Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blackpool Funds Ltd is a public listed company. Its main activity is investment in fixed interest securities. The company provides an alternative to superannuation

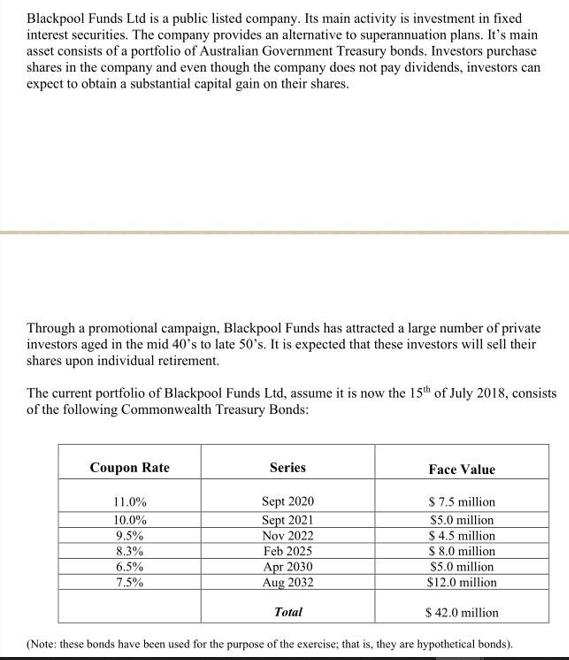

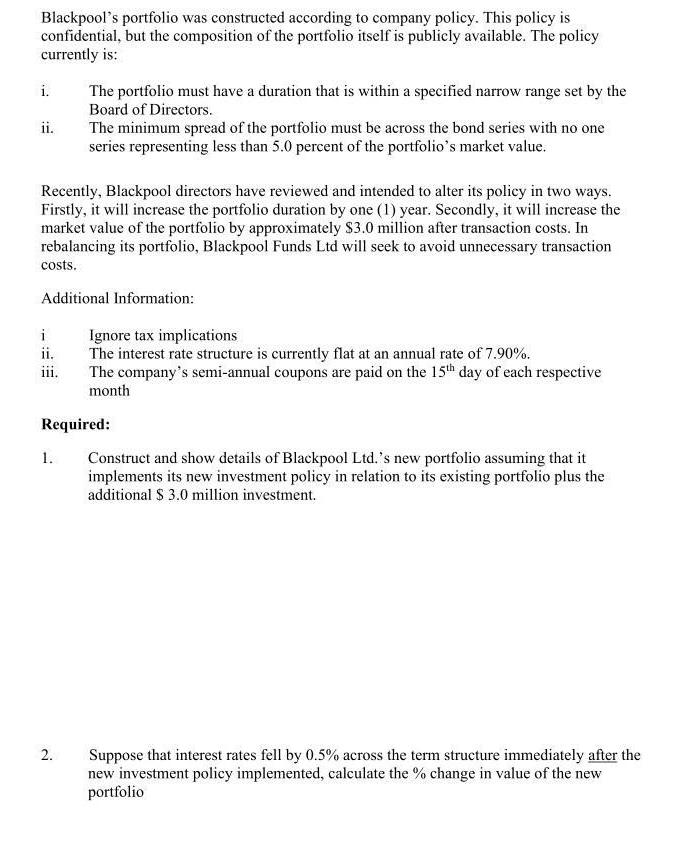

Blackpool Funds Ltd is a public listed company. Its main activity is investment in fixed interest securities. The company provides an alternative to superannuation plans. It's main asset consists of a portfolio of Australian Government Treasury bonds. Investors purchase shares in the company and even though the company does not pay dividends, investors can expect to obtain a substantial capital gain on their shares. Through a promotional campaign, Blackpool Funds has attracted a large number of private investors aged in the mid 40's to late 50's. It is expected that these investors will sell their shares upon individual retirement. The current portfolio of Blackpool Funds Ltd, assume it is now the 15th of July 2018, consists of the following Commonwealth Treasury Bonds: Coupon Rate 11.0% 10.0% 9.5% 8.3% 6.5% 7.5% Series Sept 2020. Sept 2021 Nov 2022 Feb 2025 Apr 2030 Aug 2032 Face Value $ 7.5 million $5.0 million $4.5 million $ 8.0 million. $5.0 million $12.0 million Total $42.0 million. (Note: these bonds have been used for the purpose of the exercise; that is, they are hypothetical bonds). Blackpool's portfolio was constructed according to company policy. This policy is confidential, but the composition of the portfolio itself is publicly available. The policy currently is: i. ii. ii. iii. Recently, Blackpool directors have reviewed and intended to alter its policy in two ways. Firstly, it will increase the portfolio duration by one (1) year. Secondly, it will increase the market value of the portfolio by approximately $3.0 million after transaction costs. In rebalancing its portfolio, Blackpool Funds Ltd will seek to avoid unnecessary transaction costs. Additional Information: The portfolio must have a duration that is within a specified narrow range set by the Board of Directors. 1. The minimum spread of the portfolio must be across the bond series with no one series representing less than 5.0 percent of the portfolio's market value. 2. Required: Ignore tax implications The interest rate structure is currently flat at an annual rate of 7.90%. The company's semi-annual coupons are paid on the 15th day of each respective month Construct and show details of Blackpool Ltd.'s new portfolio assuming that it implements its new investment policy in relation to its existing portfolio plus the additional $ 3.0 million investment. Suppose that interest rates fell by 0.5% across the term structure immediately after the new investment policy implemented, calculate the % change in value of the new portfolio

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Blackpool Funds Portfolio Rebalancing Given Information Existing Portfolio as of July 15 2018 Bonds with various coupon rates and maturity dates Face ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started