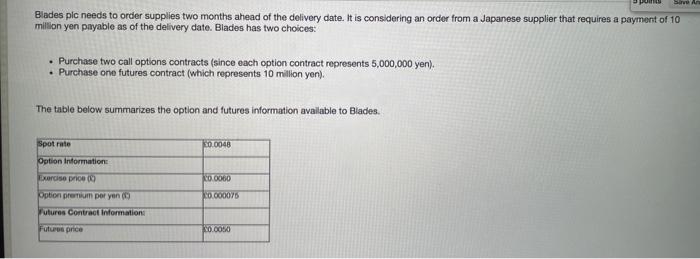

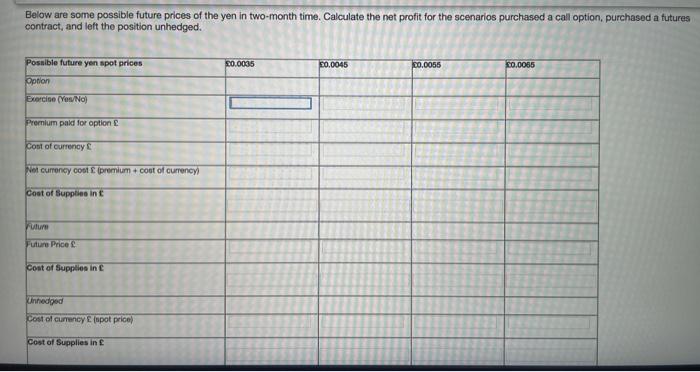

Blades pic needs to order supplies two months ahead of the delivery date. It is considering an order from a Japanese supplier that requires a payment of 10 million yen payable as of the delivery date. Blades has two choices: Purchase two call options contracts (since each option contract represents 5,000,000 yen). Purchase one futures contract (which represents 10 million yen). The table below summarizes the option and futures information available to Blades. 0.0048 Spot rate Option Information: Excercise poo option pretium per yen utures Contact Information 0.0060 0.000075 Futurs price 0.0050 Below are some possible future prices of the yen in two-month time. Calculate the net profit for the scenarios purchased a call option, purchased a futures contract, and left the position unhedged. Possible future yen spot prices 90.0035 20.0045 CO.0055 20.0066 Option Exercise (Yow No) Premium paid for option Cont of currency Nel currency cost premium cost of currency Coat of Supplies in Future Price Cost of Supplies in Unhedged cost of currency (spot price Cost of Supplies in Blades pic needs to order supplies two months ahead of the delivery date. It is considering an order from a Japanese supplier that requires a payment of 10 million yen payable as of the delivery date. Blades has two choices: Purchase two call options contracts (since each option contract represents 5,000,000 yen). Purchase one futures contract (which represents 10 million yen). The table below summarizes the option and futures information available to Blades. 0.0048 Spot rate Option Information: Excercise poo option pretium per yen utures Contact Information 0.0060 0.000075 Futurs price 0.0050 Below are some possible future prices of the yen in two-month time. Calculate the net profit for the scenarios purchased a call option, purchased a futures contract, and left the position unhedged. Possible future yen spot prices 90.0035 20.0045 CO.0055 20.0066 Option Exercise (Yow No) Premium paid for option Cont of currency Nel currency cost premium cost of currency Coat of Supplies in Future Price Cost of Supplies in Unhedged cost of currency (spot price Cost of Supplies in