Answered step by step

Verified Expert Solution

Question

1 Approved Answer

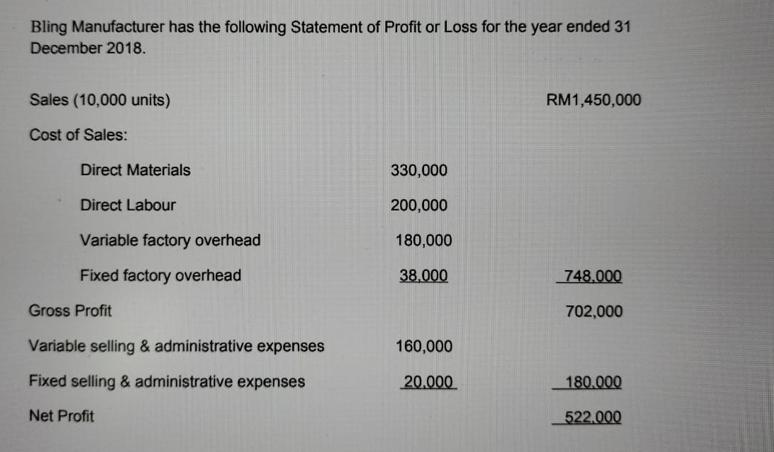

Bling Manufacturer has the following Statement of Profit or Loss for the year ended 31 December 2018. Sales (10,000 units) Cost of Sales: Direct

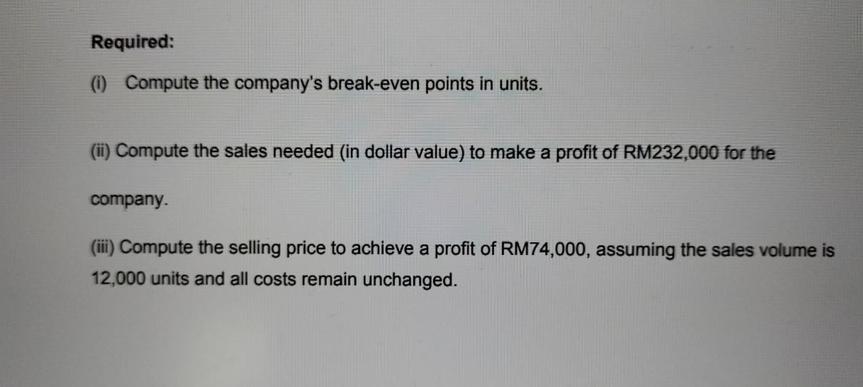

Bling Manufacturer has the following Statement of Profit or Loss for the year ended 31 December 2018. Sales (10,000 units) Cost of Sales: Direct Materials Direct Labour Variable factory overhead Fixed factory overhead Gross Profit Variable selling & administrative expenses Fixed selling & administrative expenses Net Profit 330,000 200,000 180,000 38,000 160,000 20.000 RM1,450,000 748.000 702,000 180.000 522.000 Required: (1) Compute the company's break-even points in units. (ii) Compute the sales needed (in dollar value) to make a profit of RM232,000 for the company. (iii) Compute the selling price to achieve a profit of RM74,000, assuming the sales volume is 12,000 units and all costs remain unchanged.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the requested points i BreakEven Point in Units The BreakEven Point is the level of s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started