blanks

1- ownership, use

2- ownership, use

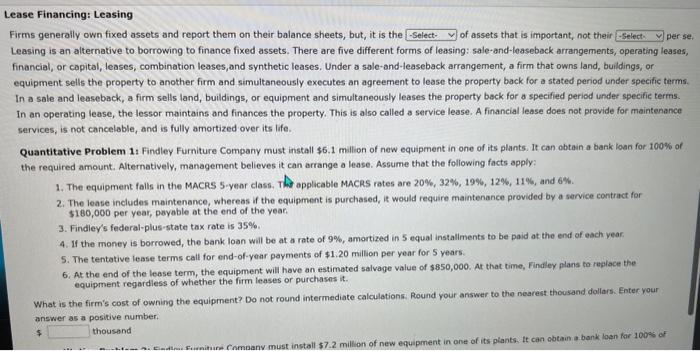

ease Financing: Leasing Firms generally own fixed assets and report them on their balance sheets, but, it is the of assets that is important, not their Leasing is an alternative to borrowing to finance fixed assets. There are five different forms of leasing: sale-and-leaseback arrangements, operating leases, financial, or capital, leases, combination leases, and synthetic leases. Under a sale-and-leaseback arrangement, a firm that owns land, buildings, or equipment sells the property to another firm and simultaneously executes an agreement to lease the property back for a stated period under specific terms. In a sale and leaseback, a firm sells land, buildings, or equipment and simultaneously leases the property back for a specified period under specific terms. In an operating lease, the lessor maintains and finances the property. This is also called a service lease. A financial lease does not provide for maintenance services, is not cancelable, and is fully amortized over its life. Quantitative Problem 1: Findley Fumiture Company must install $6.1 million of new equipment in one of its plants. It can obtain a bank loan for 100% of the required amount. Alternatively, management believes it can arrange a lease. Assume that the following facts apply: 1. The equipment falls in the MACRS 5 -yeor class. The applicable MACRS rates are 20%,32%,19%6,12%,11%, and 6%. 2. The lease includes maintenance, whereas if the equipment is purchased, it would require maintenance provided by a service contract for $180,000 per year, payable at the end of the year. 3. Findiey's federal-plus-state tax rote is 35%. 4. If the money is borrowed, the bank loan will be at a rate of 9%, amortized in 5 equal installments to be paid at the end of each year. 5. The tentative lease terms call for end-of-year payments of $1.20 million per year for 5 years. 6. At the end of the lease term, the equipment will have an estimated salvage value of $850,000. At that time, Findley plans to replace the equipment regardiess of whether the firm leases or purchases it. What is the firm's cost of owning the equipment? Do not round intermediate calculations. Round your answer to the nearest thousand dollars. Enter your answer as a positive number. 5 thousand