Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blank 1 options: Avg.Cl + Avg VI, Avg. CG, Avg. Cl + Avg. CG, Avg. VI + Avg. CG, Avg. VI Blank 2 options: Avg.Cl

Blank 1 options: Avg.Cl + Avg VI, Avg. CG, Avg. Cl + Avg. CG, Avg. VI + Avg. CG, Avg. VI

Blank 2 options: Avg.Cl + Avg VI, Avg. CG, Avg. Cl + Avg. CG, Avg. VI + Avg. CG, Avg. VI

Blank 3 options: 19.31%, 6.91%, 0.05%, 9.89%, 0.02%

Blank 4 Options: 0.08%, 9.89%, 0.02%, 6.91%, 13.40%

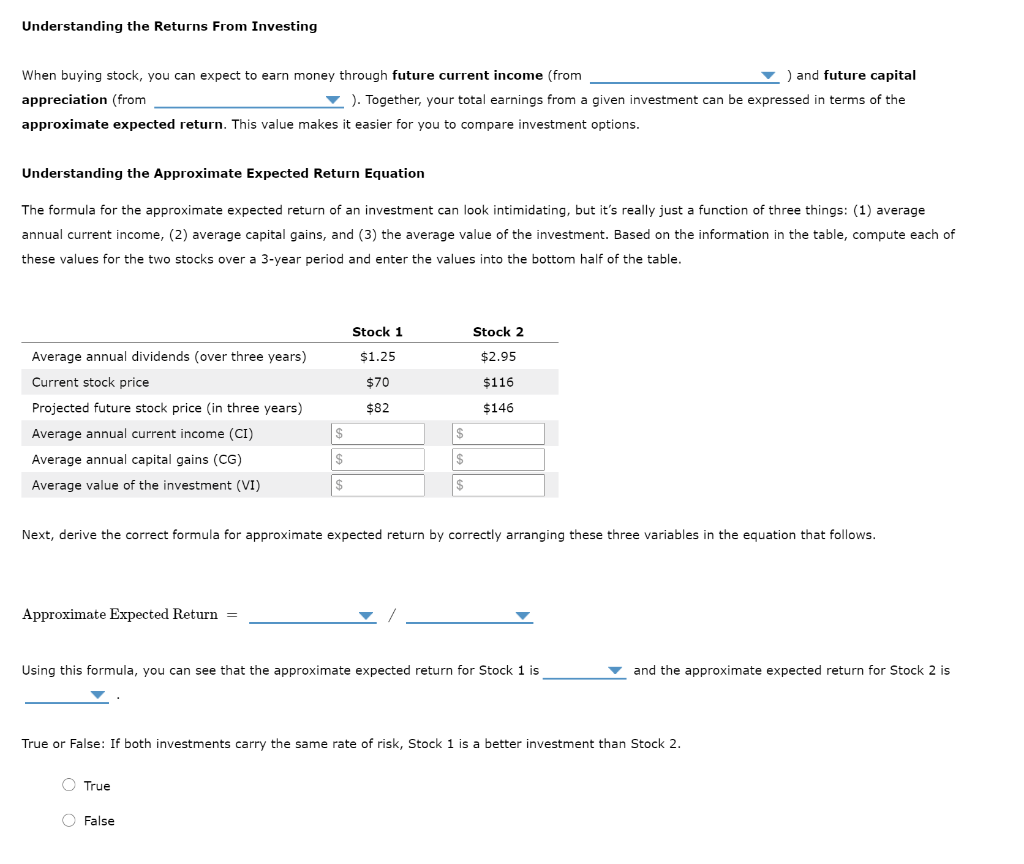

Understanding the Returns From Investing When buying stock, you can expect to earn money through future current income (from ) and future capital appreciation (from ). Together, your total earnings from a given investment can be expressed in terms of the approximate expected return. This value makes it easier for you to compare investment options. Understanding the Approximate Expected Return Equation The formula for the approximate expected return of an investment can look intimidating, but it's really just a function of three things: (1) average annual current income, (2) average capital gains, and (3) the average value of the investment. Based on the information in the table, compute each of these values for the two stocks over a 3-year period and enter the values into the bottom half of the table. Stock 1 Stock 2 $1.25 $2.95 $70 $116 $82 $146 Average annual dividends (over three years) Current stock price Projected future stock price (in three years) Average annual current income (CI) Average annual capital gains (CG) Average value of the investment (VI) $ $ $ $ $ $ Next, derive the correct formula for approximate expected return by correctly arranging these three variables in the equation that follows. Approximate Expected Return = Using this formula, you can see that the approximate expected return for Stock 1 is and the approximate expected return for Stock 2 is True or False: If both investments carry the same rate of risk, Stock 1 is a better investment than Stock 2. O True False Understanding the Returns From Investing When buying stock, you can expect to earn money through future current income (from ) and future capital appreciation (from ). Together, your total earnings from a given investment can be expressed in terms of the approximate expected return. This value makes it easier for you to compare investment options. Understanding the Approximate Expected Return Equation The formula for the approximate expected return of an investment can look intimidating, but it's really just a function of three things: (1) average annual current income, (2) average capital gains, and (3) the average value of the investment. Based on the information in the table, compute each of these values for the two stocks over a 3-year period and enter the values into the bottom half of the table. Stock 1 Stock 2 $1.25 $2.95 $70 $116 $82 $146 Average annual dividends (over three years) Current stock price Projected future stock price (in three years) Average annual current income (CI) Average annual capital gains (CG) Average value of the investment (VI) $ $ $ $ $ $ Next, derive the correct formula for approximate expected return by correctly arranging these three variables in the equation that follows. Approximate Expected Return = Using this formula, you can see that the approximate expected return for Stock 1 is and the approximate expected return for Stock 2 is True or False: If both investments carry the same rate of risk, Stock 1 is a better investment than Stock 2. O True FalseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started