Blooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a relatively cheap purification system for $8 million. The system will last 4 years. Do-It-Right sells a sturdier but more expensive system for $18 million; it will last for 9 years. Both systems entail $3 million in operating costs; both will be depreciated straight-line to a final value of zero over their useful lives; neither will have any salvage value at the end of its life. The firms tax rate is 30%, and the discount rate is 16%. Either machine will be replaced at the end of its life.

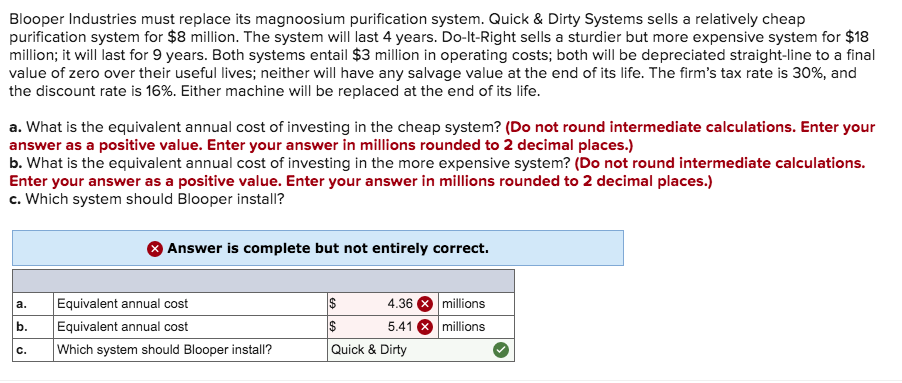

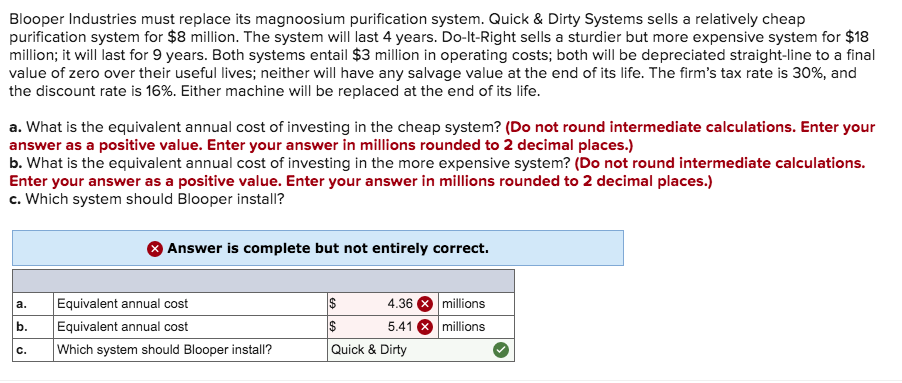

a. What is the equivalent annual cost of investing in the cheap system? (Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.)

b. What is the equivalent annual cost of investing in the more expensive system? (Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.)

c. Which system should Blooper install?

Blooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a relatively cheap purification system for $8 million. The system will last 4 years. Do-It-Right sells a sturdier but more expensive system for $18 million; it will last for 9 years. Both systems entail $3 million in operating costs; both will be depreciated straight-line to a final value of zero over their useful lives; neither will have any salvage value at the end of its life. The firm's tax rate is 30%, and the discount rate is 16%. Either machine will be replaced at the end of its life. a. What is the equivalent annual cost of investing in the cheap system? (Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.) b. What is the equivalent annual cost of investing in the more expensive system? (Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.) c. Which system should Blooper install? Answer is complete but not entirely correct. Equivalent annual cost Equivalent annual cost Which system should Blooper install? 4.36 5.41 Quick & Dirty millions millions Blooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a relatively cheap purification system for $8 million. The system will last 4 years. Do-It-Right sells a sturdier but more expensive system for $18 million; it will last for 9 years. Both systems entail $3 million in operating costs; both will be depreciated straight-line to a final value of zero over their useful lives; neither will have any salvage value at the end of its life. The firm's tax rate is 30%, and the discount rate is 16%. Either machine will be replaced at the end of its life. a. What is the equivalent annual cost of investing in the cheap system? (Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.) b. What is the equivalent annual cost of investing in the more expensive system? (Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.) c. Which system should Blooper install? Answer is complete but not entirely correct. Equivalent annual cost Equivalent annual cost Which system should Blooper install? 4.36 5.41 Quick & Dirty millions millions