Answered step by step

Verified Expert Solution

Question

1 Approved Answer

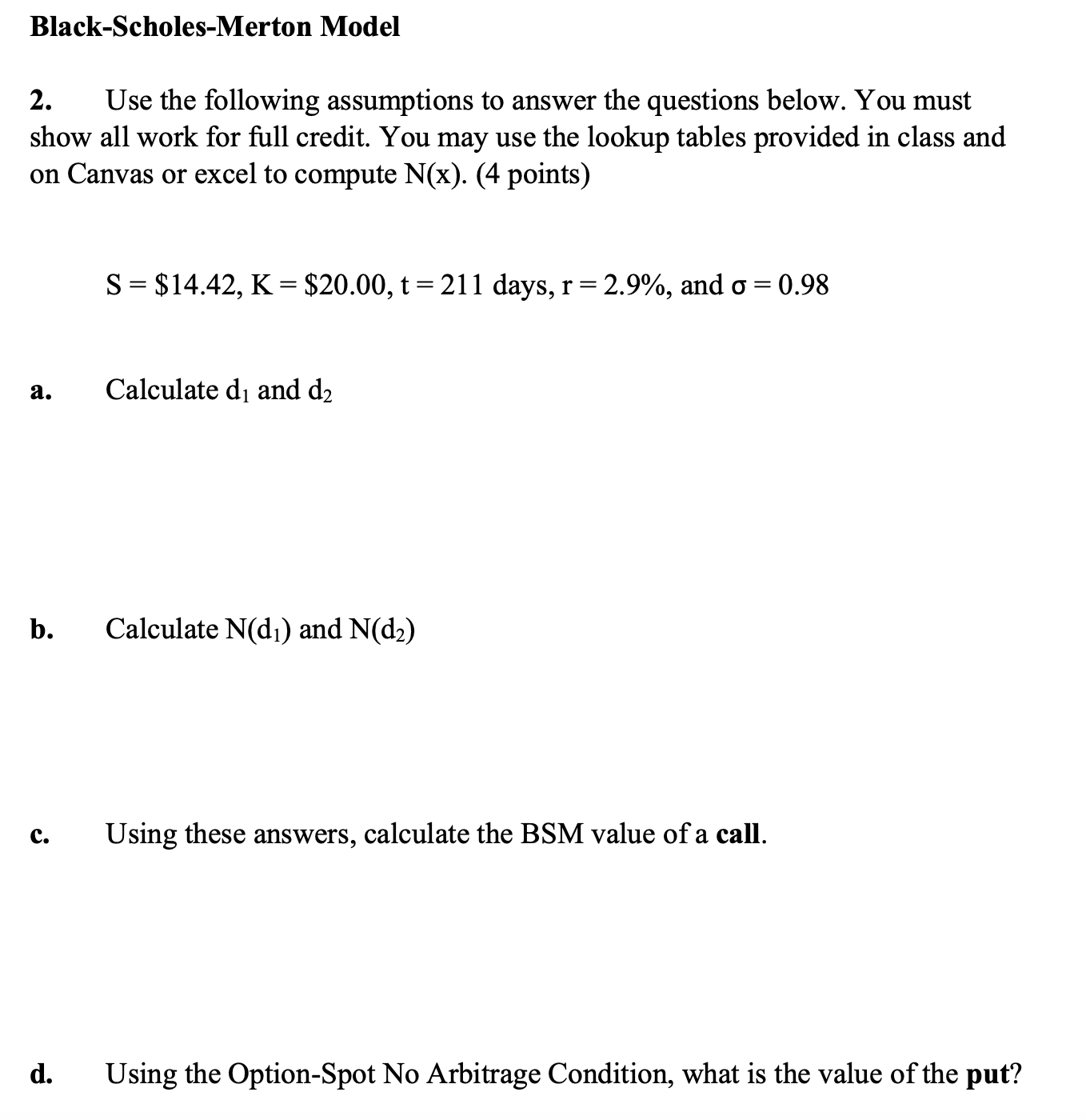

Black-Scholes-Merton Model 2. Use the following assumptions to answer the questions below. You must show all work for full credit. You may use the

Black-Scholes-Merton Model 2. Use the following assumptions to answer the questions below. You must show all work for full credit. You may use the lookup tables provided in class and on Canvas or excel to compute N(x). (4 points) S = $14.42, K = $20.00, t = 211 days, r = 2.9%, and = a. Calculate d and d b. Calculate N(d) and N(d2) C. d. Using these answers, calculate the BSM value of a call. = 0.98 Using the Option-Spot No Arbitrage Condition, what is the value of the put?

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the values required in the BlackScholesMerton BSM model we will use the following formu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started