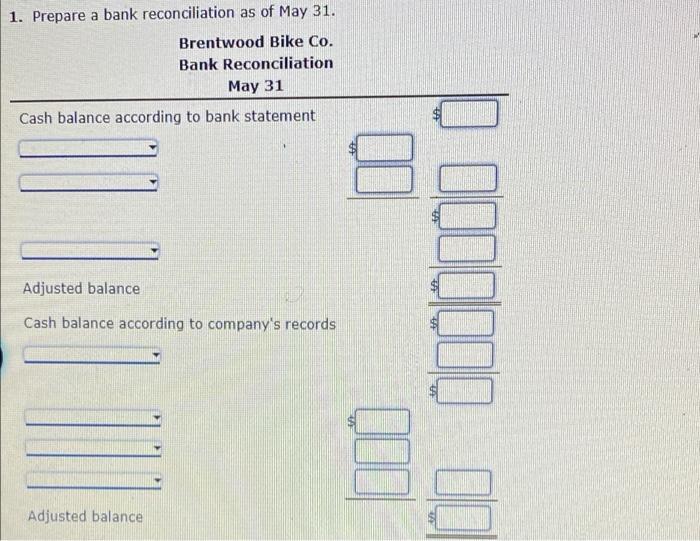

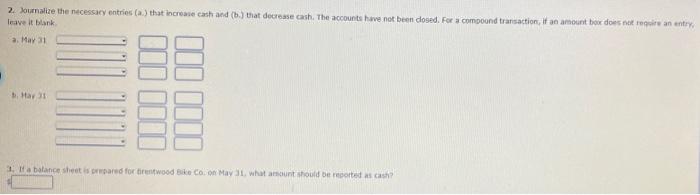

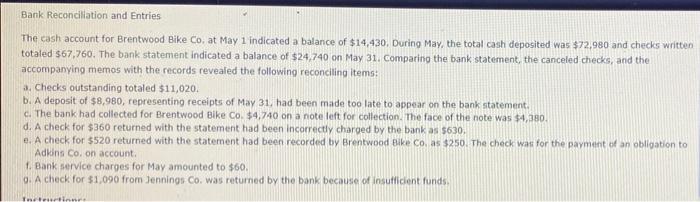

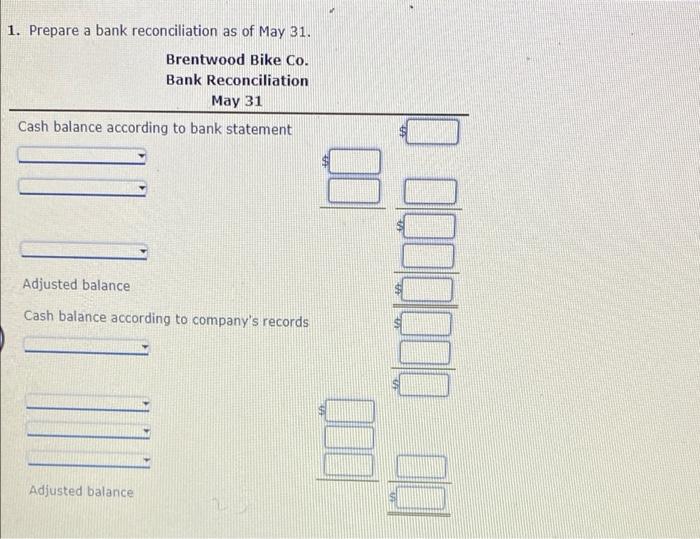

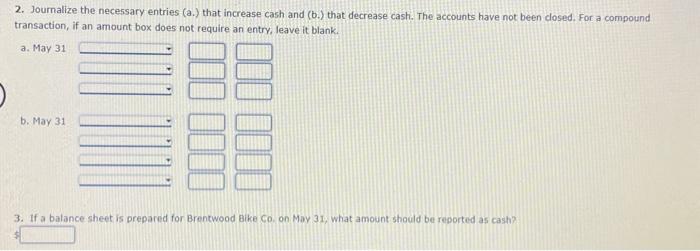

Blant condition and Entries The cash account for rentwood Bike Coat May 1 indicated a balance of $14.430. During May, the total cas deposited was 572,980 and ched written totaled $67,760. The bank statement indicated balance of $24.740 on May 31. Comparing the bank statement, the canceled checks and the accompanying memes with the records revealed the following reconciling items a. Check outstanding tot led 511,070 D. A deposit of $1,980, representing recepts of May 1, had been made too late to appear on the bank statement The bank tad collected for Brentwood Bike CO 34,740 on a note left for collection. The face of the note was $4,500 d. A check for $360 returned with the statement had been incorrectly charged by the banks $530, A check for $520 returned with the statement had been recorded by Brentwood Bike $250. The check was for the payment of an obligation to Adkins Co, on account t. Bank service charge for Hayamounted to $60. o check for $1,000 from Jennings Co. was returned by the bank because of insufficient funds 1. Prepare a bank reconciliation as of May 31. Brentwood Bike Co. Bank Reconciliation May 31 Cash balance according to bank statement Adjusted balance Cash balance according to company's records ODIDI Adjusted balance 2. Journalize the necessary entries that increase cash and (b) that decrease cash. The accounts have not been closed. For a compound transaction, it an amount box does not require an entry leave it blank a. May 31 Har33 III III WII II la balance sheet is pared for rentwood Bike Co. May what amount should be reported cash Bank Reconciliation and Entries The cash account for Brentwood Bike Co. at May 1 indicated a balance of $14,430. During May, the total cash deposited was $72,980 and checks written totaled $67,760. The bank statement indicated a balance of $24.740 on May 31. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: 3. Checks outstanding totaled $11,020. b. A deposit of $8,980, representing receipts of May 31, had been made too late to appear on the bank statement. c. The bank had collected for Brentwood Bike Co. $4,740 on a note left for collection. The face of the note was $4,380. d. A check for $360 returned with the statement had been incorrectly charged by the bank as 5630. e. A check for $520 returned with the statement had been recorded by Brentwood Bike Co as $250 The check was for the payment of an obligation to Adkins Co, on account. Bank service charges for May amounted to $60. 0. A check for $1.090 from Jennings Co. was returned by the bank because of insufficient funds, Tue 1. Prepare a bank reconciliation as of May 31. Brentwood Bike Co. Bank Reconciliation May 31 Cash balance according to bank statement Adjusted balance Cash balance according to company's records ODIO 00 Adjusted balance 2. Journalize the necessary entries (a.) that increase cash and (b.) that decrease cash. The accounts have not been dosed. For a compound transaction, if an amount box does not require an entry, leave it blank. a. May 31 b. May 31 3. If a balance sheet is prepared for Brentwood Bike Co. on May 31, what amount should be reported as cash