Answered step by step

Verified Expert Solution

Question

1 Approved Answer

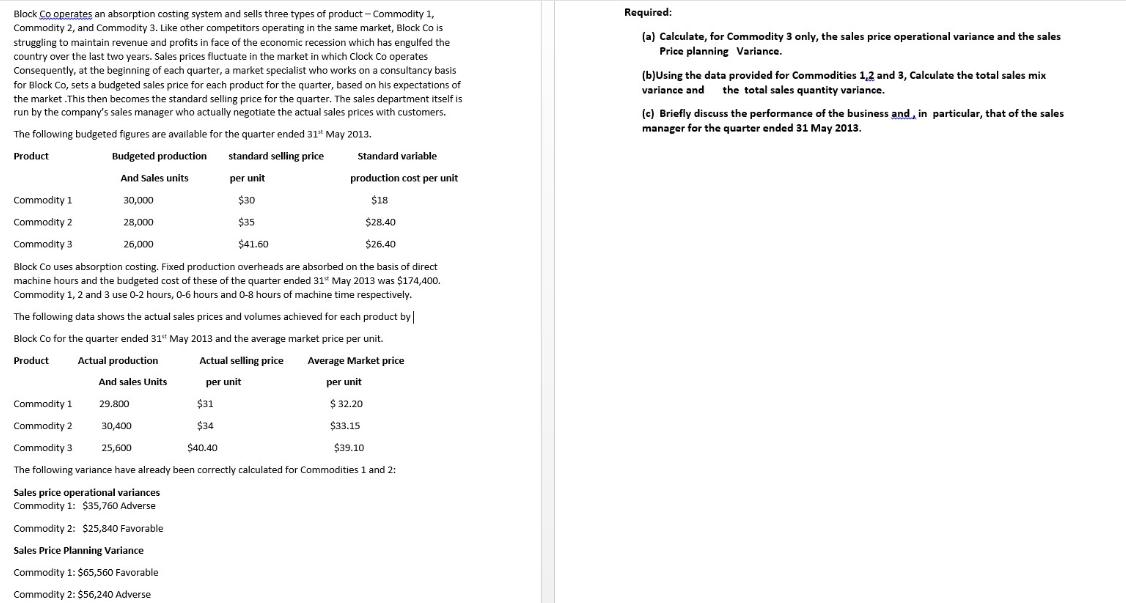

Block Co operates an absorption costing system and sells three types of product-Commodity 1, Commodity 2, and Commodity 3. Like other competitors operating in

Block Co operates an absorption costing system and sells three types of product-Commodity 1, Commodity 2, and Commodity 3. Like other competitors operating in the same market, Block Co is struggling to maintain revenue and profits in face of the economic recession which has engulfed the country over the last two years. Sales prices fluctuate in the market in which Clock Co operates Consequently, at the beginning of each quarter, a market specialist who works on a consultancy basis for Block Co, sets a budgeted sales price for each product for the quarter, based on his expectations of the market. This then becomes the standard selling price for the quarter. The sales department itself is run by the company's sales manager who actually negotiate the actual sales prices with customers. The following budgeted figures are available for the quarter ended 31" May 2013. Product Standard variable Required: (a) Calculate, for Commodity 3 only, the sales price operational variance and the sales Price planning Variance. (b) Using the data provided for Commodities 1,2 and 3, Calculate the total sales mix variance and the total sales quantity variance. (c) Briefly discuss the performance of the business and, in particular, that of the sales manager for the quarter ended 31 May 2013. Budgeted production standard selling price And Sales units per unit production cost per unit Commodity 1 30,000 $30 $18 Commodity 2 28,000 $35 $28.40 Commodity 3 26,000 $41.60 $26.40 Block Co uses absorption costing. Fixed production overheads are absorbed on the basis of direct machine hours and the budgeted cost of these of the quarter ended 31 May 2013 was $174,400. Commodity 1, 2 and 3 use 0-2 hours, 0-6 hours and 0-8 hours of machine time respectively. The following data shows the actual sales prices and volumes achieved for each product by Block Co for the quarter ended 31" May 2013 and the average market price per unit. Product Actual production And sales Units Actual selling price Average Market price per unit per unit Commodity 1 29.800 $31 $32.20 Commodity 2 30,400 $34 $33.15 Commodity 3 25,600 $40.40 $39.10 The following variance have already been correctly calculated for Commodities 1 and 2: Sales price operational variances Commodity 1: $35,760 Adverse Commodity 2: $25,840 Favorable Sales Price Planning Variance Commodity 1: $65,560 Favorable Commodity 2: $56,240 Adverse

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started