Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bloomfield Ltd, a New Zealand importer, has bought US$150,000 of products overseas. The payment is due in exactly two months time. At the time

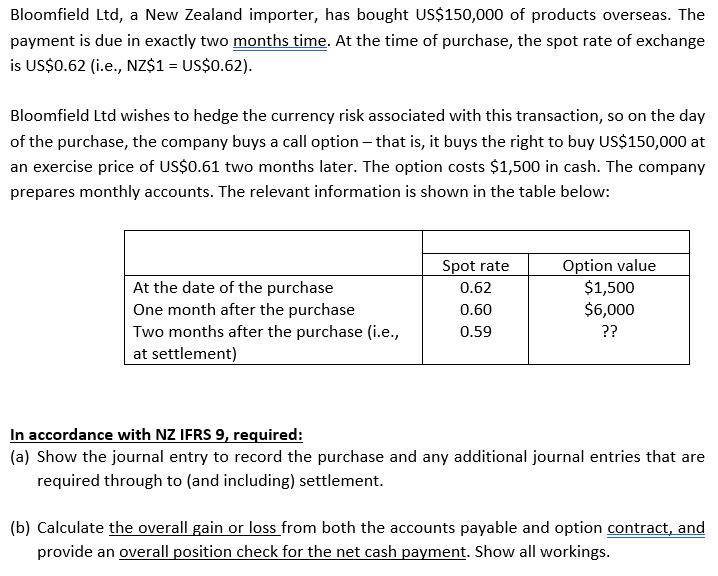

Bloomfield Ltd, a New Zealand importer, has bought US$150,000 of products overseas. The payment is due in exactly two months time. At the time of purchase, the spot rate of exchange is US$0.62 (i.e., NZ$1 = US$0.62). Bloomfield Ltd wishes to hedge the currency risk associated with this transaction, so on the day of the purchase, the company buys a call option that is, it buys the right to buy US$150,000 at an exercise price of US$0.61 two months later. The option costs $1,500 in cash. The company prepares monthly accounts. The relevant information is shown in the table below: At the date of the purchase One month after the purchase Two months after the purchase (i.e., at settlement) Spot rate 0.62 0.60 0.59 Option value $1,500 $6,000 ?? In accordance with NZ IFRS 9, required: (a) Show the journal entry to record the purchase and any additional journal entries that are required through to (and including) settlement. (b) Calculate the overall gain or loss from both the accounts payable and option contract, and provide an overall position check for the net cash payment. Show all workings.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Show the journal entry to record the purchase and any additional journal entries that are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started