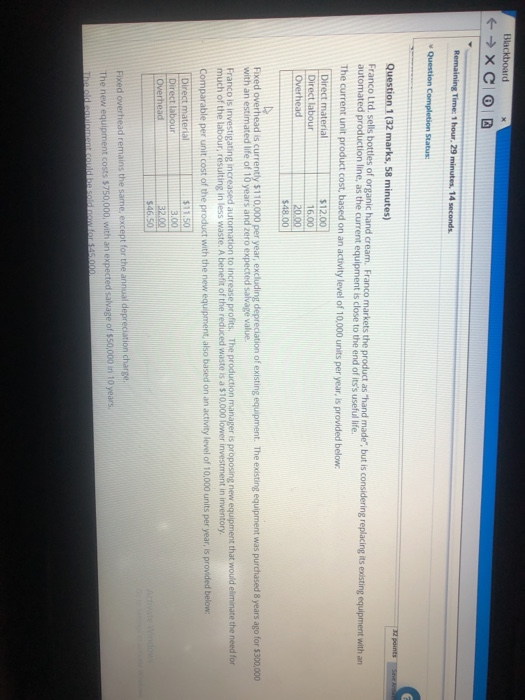

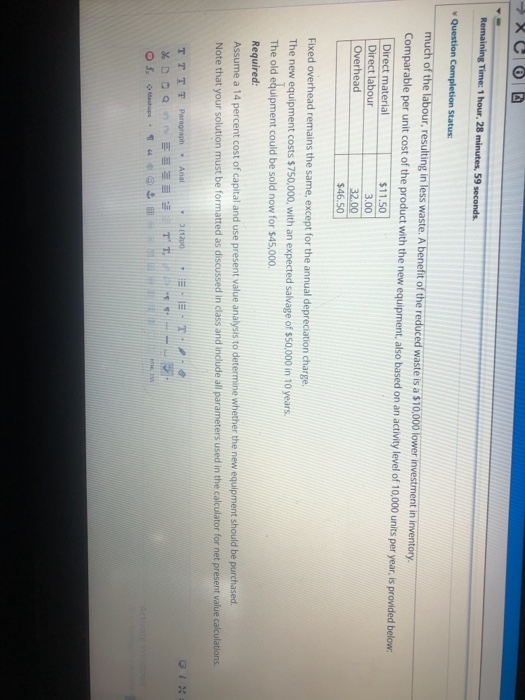

Blackboard 4 XCO Remaining Time 1hou.29 . 14 seconds Question Completion Status Question 1 (32 marks, 58 minutes) Franco ltd. sells bottles of organic hand cream. Franco markets the product as hand made, but is considering replacing its existing equipment with an automated production line, as the current equipment is close to the end of it's useful life The current unit product cost, based on an activity level of 10,000 units per year, is provided below Direct material $12.00 Direct labour 16.00 Overhead 20.00 $48.00 Fixed overhead is currently $110.000 per year, excluding depreciation of existing equipment. The existing equipment was purchased 8 years ago for 300.000 with an estimated We of 10 years and zero expected salvace value Francois investigating increased automation to increase profits. The production manager is proposing new equipment that would m ate the need for much of the labour, resulting in less waste. A benet of the reduced waste as.000 lower investment in inventory Comparable per unit cost of the product with the new equipment also based on an activity level of 10,000 units per year, is provided below Direct material $11.50 Direct labour Overhead 32.00 $46.90 13.00 Fixed overhead remains the same, except for the annual depreciation charge The new equipment costs $750,000, with an expected salvage of $50,000 in 10 years. Thendime. com XCO Remaining Time: 1 hour, 28 minutes, 59 seconds. Question Completion Status: much of the labour, resulting in less waste. A benefit of the reduced waste is a $10,000 lower investment in inventory. Comparable per unit cost of the product with the new equipment, also based on an activity level of 10,000 units per year, is provided below. Direct material $11.50 Direct labour 3.00 Overhead 32.00 $46.50 Fixed overhead remains the same, except for the annual depreciation charge. The new equipment costs $750,000, with an expected salvage of $50,000 in 10 years. The old equipment could be sold now for $45,000 Required: Assume a 14 percent cost of capital and use present value analysis to determine whether the new equipment should be purchased. Note that your solution must be formatted as discussed in class and include all parameters used in the calculator for net present value calculations. T H TTTT Paragraph. Anal %D0Q OSOM. 31200 TT