Blenheim Electric Works (BLEW) manufactures small diesel-powered electric generators for the home, farm and light-industry markets. It is based in the UK, but 90%

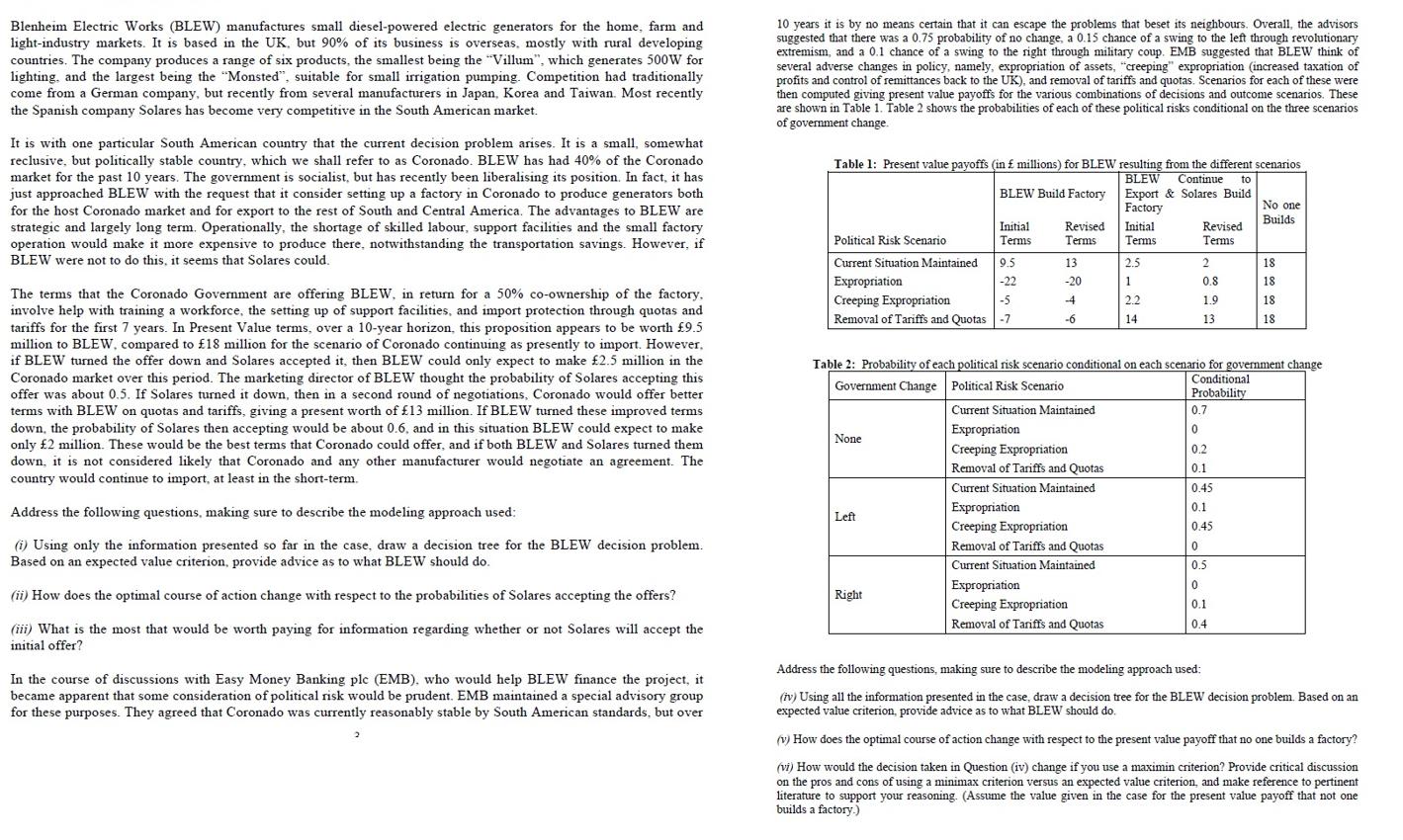

Blenheim Electric Works (BLEW) manufactures small diesel-powered electric generators for the home, farm and light-industry markets. It is based in the UK, but 90% of its business is overseas, mostly with rural developing countries. The company produces a range of six products, the smallest being the "Villum", which generates 500W for lighting, and the largest being the "Monsted", suitable for small irrigation pumping. Competition had traditionally come from a German company, but recently from several manufacturers in Japan, Korea and Taiwan. Most recently the Spanish company Solares has become very competitive in the South American market. It is with one particular South American country that the current decision problem arises. It is a small, somewhat reclusive, but politically stable country, which we shall refer to as Coronado. BLEW has had 40% of the Coronado market for the past 10 years. The government is socialist, but has recently been liberalising its position. In fact, it has just approached BLEW with the request that it consider setting up a factory in Coronado to produce generators both for the host Coronado market and for export to the rest of South and Central America. The advantages to BLEW are strategic and largely long term. Operationally, the shortage of skilled labour, support facilities and the small factory operation would make it more expensive to produce there, notwithstanding the transportation savings. However, if BLEW were not to do this, it seems that Solares could. The terms that the Coronado Government are offering BLEW, in return for a 50% co-ownership of the factory. involve help with training a workforce, the setting up of support facilities, and import protection through quotas and tariffs for the first 7 years. In Present Value terms, over a 10-year horizon, this proposition appears to be worth 9.5 million to BLEW, compared to 18 million for the scenario of Coronado continuing as presently to import. However, if BLEW turned the offer down and Solares accepted it, then BLEW could only expect to make 2.5 million in the Coronado market over this period. The marketing director of BLEW thought the probability of Solares accepting this offer was about 0.5. If Solares turned it down, then in a second round of negotiations, Coronado would offer better terms with BLEW on quotas and tariffs, giving a present worth of 13 million. If BLEW turned these improved terms down, the probability of Solares then accepting would be about 0.6, and in this situation BLEW could expect to make only 2 million. These would be the best terms that Coronado could offer, and if both BLEW and Solares turned them down, it is not considered likely that Coronado and any other manufacturer would negotiate an agreement. The country would continue to import, at least in the short-term. Address the following questions, making sure to describe the modeling approach used: (i) Using only the information presented so far in the case, draw a decision tree for the BLEW decision problem. Based on an expected value criterion, provide advice as to what BLEW should do. (ii) How does the optimal course of action change with respect to the probabilities of Solares accepting the offers? (iii) What is the most that would be worth paying for information regarding whether or not Solares will accept the initial offer? In the course of discussions with Easy Money Banking plc (EMB), who would help BLEW finance the project, it became apparent that some consideration of political risk would be prudent. EMB maintained a special advisory group for these purposes. They agreed that Coronado was currently reasonably stable by South American standards, but over 10 years it is by no means certain that it can escape the problems that beset its neighbours. Overall, the advisors suggested that there was a 0.75 probability of no change, a 0.15 chance of a swing to the left through revolutionary extremism, and a 0.1 chance of a swing to the right through military coup. EMB suggested that BLEW think of several adverse changes in policy, namely, expropriation of assets, "creeping" expropriation (increased taxation of profits and control of remittances back to the UK), and removal of tariffs and quotas. Scenarios for each of these were then computed giving present value payoffs for the various combinations of decisions and outcome scenarios. These are shown in Table 1. Table 2 shows the probabilities of each of these political risks conditional on the three scenarios of government change. to BLEW Build Factory Table 1: Present value payoffs (in millions) for BLEW resulting from the different scenarios BLEW Continue Export & Solares Build Factory Initial Terms. 2.5 1 Political Risk Scenario Initial Terms 9.5 Current Situation Maintained. Expropriation -22 -5 Creeping Expropriation Removal of Tariffs and Quotas -7 None Left Revised Terms 13. -20 Right -4 -6 2.2 14 Revised Terms 2 0.8 1.9 13 Table 2: Probability of each political risk scenario conditional on each scenario for government change Government Change Political Risk Scenario Conditional Probability Current Situation Maintained Expropriation Creeping Expropriation Removal of Tariffs and Quotas Current Situation Maintained Expropriation Creeping Expropriation Removal of Tariffs and Quotas Current Situation Maintained Expropriation Creeping Expropriation Removal of Tariffs and Quotas 0.7 0 0.2 0.1 0.45 0.1 0.45 No one Builds 0 0.5 0 0.1 0.4 18. 18 18 18 Address the following questions, making sure to describe the modeling approach used: (iv) Using all the information presented in the case, draw a decision tree for the BLEW decision problem. Based on an expected value criterion, provide advice as to what BLEW should do. (v) How does the optimal course of action change with respect to the present value payoff that no one builds a factory? (vi) How would the decision taken in Question (iv) change if you use a maximin criterion? Provide critical discussion on the pros and cons of using a minimax criterion versus an expected value criterion, and make reference to pertinent literature to support your reasoning. (Assume the value given in the case for the present value payoff that not one builds a factory.)

Step by Step Solution

3.54 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION o address the questions and provide advice to BLEW we need to create a decision tree and evaluate the different scenarios using an expected value criterion Lets break down the questions step ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started