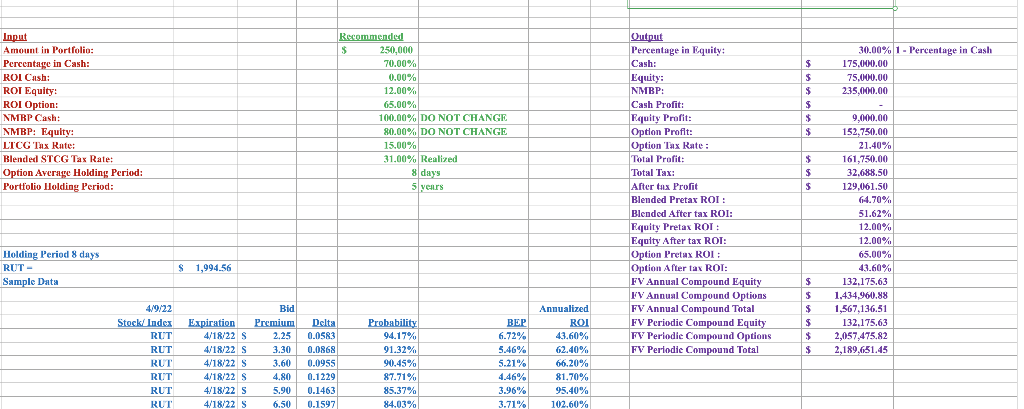

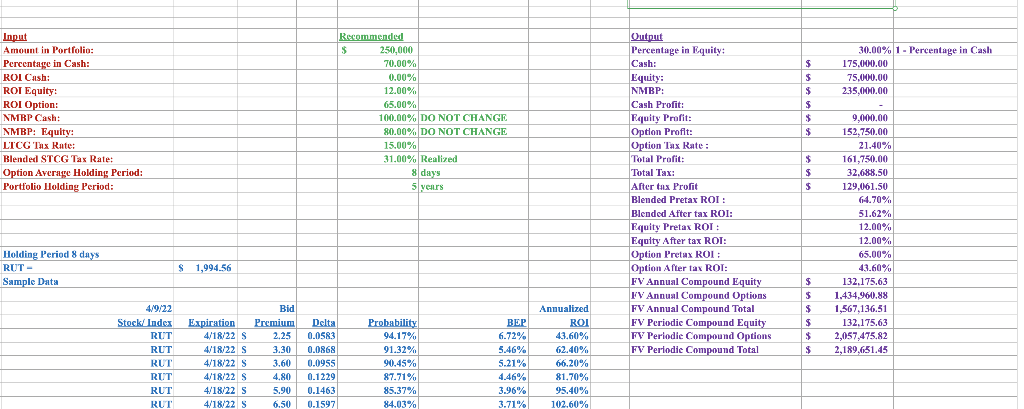

Black Scholes Option Pricing Model Questions: A. Who is Fisher Black and Myron Scholes? What award did they win? B. Briefly explain the model, non- quantitatively. 5 C. List and explain the ASSUMPTIONS of the model. D. Explain the inaccuracies of some of the assumptions of the model. $ $ 30.00% 1 - Percentage in Cash 175.000.00 75,000.00 235.000.00 Input Amount in Portfolio: Percentage in Cash: ROI Cash: ROI Equity: ROI Option: NMRP Cash: : NMBP: Equity: LTCG Tax Rate: Blended STCG Tax Rate: Option Average Holding Period: Portfolio Holding Period: Recommended $ $ 250,000 70.00% 0.00% 12.00% 65.00% 100.00% DO NOT CHANGE 80.00% DO NOT CHANGE 15.00% 31.00% Realized 8 days 5 years $ $ $ $ $ $ $ Output Percentage in Equity Cash: Equity: NMBP: Cash Profit Equity Profit Option Profit: Option Tax Rate : Total Profit: Total Tax: After tax Profit Blended Pretax ROI : Blended After tax ROI: Equity Pretax ROT Equity After tax ROT: Option Pretax ROI Option After tax ROT: FV Annual Compound Equity FV Annual Compound Options FV Annual Compound Total FV Periodic Compound Equity FV Perlodie Compound Options FV Periodie Compound Total 9,000.00 152.750.00 21.40% 161,750,00 32.688.50 129,061.50 64.70% 51.62% 12.00% 12.00% 65.00% 43.60% % 132.175.63 1,434,960.88 1,567,136.51 132.175.63 2,057,475.82 2,189.651.45 Holding Period 8 days RUT- Sample Data $ 1,994.56 $ $ $ $ $ 4/9/22 Stock/ Index RUT RUT RUT RUT RUT RUT Expiration 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 s 4/18/22 Bid Premium Delta 2.25 0.05R3 3.30 0.0868 3.60 0.0955 4.80 0.1229 5.90 0.1463 6.50 0.15971 Probability 94.17% 91.32% 90.45% 87.71% 85.37% 84.03% BEP 6.72% 5.46% 5.21% 4.46% 3.96% 3.71% Annualized ROI 43.60% 62.40% 66.20% 81.70% 95.40% 102.60% Black Scholes Option Pricing Model Questions: A. Who is Fisher Black and Myron Scholes? What award did they win? B. Briefly explain the model, non- quantitatively. 5 C. List and explain the ASSUMPTIONS of the model. D. Explain the inaccuracies of some of the assumptions of the model. $ $ 30.00% 1 - Percentage in Cash 175.000.00 75,000.00 235.000.00 Input Amount in Portfolio: Percentage in Cash: ROI Cash: ROI Equity: ROI Option: NMRP Cash: : NMBP: Equity: LTCG Tax Rate: Blended STCG Tax Rate: Option Average Holding Period: Portfolio Holding Period: Recommended $ $ 250,000 70.00% 0.00% 12.00% 65.00% 100.00% DO NOT CHANGE 80.00% DO NOT CHANGE 15.00% 31.00% Realized 8 days 5 years $ $ $ $ $ $ $ Output Percentage in Equity Cash: Equity: NMBP: Cash Profit Equity Profit Option Profit: Option Tax Rate : Total Profit: Total Tax: After tax Profit Blended Pretax ROI : Blended After tax ROI: Equity Pretax ROT Equity After tax ROT: Option Pretax ROI Option After tax ROT: FV Annual Compound Equity FV Annual Compound Options FV Annual Compound Total FV Periodic Compound Equity FV Perlodie Compound Options FV Periodie Compound Total 9,000.00 152.750.00 21.40% 161,750,00 32.688.50 129,061.50 64.70% 51.62% 12.00% 12.00% 65.00% 43.60% % 132.175.63 1,434,960.88 1,567,136.51 132.175.63 2,057,475.82 2,189.651.45 Holding Period 8 days RUT- Sample Data $ 1,994.56 $ $ $ $ $ 4/9/22 Stock/ Index RUT RUT RUT RUT RUT RUT Expiration 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 s 4/18/22 Bid Premium Delta 2.25 0.05R3 3.30 0.0868 3.60 0.0955 4.80 0.1229 5.90 0.1463 6.50 0.15971 Probability 94.17% 91.32% 90.45% 87.71% 85.37% 84.03% BEP 6.72% 5.46% 5.21% 4.46% 3.96% 3.71% Annualized ROI 43.60% 62.40% 66.20% 81.70% 95.40% 102.60%