Answered step by step

Verified Expert Solution

Question

1 Approved Answer

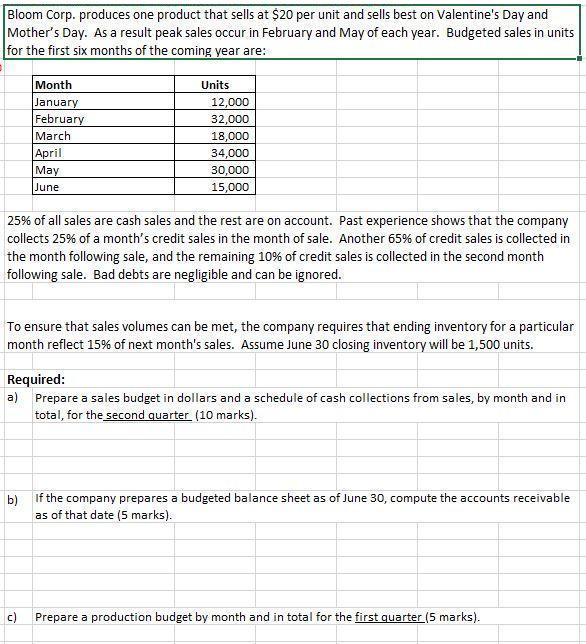

Bloom Corp. produces one product that sells at $20 per unit and sells best on Valentine's Day and Mother's Day. As a result peak

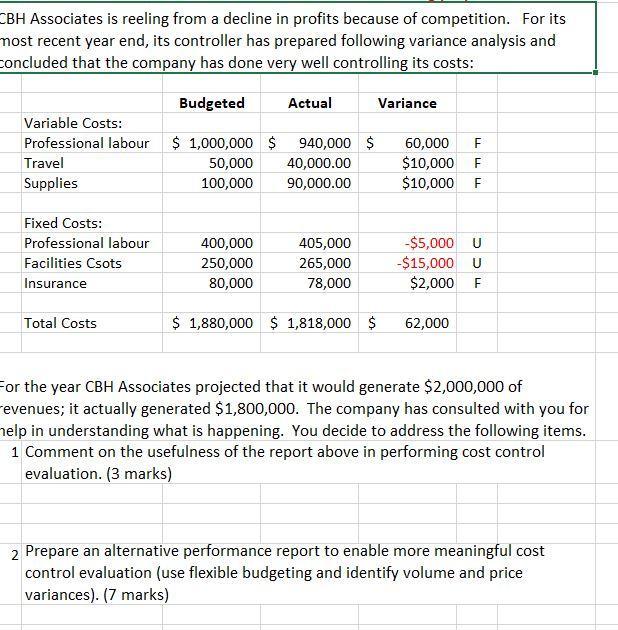

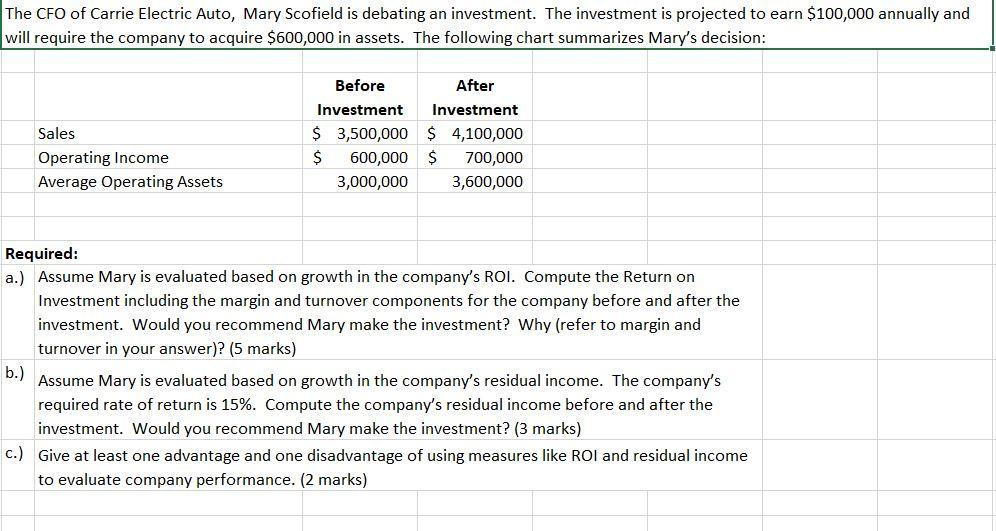

Bloom Corp. produces one product that sells at $20 per unit and sells best on Valentine's Day and Mother's Day. As a result peak sales occur in February and May of each year. Budgeted sales in units for the first six months of the coming year are: Month Units January 12,000 February 32,000 March 18,000 34,000 30,000 15,000 April May June 25% of all sales are cash sales and the rest are on account. Past experience shows that the company collects 25% of a month's credit sales in the month of sale. Another 65% of credit sales is collected in the month following sale, and the remaining 10% of credit sales is collected in the second month following sale. Bad debts are negligible and can be ignored. To ensure that sales volumes can be met, the company requires that ending inventory for a particular month reflect 15% of next month's sales. Assume June 30 closing inventory will be 1,500 units. Required: a) Prepare a sales budget in dollars and a schedule of cash collections from sales, by month and in total, for the second quarter (10 marks). b) If the company prepares a budgeted balance sheet as of June 30, compute the accounts receivable as of that date (5 marks). Prepare a production budget by month and in total for the first quarter (5 marks). CBH Associates is reeling from a decline in profits because of competition. For its most recent year end, its controller has prepared following variance analysis and concluded that the company has done very well controlling its costs: Budgeted Actual Variance Variable Costs: Professional labour $ 1,000,000 $ 50,000 940,000 $ 40,000.00 60,000 $10,000 F $10,000 Travel Supplies 100,000 90,000.00 Fixed Costs: Professional labour 400,000 405,000 -$5,000 U -$15,000 U $2,000 F Facilities Csots 250,000 265,000 Insurance 80,000 78,000 Total Costs $ 1,880,000 $ 1,818,000 $ 62,000 For the year CBH Associates projected that it would generate $2,000,000 of revenues; it actually generated $1,800,000. The company has consulted with you for help in understanding what is happening. You decide to address the following items. 1 Comment on the usefulness of the report above in performing cost control evaluation. (3 marks) 2 Prepare an alternative performance report to enable more meaningful cost control evaluation (use flexible budgeting and identify volume and price variances). (7 marks) The CFO of Carrie Electric Auto, Mary Scofield is debating an investment. The investment is projected to earn $100,000 annually and will require the company to acquire $600,000 in assets. The following chart summarizes Mary's decision: Before After Investment Investment Sales $ 3,500,000 $ 4,100,000 Operating Income Average Operating Assets 600,000 $ 700,000 3,000,000 3,600,000 Required: a.) Assume Mary is evaluated based on growth in the company's ROI. Compute the Return on Investment including the margin and turnover components for the company before and after the investment. Would you recommend Mary make the investment? Why (refer to margin and turnover in your answer)? (5 marks) b.) Assume Mary is evaluated based on growth in the company's residual income. The company's required rate of return is 15%. Compute the company's residual income before and after the investment. Would you recommend Mary make the investment? (3 marks) c.) Give at least one advantage and one disadvantage of using measures like ROI and residual income to evaluate company performance. (2 marks)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 In the above question we have asked to prepare sales budget cash collection from sales produc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started