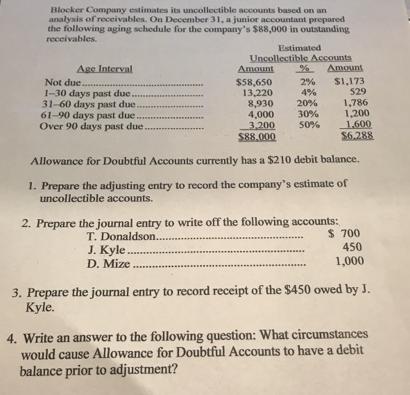

Blocker Company estimates ita uncollectible accounts based on an analysis of receivables. On December 31, a junior accountant prepared the following aging schedule for

Blocker Company estimates ita uncollectible accounts based on an analysis of receivables. On December 31, a junior accountant prepared the following aging schedule for the company's $88,000 in outstanding receivables. Estimated Uncollectible Accounts Age Interval Amount Amount $58,650 13,220 8,930 4,000 3,200 $88.000 S1,173 529 1,786 1,200 1.600 $6.288 2% 4% Not due. 1-30 days past due. 31-60 days past due. 61-90 days past due. Over 90 days past due. 20% 30% 50% Allowance for Doubtful Accounts currently has a $210 debit balance. 1. Prepare the adjusting entry to record the company's estimate of uncollectible accounts. 2. Prepare the journal entry to write off the following accounts: $ 700 450 T. Donaldson. J. Kyle. D. Mize 1,000 3. Prepare the journal entry to record receipt of the $450 owed by J. Kyle. 4. Write an answer to the following question: What circumstances would cause Allowance for Doubtful Accounts to have a debit balance prior to adjustment?

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Account Title Bad Debt Expense Allowance for Doubtful Accounts To record provision for ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started