Blades, Inc., just received a special order for 120,000 pairs of Speedos, its primary roller blade product. Ben Holt, Blades chief financial officer (CFO), needs

Blades, Inc., just received a special order for 120,000 pairs of Speedos, its primary roller blade product. Ben Holt, Blades’ chief financial officer (CFO), needs shortterm financing to finance this large order from the time Blades orders its supplies until the time it will receive payment. Blades will charge a price of 5,000 baht per pair of Speedos. The materials needed to manufacture these 120,000 pairs will be purchased from Thai suppliers. Blades expects the cost of the components for one pair of Speedos to be approximately 3,500 baht in its first year of operating the Thai subsidiary.

Because Blades is relatively unknown in Thailand, its suppliers have indicated that they would like to receive payment as early as possible. The customer that placed this order insists on open account transactions, which means that Blades will receive payment for the roller blades approximately 3 months subsequent to the sale. Furthermore, the production cycle necessary to produce Speedos, from purchase of the materials to the eventual sale of the product, is approximately 3 months. Because of these considerations, Blades expects to collect its revenues approximately 6 months after it has paid for the materials, such as rubber and plastic components, needed to manufacture Speedos.

Holt has identified at least two alternatives for satisfying Blades’ financing needs. First, Blades could borrow Japanese yen for 6 months, convert the yen to Thai baht, and use the baht to pay the Thai suppliers. When the accounts receivable in Thailand are collected, Blades would convert the baht received to yen and repay the Japanese yen loan. Second, Blades could borrow Thai baht for 6 months in order to pay its Thai suppliers. When Blades collects its accounts receivable, it would use these receipts to repay the baht loan. Thus, Blades will use revenue generated in Thailand to repay the loan, whether it borrows the money in yen or in baht.

Holt’s initial research indicates that the 180-day interest rates available to Blades in Japan and in Thailand are 4 and 6 percent, respectively. Consequently, Holt favors borrowing the Japanese yen, as he believes this loan will be cheaper than the baht-denominated loan. He is aware that he should somehow incorporate the future movements of the yen-baht exchange rate in his analysis, but he is unsure how to accomplish this.

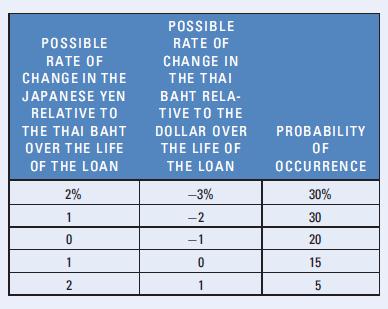

However, he has identified the following probability distribution of the change in the value of the Japanese yen with respect to the Thai baht and of the change in the value of the Thai baht with respect to the dollar over the 6-month period of the loan:

Holt has also informed you that the current spot rate of the yen (in Thai baht) is THB.347826, while the current spot rate of the baht (in dollars) is $.023.

As a financial analyst for Blades, you have been asked to answer the following questions for Holt:

What is the amount, in baht, that Blades needs to borrow to cover the payments due to the Thai suppliers? What is the amount, in yen, that Blades needs to borrow to cover the payments due to the Thai suppliers?

POSSIBLE POSSIBLE RATE OF RATE OF CHANGE IN THE THAI CHANGE IN THE JAPANESE YEN RELATIVE TO T RELA- TIVE TO THE THE THAI BAHT DOLLAR OVER PROBABILITY OVER THE LIFE THE LIFE OF OF OF THE LOAN THE LOAN OCCURRENCE 2% -3% 30% 1 -2 30 -1 20 1 15 2 1

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Amount of THB required to pay off the suppliers Unit Cost 120000 3500 420000000 THB 2 1 Yen ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started