan makes cash distributions of $40,000 each to Black and Tom. Click here to view the Dividend Received Deduction Table. a. Complete the statements below that outline how the two shareholders are taxed on the distribution. Black Corporation has dividend income of $ and is entitled to a dividends received deduction of $ Tom has dividend income of $ of which $ is taxed at income tax rate. b. Tan Corporation's accumulated E & P at year-end is a balance of $ EXHIBIT 3.2 Dividends Received Deduction Percentage of Ownership by Corporate Shareholder Deduction Percentage Less than 20% 50% 20% or more (but less than 80%) 65% 80% or more* 100% *The payor corporation must be a member of an affiliated group with the recipient corporation.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer a 1 40000 2 entitled to a dividends received deduction of 32000 3 40000 4 40000 Black ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started