Answered step by step

Verified Expert Solution

Question

1 Approved Answer

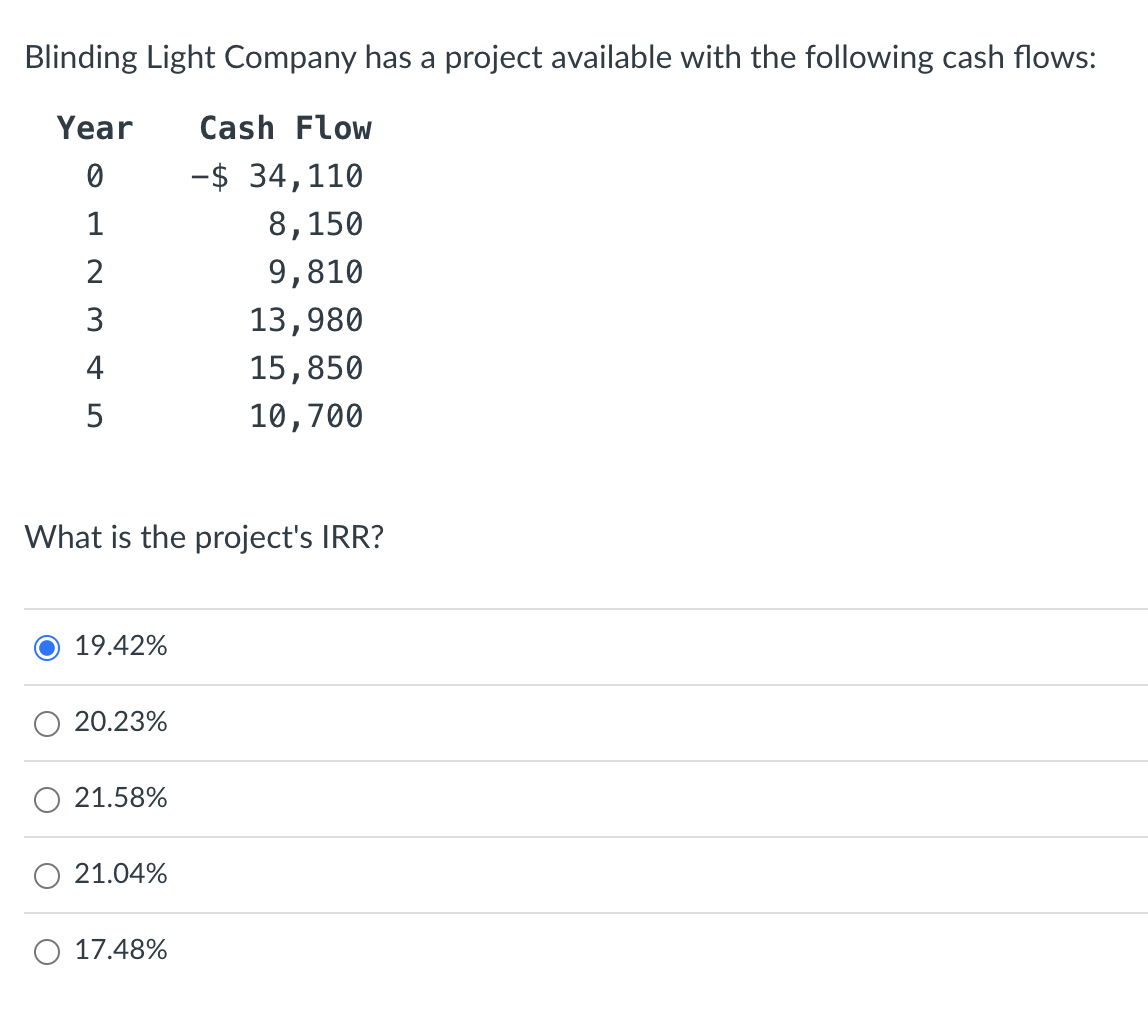

Blinding Light Company has a project available with the following cash flows: What is the project's IRR? begin{tabular}{l} 19.42% hline 20.23% hline 21.58%

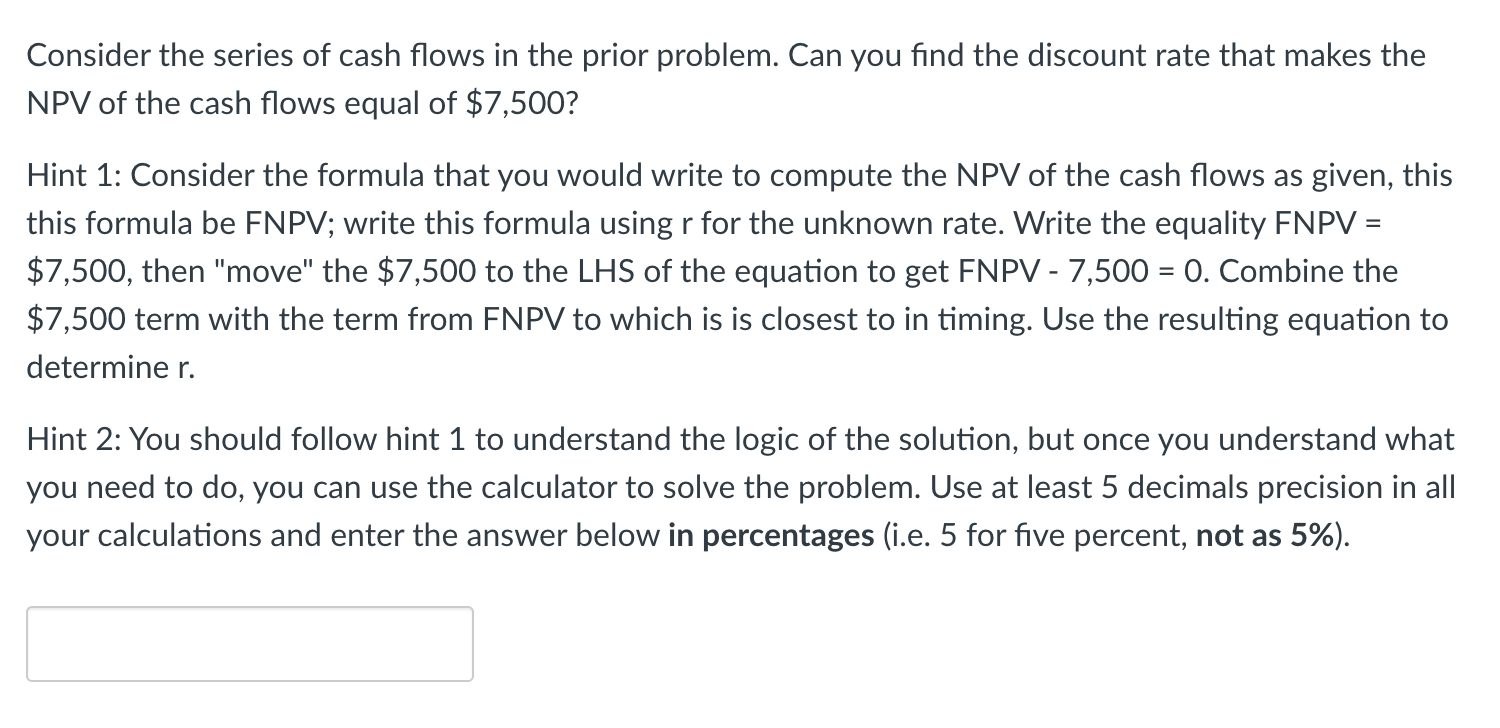

Blinding Light Company has a project available with the following cash flows: What is the project's IRR? \begin{tabular}{l} 19.42% \\ \hline 20.23% \\ \hline 21.58% \\ \hline 21.04% \\ 17.48% \end{tabular} Consider the series of cash flows in the prior problem. Can you find the discount rate that makes the NPV of the cash flows equal of $7,500 ? Hint 1: Consider the formula that you would write to compute the NPV of the cash flows as given, this this formula be FNPV; write this formula using r for the unknown rate. Write the equality FNPV = $7,500, then "move" the $7,500 to the LHS of the equation to get FNPV 7,500=0. Combine the $7,500 term with the term from FNPV to which is is closest to in timing. Use the resulting equation to determine r. Hint 2: You should follow hint 1 to understand the logic of the solution, but once you understand what you need to do, you can use the calculator to solve the problem. Use at least 5 decimals precision in all your calculations and enter the answer below in percentages (i.e. 5 for five percent, not as 5\%)

Blinding Light Company has a project available with the following cash flows: What is the project's IRR? \begin{tabular}{l} 19.42% \\ \hline 20.23% \\ \hline 21.58% \\ \hline 21.04% \\ 17.48% \end{tabular} Consider the series of cash flows in the prior problem. Can you find the discount rate that makes the NPV of the cash flows equal of $7,500 ? Hint 1: Consider the formula that you would write to compute the NPV of the cash flows as given, this this formula be FNPV; write this formula using r for the unknown rate. Write the equality FNPV = $7,500, then "move" the $7,500 to the LHS of the equation to get FNPV 7,500=0. Combine the $7,500 term with the term from FNPV to which is is closest to in timing. Use the resulting equation to determine r. Hint 2: You should follow hint 1 to understand the logic of the solution, but once you understand what you need to do, you can use the calculator to solve the problem. Use at least 5 decimals precision in all your calculations and enter the answer below in percentages (i.e. 5 for five percent, not as 5\%) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started