Answered step by step

Verified Expert Solution

Question

1 Approved Answer

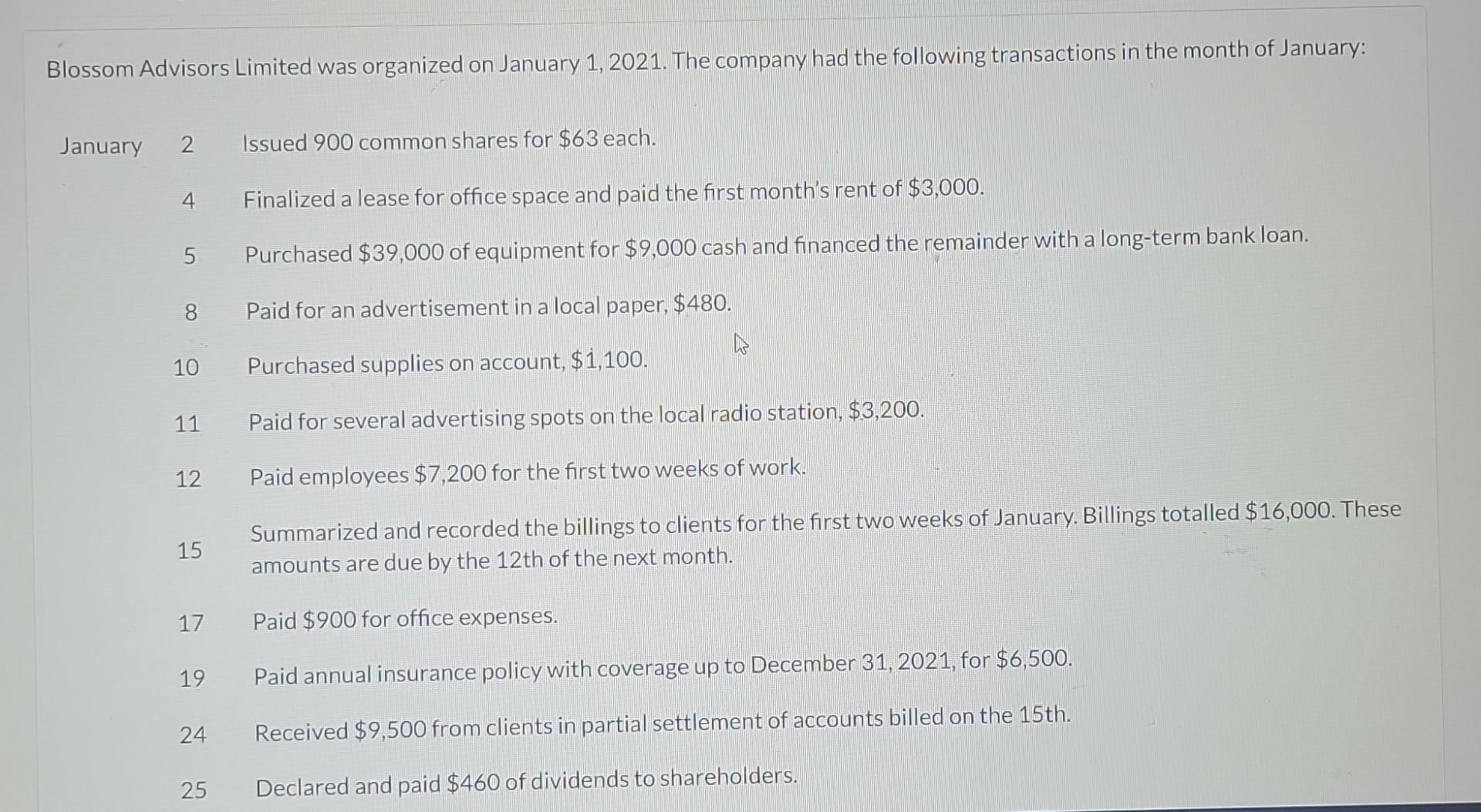

Blossom Advisors Limited was organized on January 1, 2021. The company had the following transactions in the month of January: January 2 4 5

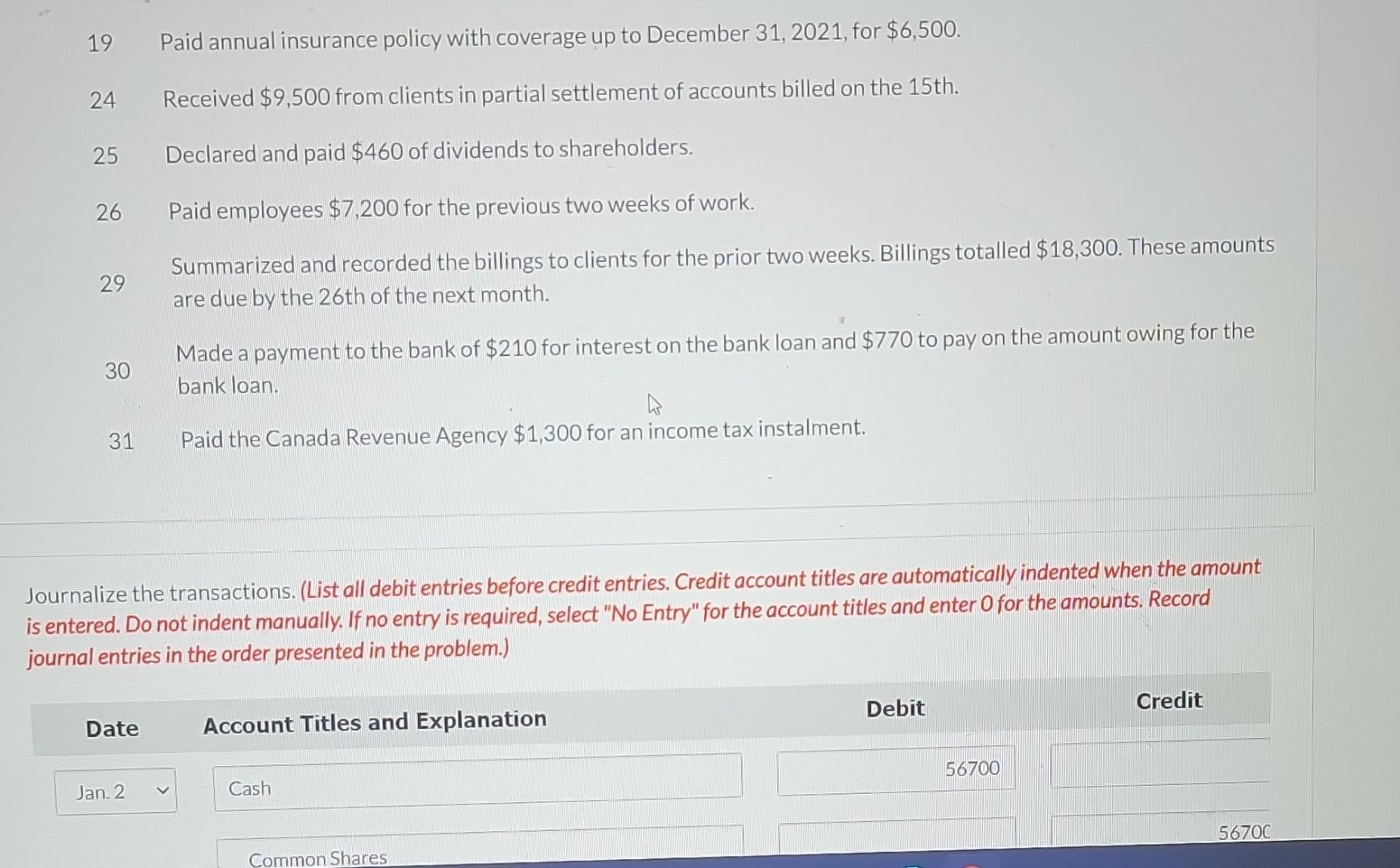

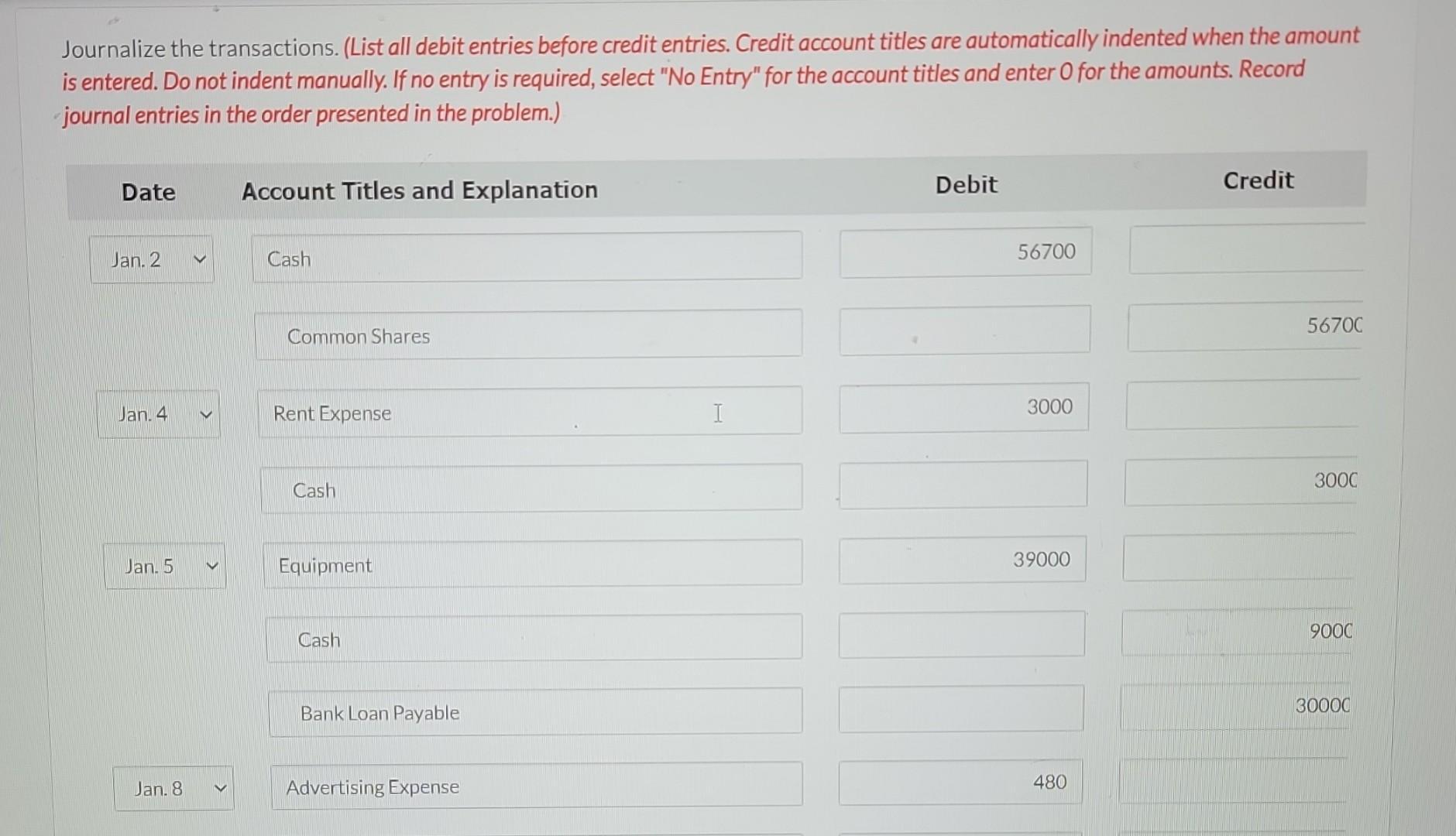

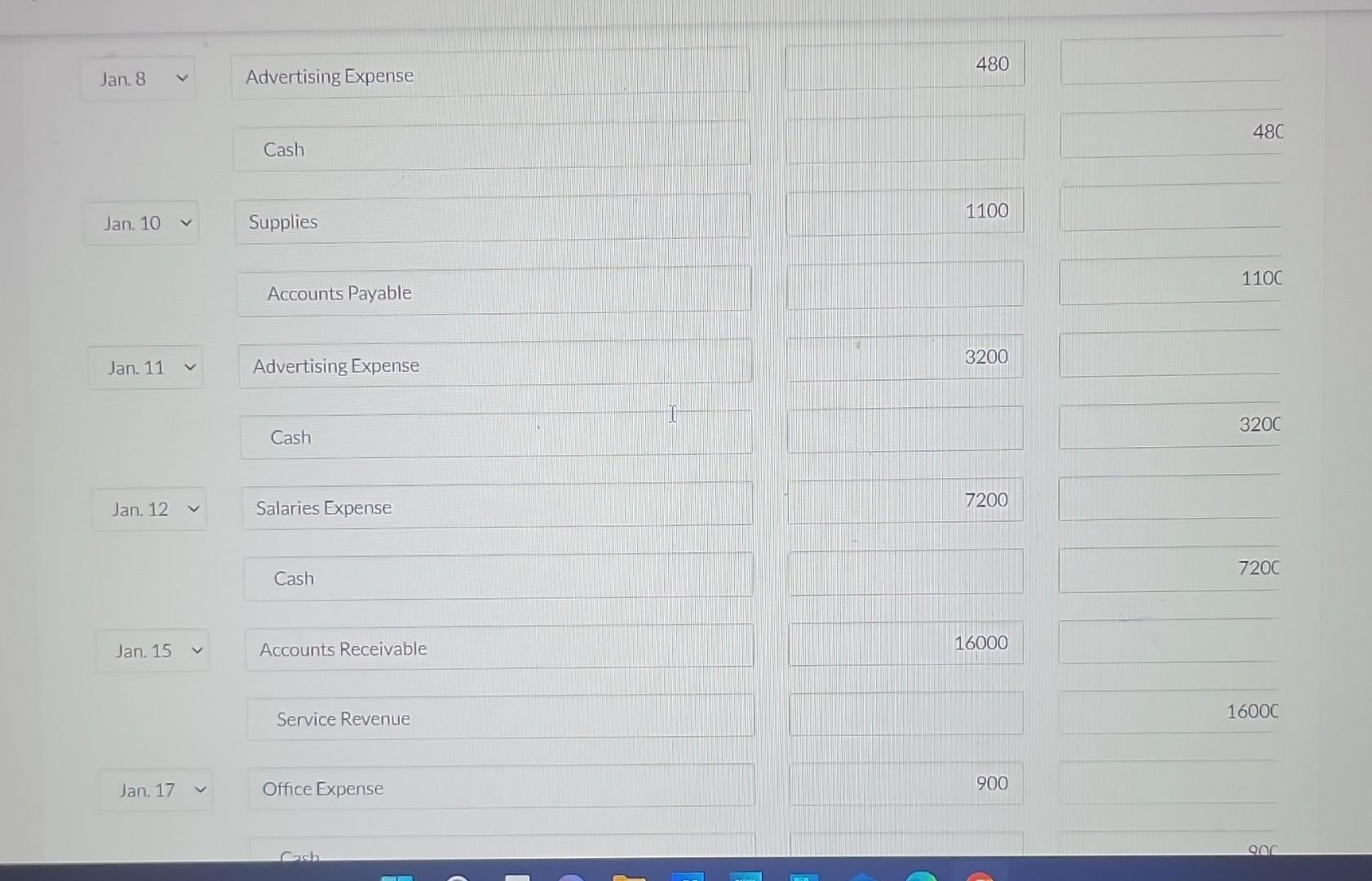

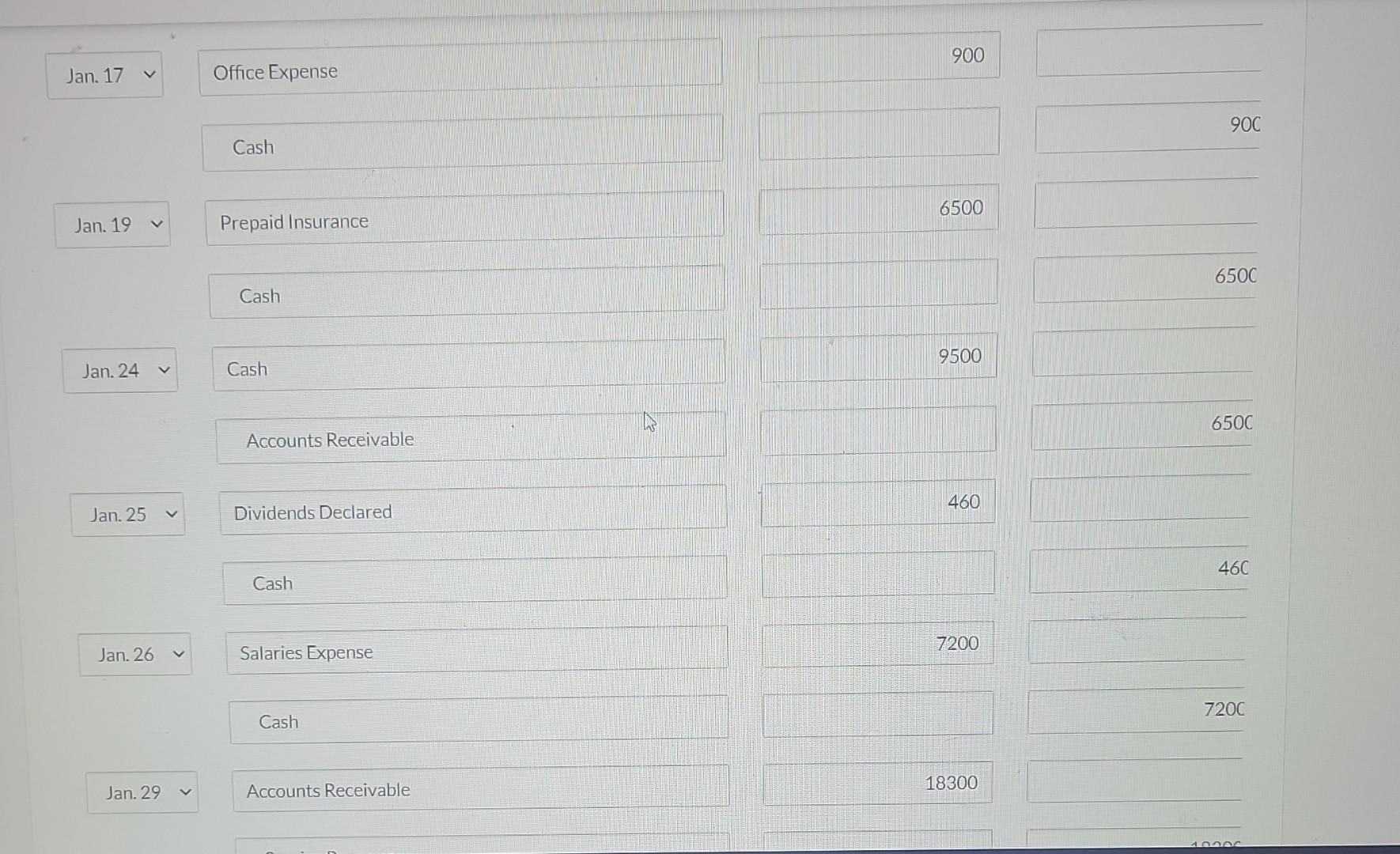

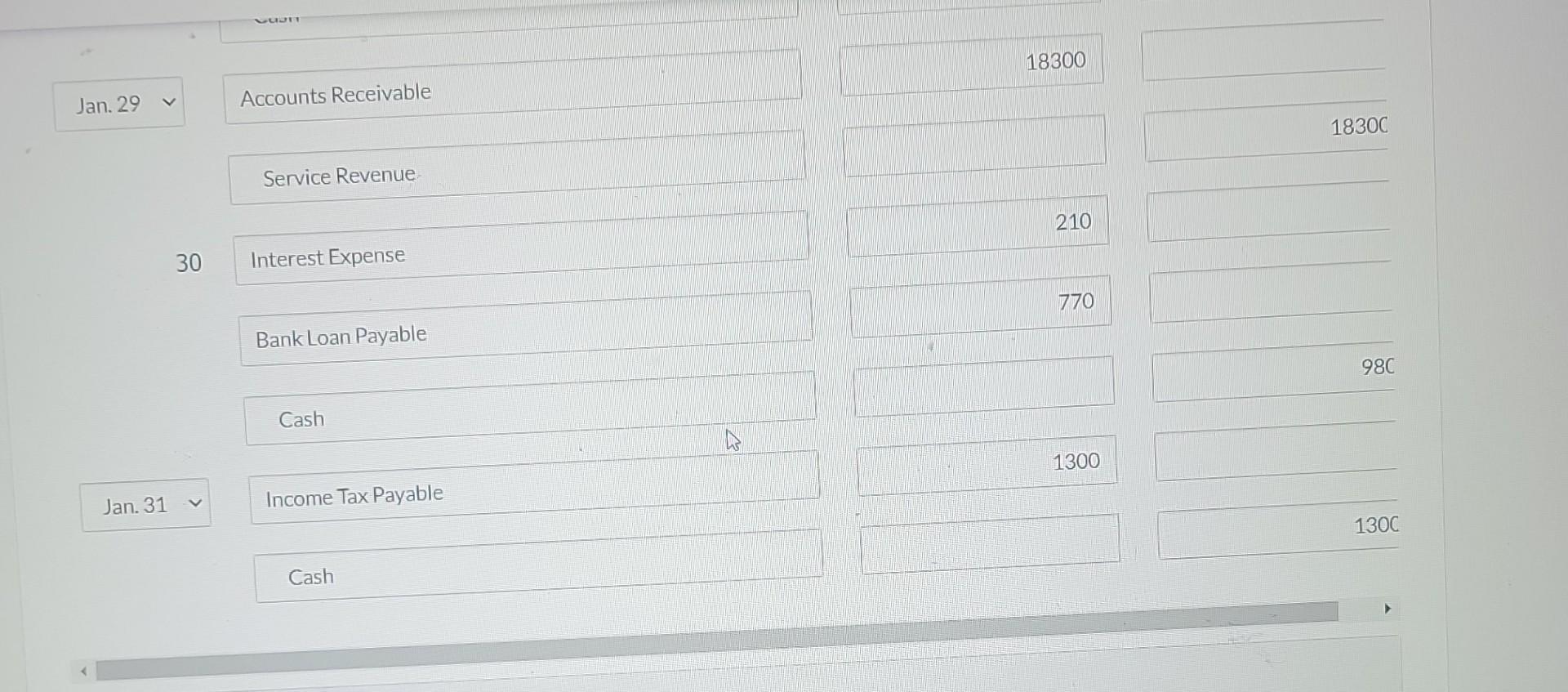

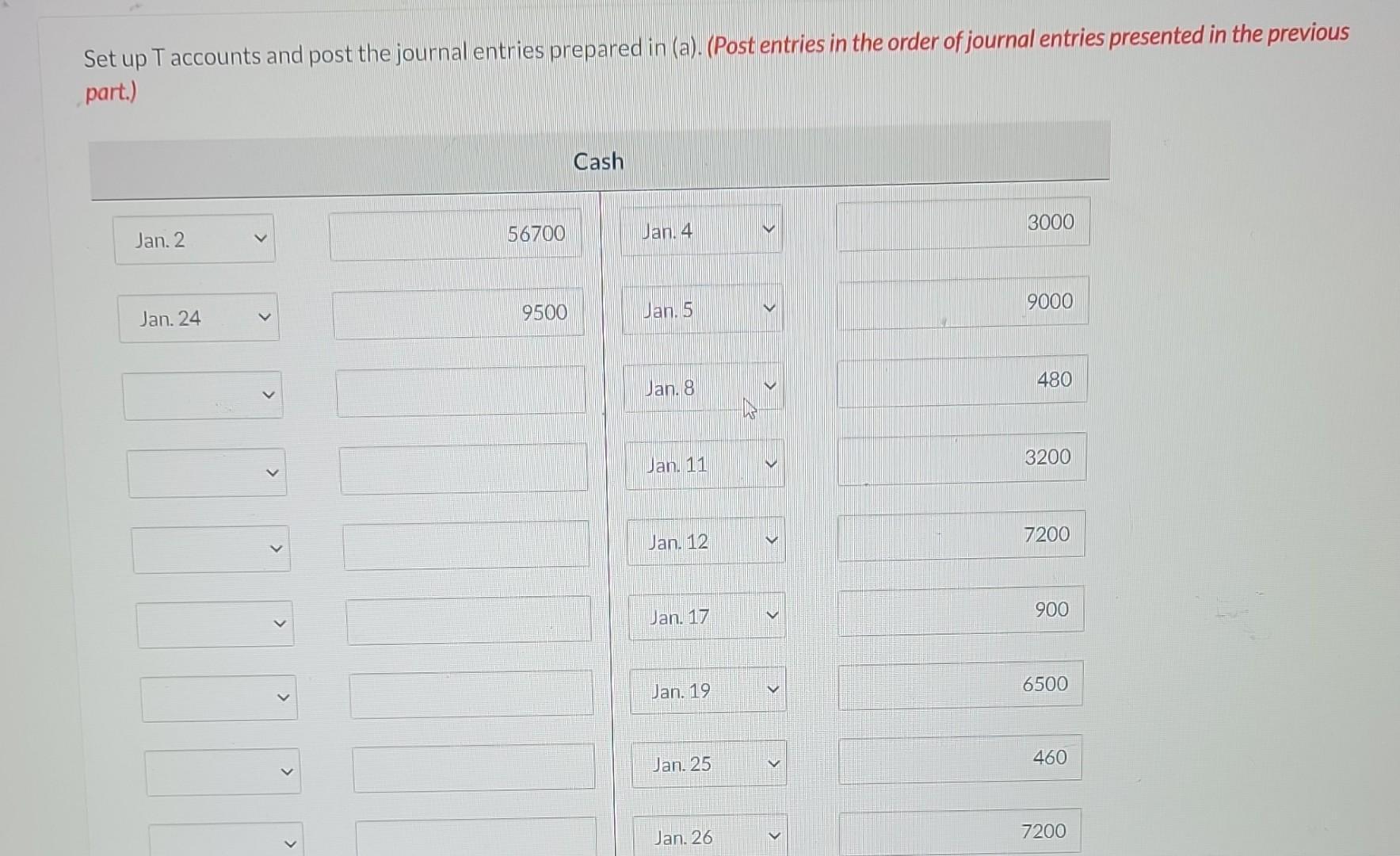

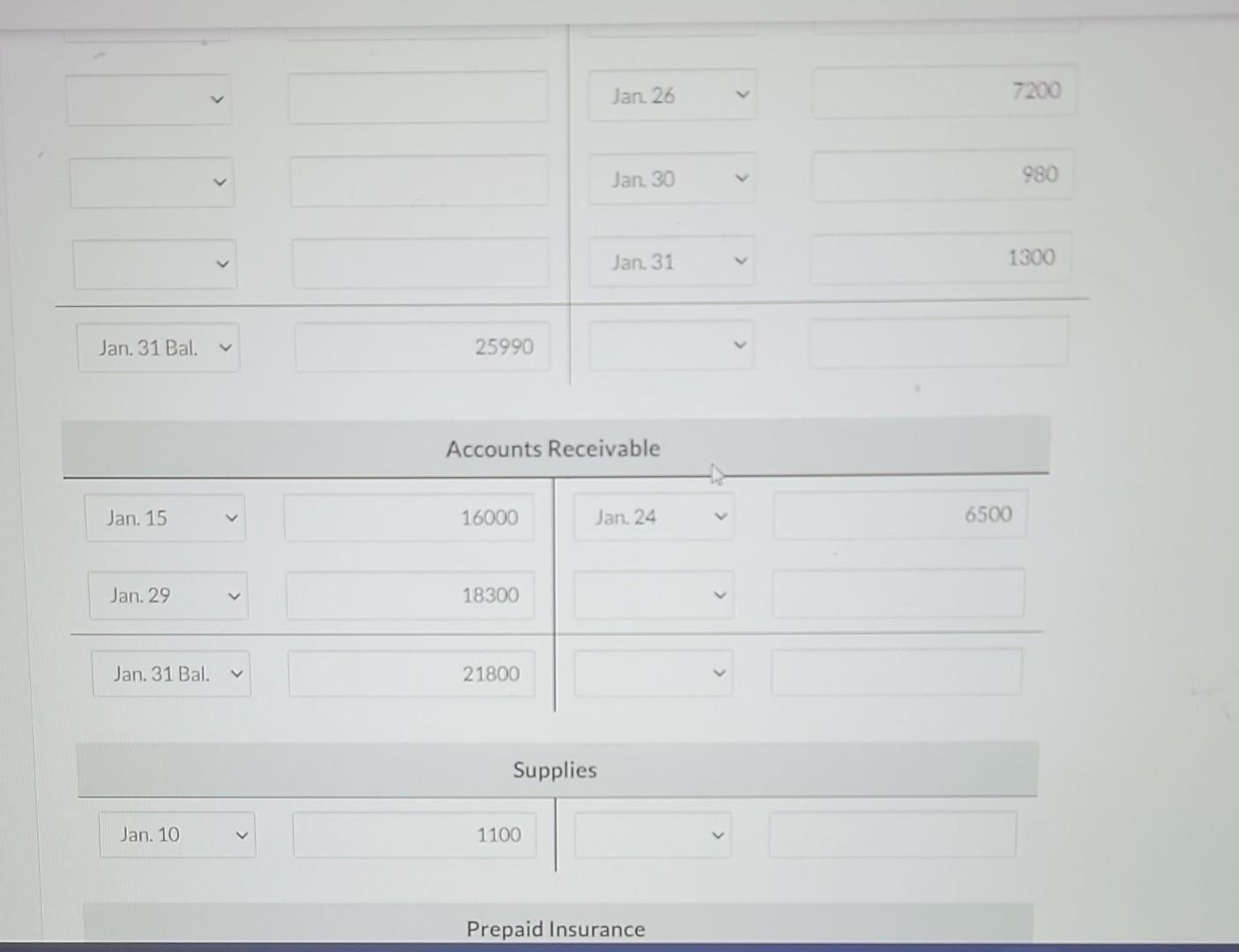

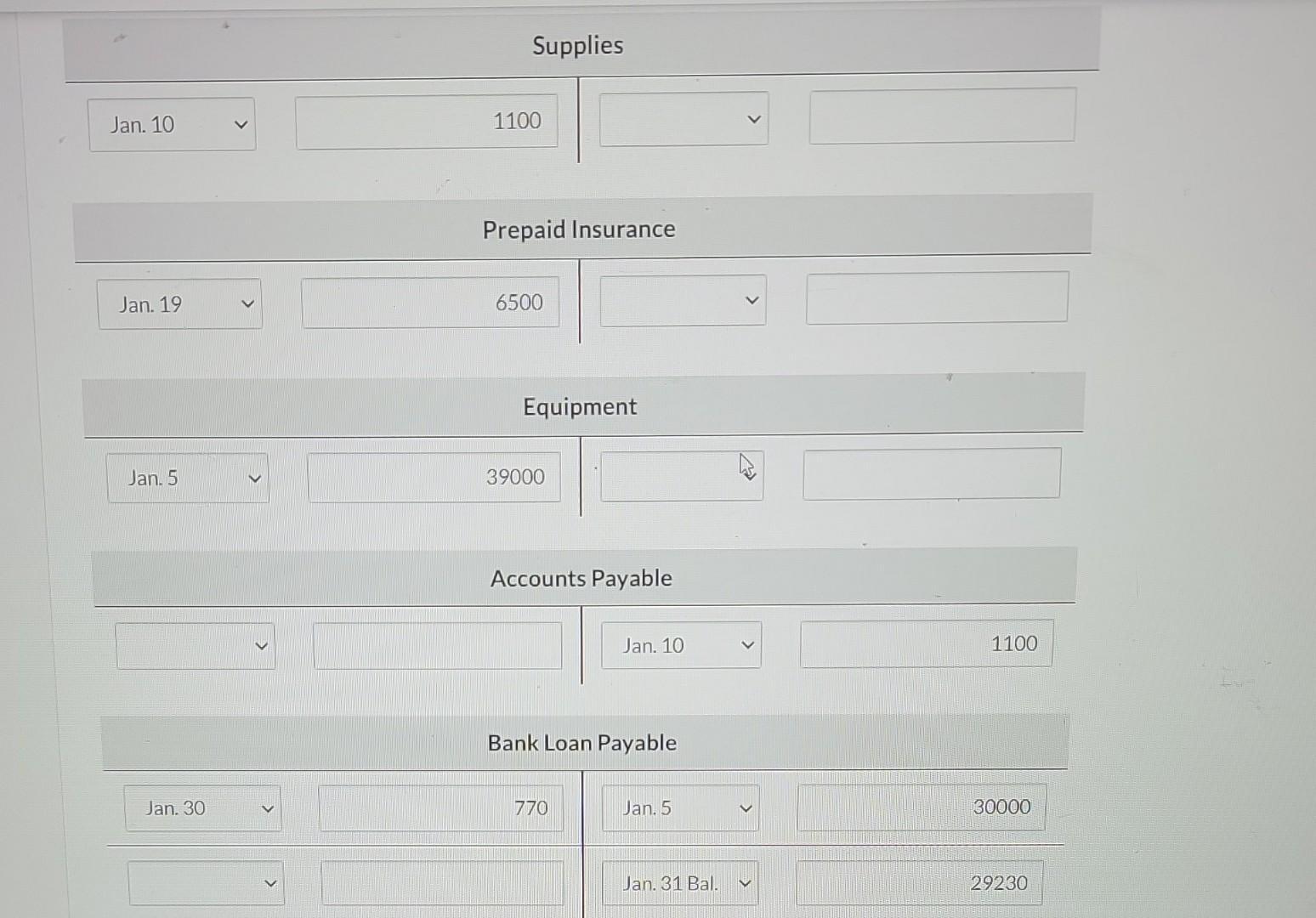

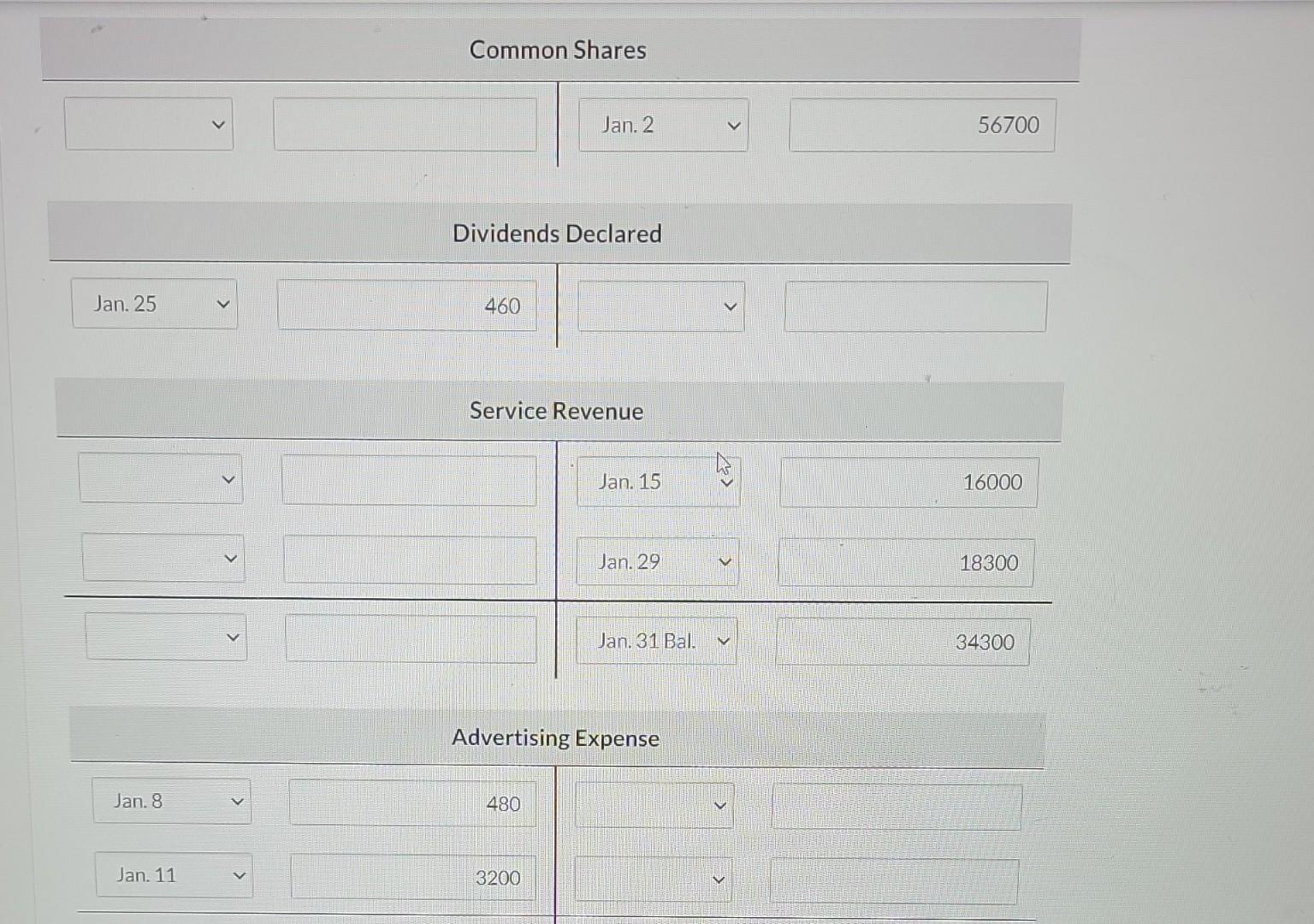

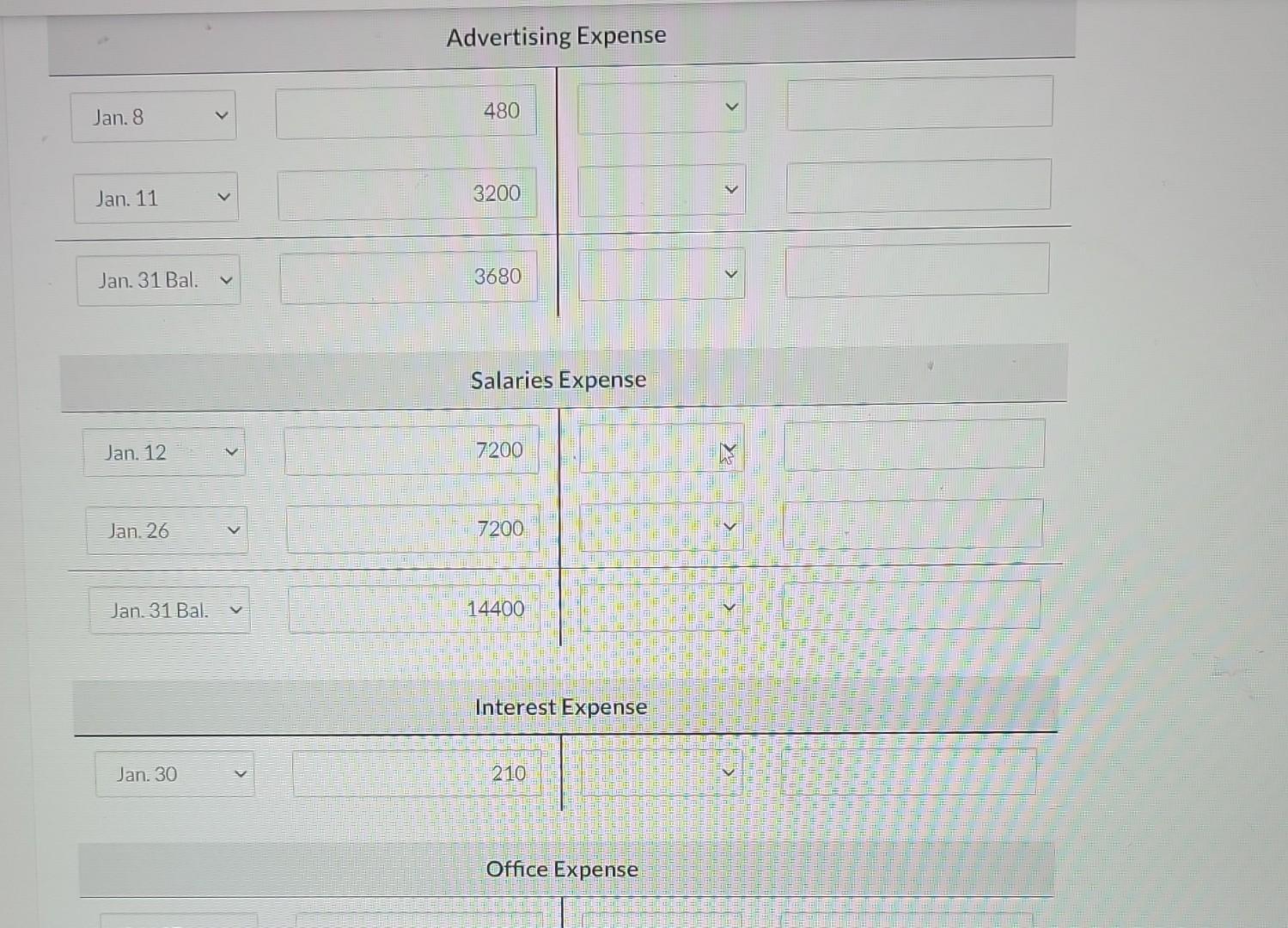

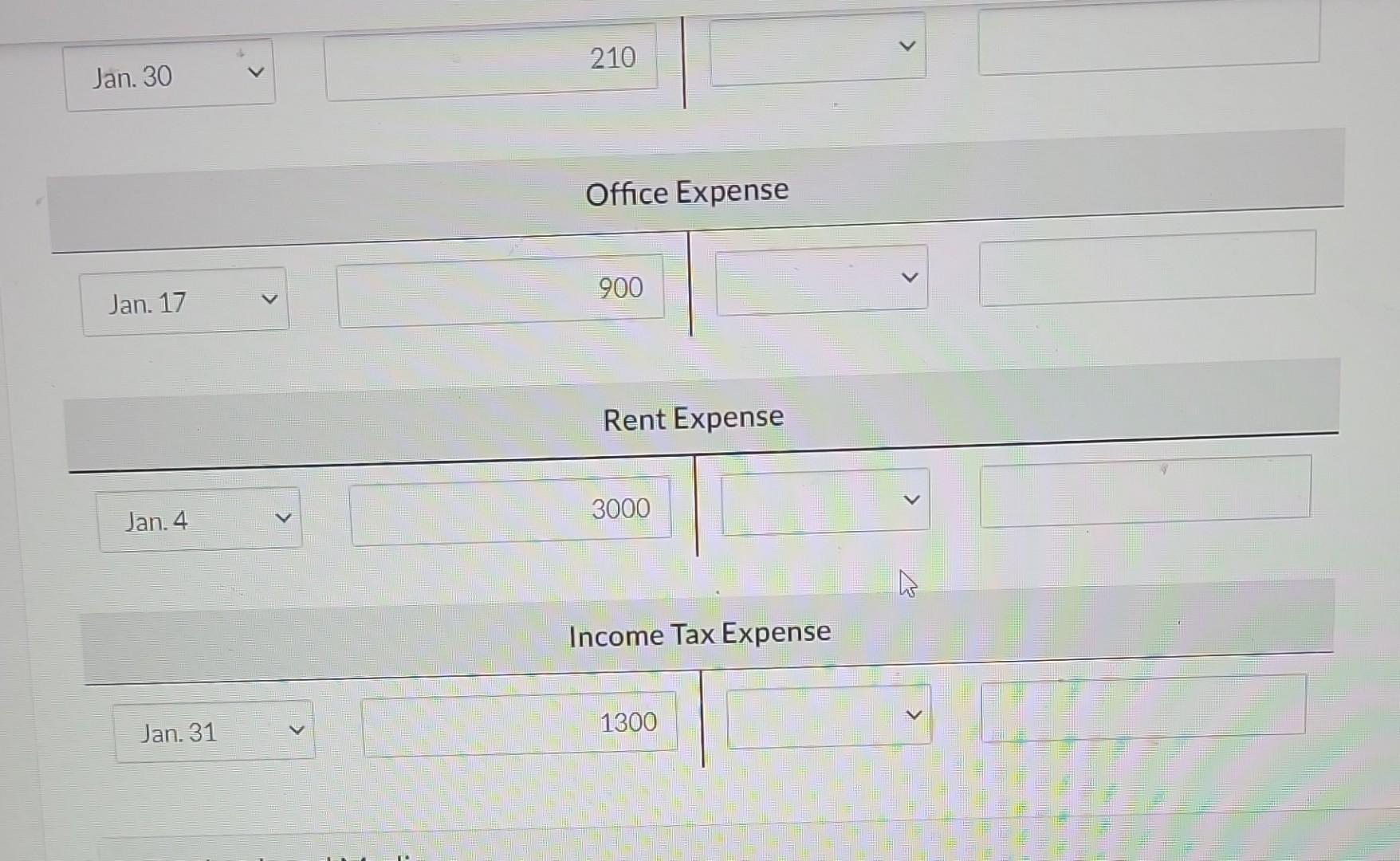

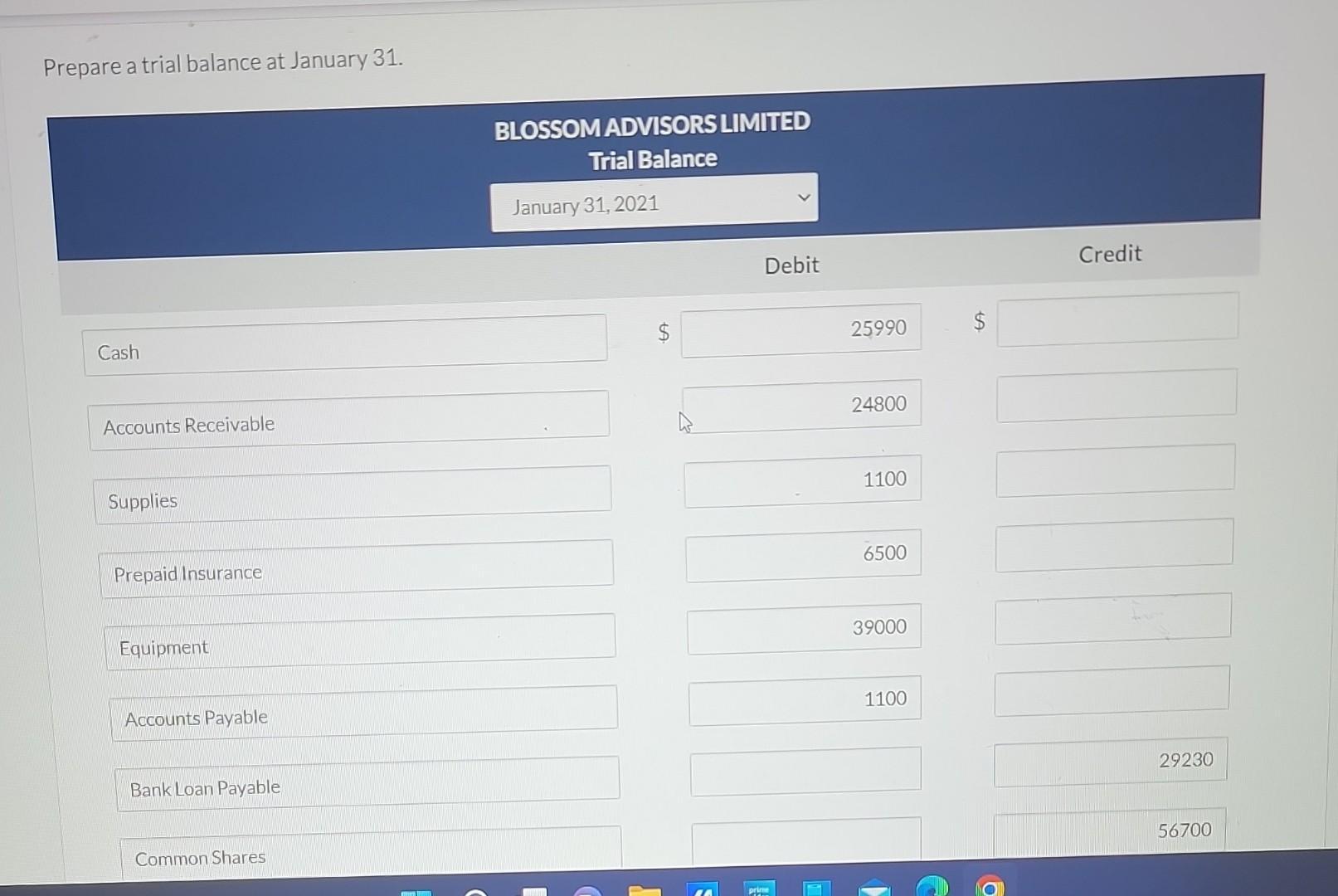

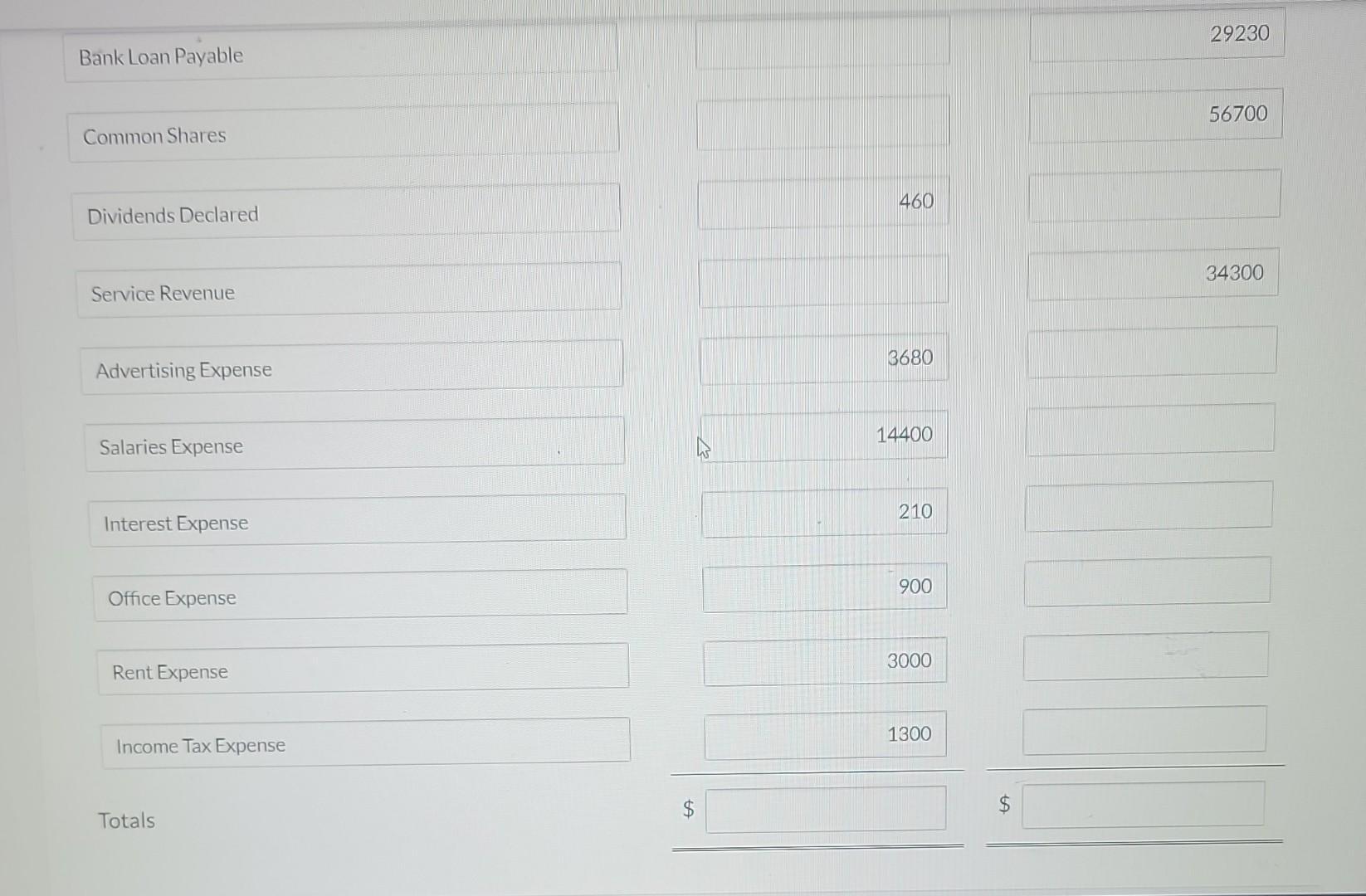

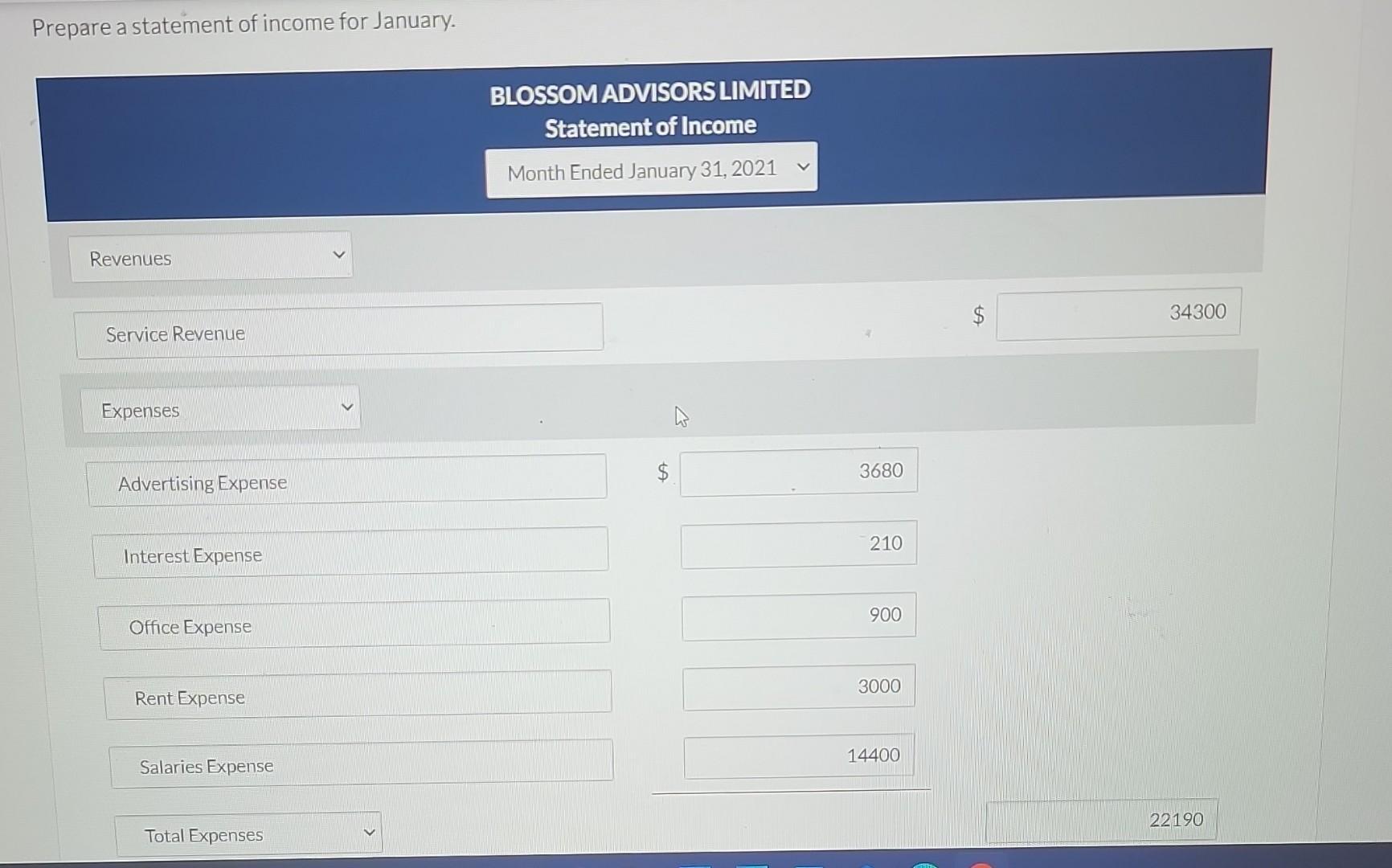

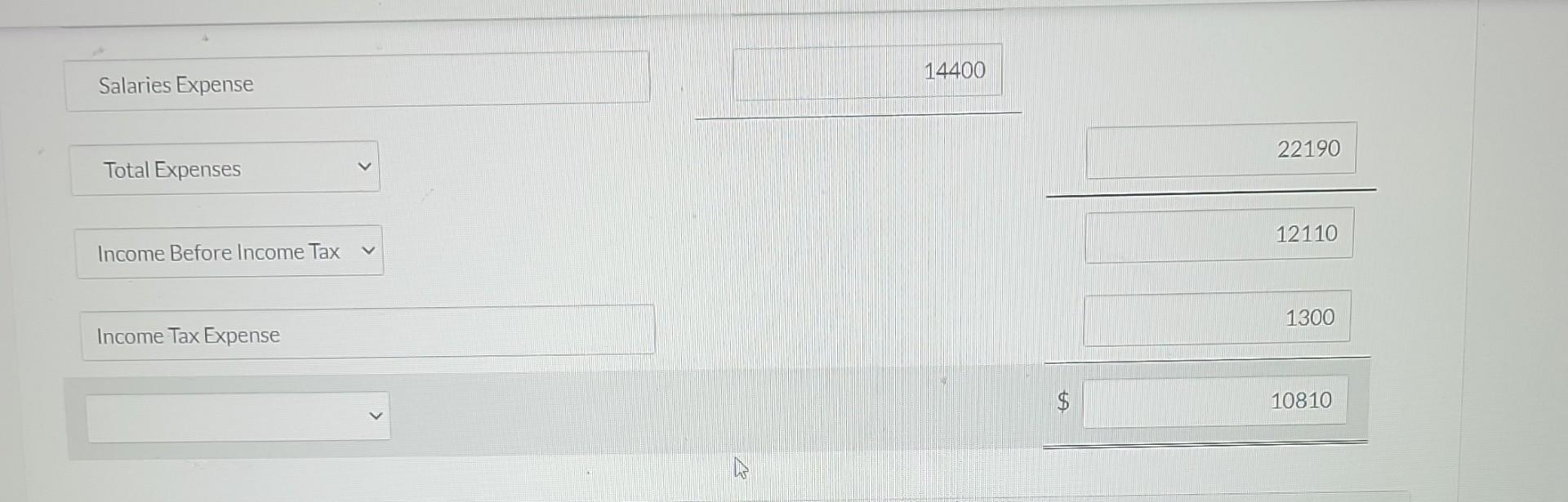

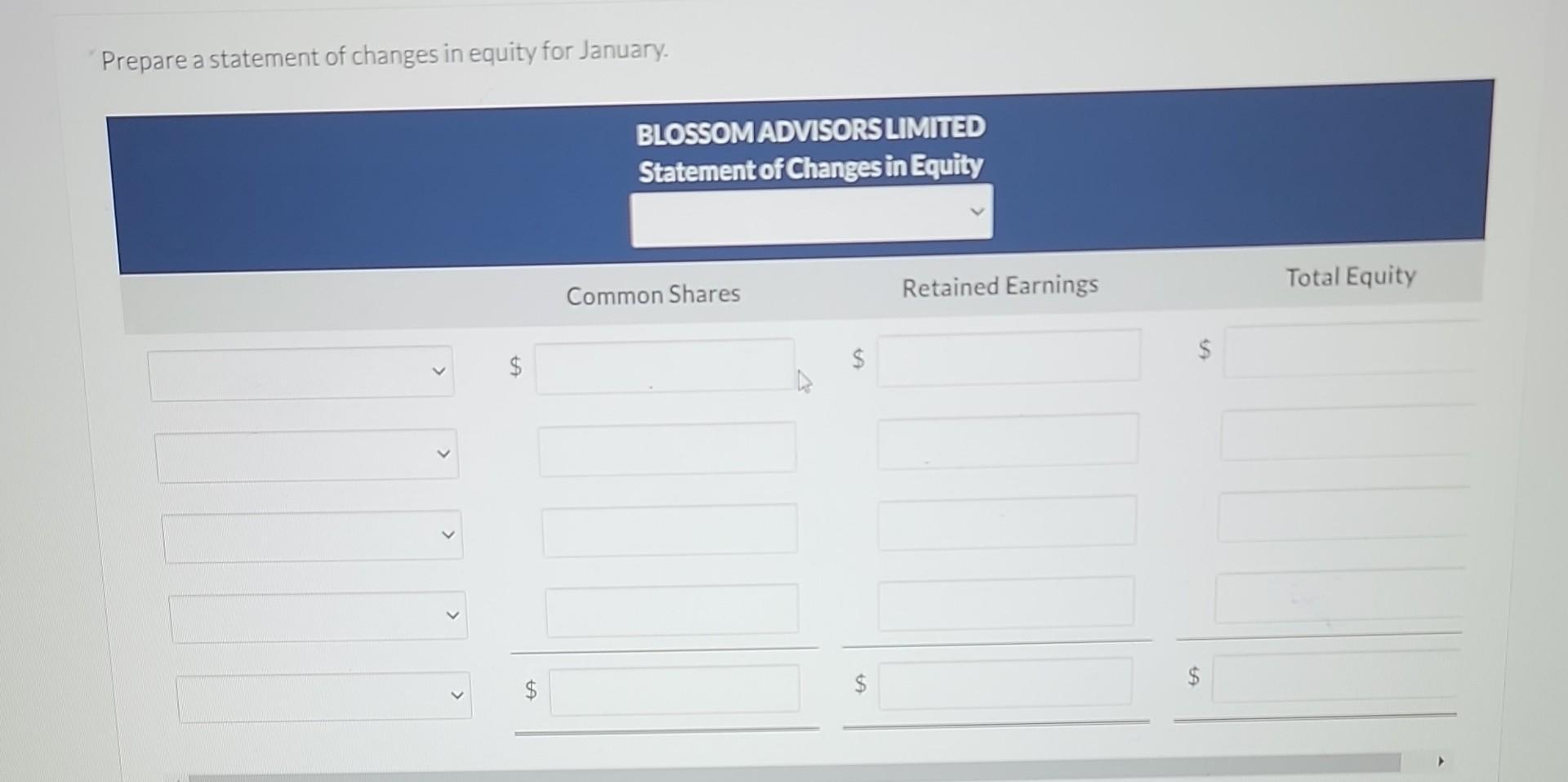

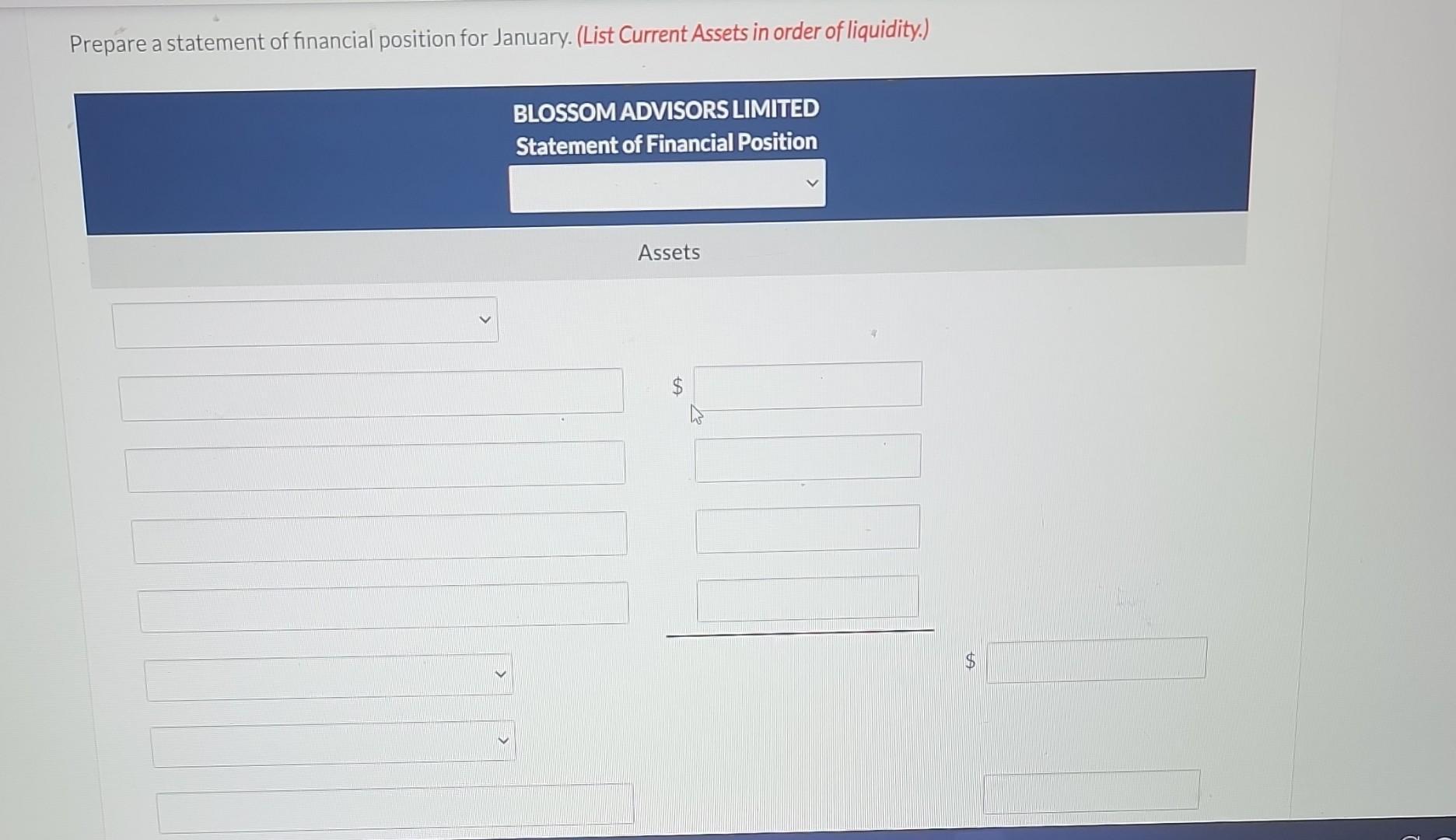

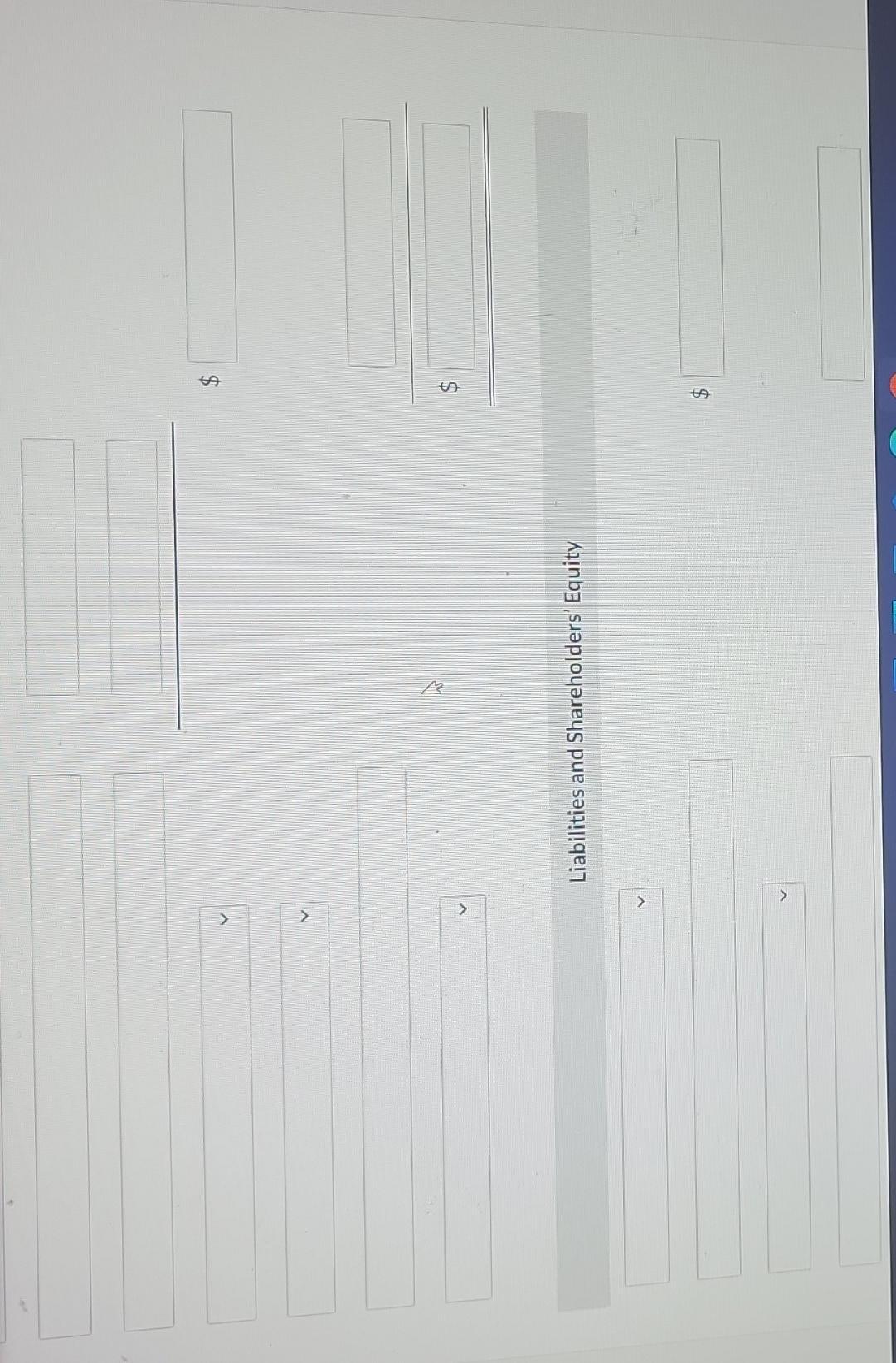

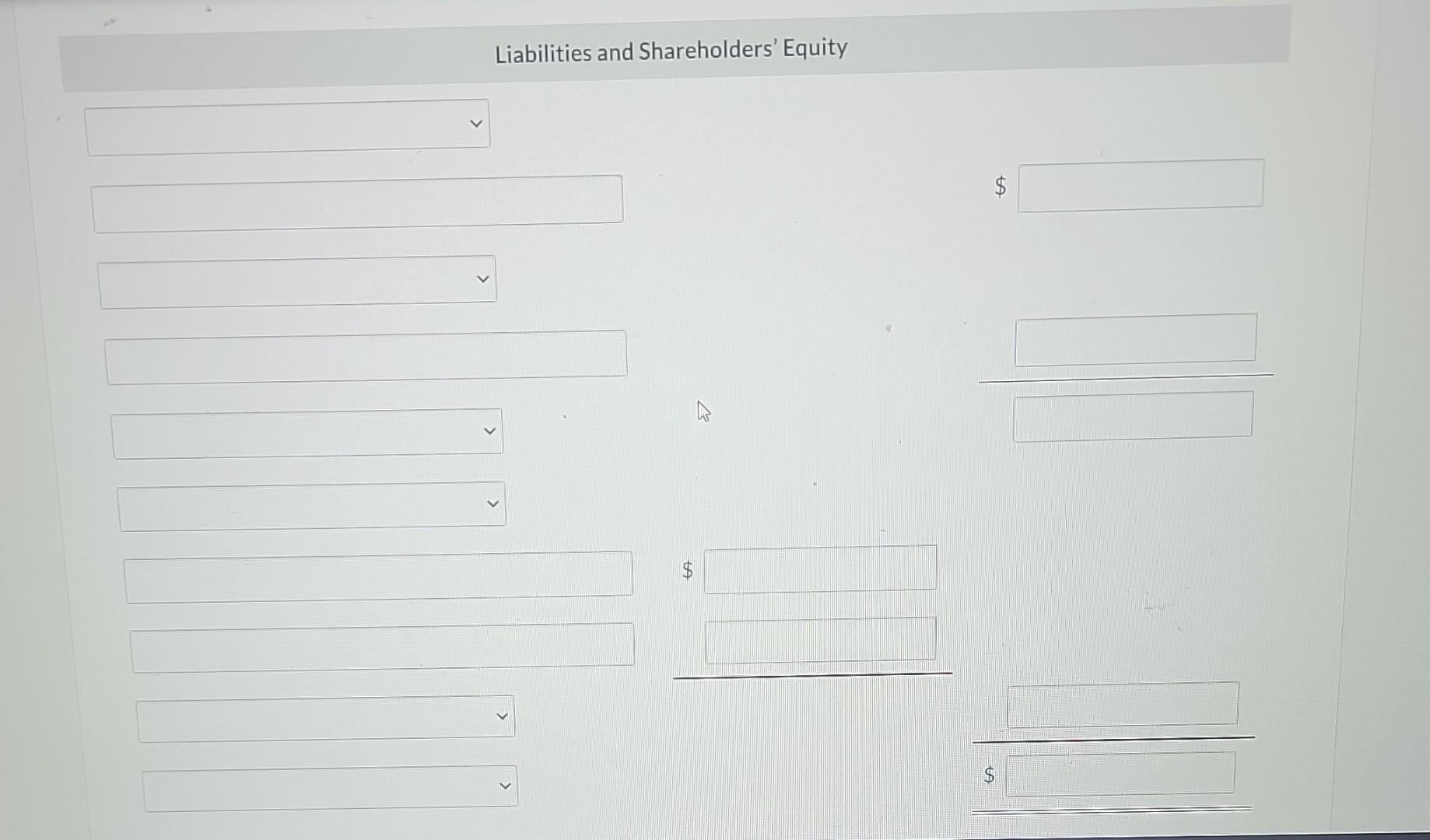

Blossom Advisors Limited was organized on January 1, 2021. The company had the following transactions in the month of January: January 2 4 5 8 10 11 12 15 19 17 Paid $900 for office expenses. Paid annual insurance policy with coverage up to December 31, 2021, for $6,500. Received $9,500 from clients in partial settlement of accounts billed on the 15th. Declared and paid $460 of dividends to shareholders. 24 Issued 900 common shares for $63 each. Finalized a lease for office space and paid the first month's rent of $3,000. Purchased $39,000 of equipment for $9,000 cash and financed the remainder with a long-term bank loan. Paid for an advertisement in a local paper, $480. Purchased supplies on account, $1,100. Paid for several advertising spots on the local radio station, $3,200. Paid employees $7,200 for the first two weeks of work. 25 Summarized and recorded the billings to clients for the first two weeks of January. Billings totalled $16,000. These amounts are due by the 12th of the next month. Paid annual insurance policy with coverage up to December 31, 2021, for $6,500. 24 Received $9,500 from clients in partial settlement of accounts billed on the 15th. 25 Declared and paid $460 of dividends to shareholders. Paid employees $7,200 for the previous two weeks of work. Summarized and recorded the billings to clients for the prior two weeks. Billings totalled $18,300. These amounts are due by the 26th of the next month. 19 26 29 30 31 Journalize the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Date Made a payment to the bank of $210 for interest on the bank loan and $770 to pay on the amount owing for the bank loan. Paid the Canada Revenue Agency $1,300 for an income tax instalment. Jan. 2 Account Titles and Explanation Cash Common Shares Debit 56700 Credit 56700 Journalize the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Date Jan. 2 Jan. 4 Jan. 5 Jan. 8 > Account Titles and Explanation Cash Common Shares Rent Expense Cash Equipment Cash Bank Loan Payable Advertising Expense I Debit 56700 3000 39000 480 Credit 56700 3000 9000 30000 Jan. 8 Jan. 10 V Jan. 11 V Jan. 12 v Jan. 15 Jan. 17 Advertising Expense Cash Supplies Accounts Payable Advertising Expense Cash Salaries Expense Cash Accounts Receivable Service Revenue Office Expense 480 1100 3200 7200 16000 900 480 1100 3200 7200 1600C 900 Jan. 17 Jan. 19 Jan. 24 Jan. 25 Jan. 26 Jan. 29 V Office Expense Cash Prepaid Insurance Cash Cash Accounts Receivable Dividends Declared Cash Salaries Expense Cash Accounts Receivable 900 6500 9500 460 7200 18300 900 6500 6500 460 7200 Jan. 29 Jan. 31 30 Guan Accounts Receivable Service Revenue- Interest Expense Bank Loan Payable Cash Income Tax Payable Cash 18300 210 770 1300 18300 980 1300 Set up T accounts and post the journal entries prepared in (a). (Post entries in the order of journal entries presented in the previous part.) Jan. 2 Jan. 24 < 56700 9500 Cash Jan. 4 Jan. 5 Jan. 8 Jan. 11 Jan. 12 Jan. 17 Jan. 19 Jan. 25 Jan. 26 3000 9000 480 3200 7200 900 6500 460 7200 Jan. 31 Bal. Jan. 15 Jan. 29 Jan. 31 Bal. Jan. 10 25990 16000 18300 Accounts Receivable 21800 Jan. 26 Supplies 1100 Jan. 30 Jan. 31 Jan, 24 Prepaid Insurance 7200 980 1300 6500 Jan. 10 Jan. 19 Jan. 5 Jan. 30 Supplies 1100 Prepaid Insurance 6500 Equipment 39000 Accounts Payable Jan. 10 Bank Loan Payable 770 Jan. 5 Jan. 31 Bal. 1100 30000 29230 Jan. 25 Jan. 8 Jan. 11 Common Shares Dividends Declared 460 Jan. 2 Service Revenue 480 3200 Jan. 15 Jan. 29 Advertising Expense Jan. 31 Bal. V V 56700 16000 18300 34300 Jan. 8 Jan. 11 Jan. 31 Bal. V Jan. 12 Jan. 26 Jan. 31 Bal. Jan. 30 Advertising Expense 480 3200 3680 Salaries Expense 7200 7200 14400 Interest Expense 210 Office Expense Jan. 30 Jan. 17 Jan. 4 Jan. 31 210 Office Expense 900 Rent Expense 3000 Income Tax Expense 1300 43 Prepare a trial balance at January 31. Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Bank Loan Payable Common Shares BLOSSOM ADVISORS LIMITED Trial Balance January 31, 2021 Debit prime 25990 24800 1100 6500 39000 1100 Credit 29230 56700 Bank Loan Payable Common Shares Dividends Declared Service Revenue Advertising Expense Salaries Expense Interest Expense Office Expense Rent Expense Income Tax Expense Totals $ 460 3680 14400 210 900 3000 1300 $ 29230 56700 34300 Prepare a statement of income for January. Revenues Service Revenue Expenses Advertising Expense Interest Expense Office Expense Rent Expense Salaries Expense Total Expenses BLOSSOM ADVISORS LIMITED Statement of Income Month Ended January 31, 2021 v LA $ 3680 210 900 3000 14400 LA 34300 22190 Salaries Expense Total Expenses Income Before Income Tax Income Tax Expense A 14400 $ 22190 12110 1300 10810 Prepare a statement of changes in equity for January. $ tA $ BLOSSOM ADVISORS LIMITED Statement of Changes in Equity Common Shares S $ Retained Earnings $ $ Total Equity Prepare a statement of financial position for January. (List Current Assets in order of liquidity.) BLOSSOM ADVISORS LIMITED Statement of Financial Position Assets Liabilities and Shareholders' Equity $ Liabilities and Shareholders' Equity > LA $ TA Blossom Advisors Limited was organized on January 1, 2021. The company had the following transactions in the month of January: January 2 4 5 8 10 11 12 15 19 17 Paid $900 for office expenses. Paid annual insurance policy with coverage up to December 31, 2021, for $6,500. Received $9,500 from clients in partial settlement of accounts billed on the 15th. Declared and paid $460 of dividends to shareholders. 24 Issued 900 common shares for $63 each. Finalized a lease for office space and paid the first month's rent of $3,000. Purchased $39,000 of equipment for $9,000 cash and financed the remainder with a long-term bank loan. Paid for an advertisement in a local paper, $480. Purchased supplies on account, $1,100. Paid for several advertising spots on the local radio station, $3,200. Paid employees $7,200 for the first two weeks of work. 25 Summarized and recorded the billings to clients for the first two weeks of January. Billings totalled $16,000. These amounts are due by the 12th of the next month. Paid annual insurance policy with coverage up to December 31, 2021, for $6,500. 24 Received $9,500 from clients in partial settlement of accounts billed on the 15th. 25 Declared and paid $460 of dividends to shareholders. Paid employees $7,200 for the previous two weeks of work. Summarized and recorded the billings to clients for the prior two weeks. Billings totalled $18,300. These amounts are due by the 26th of the next month. 19 26 29 30 31 Journalize the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Date Made a payment to the bank of $210 for interest on the bank loan and $770 to pay on the amount owing for the bank loan. Paid the Canada Revenue Agency $1,300 for an income tax instalment. Jan. 2 Account Titles and Explanation Cash Common Shares Debit 56700 Credit 56700 Journalize the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Date Jan. 2 Jan. 4 Jan. 5 Jan. 8 > Account Titles and Explanation Cash Common Shares Rent Expense Cash Equipment Cash Bank Loan Payable Advertising Expense I Debit 56700 3000 39000 480 Credit 56700 3000 9000 30000 Jan. 8 Jan. 10 V Jan. 11 V Jan. 12 v Jan. 15 Jan. 17 Advertising Expense Cash Supplies Accounts Payable Advertising Expense Cash Salaries Expense Cash Accounts Receivable Service Revenue Office Expense 480 1100 3200 7200 16000 900 480 1100 3200 7200 1600C 900 Jan. 17 Jan. 19 Jan. 24 Jan. 25 Jan. 26 Jan. 29 V Office Expense Cash Prepaid Insurance Cash Cash Accounts Receivable Dividends Declared Cash Salaries Expense Cash Accounts Receivable 900 6500 9500 460 7200 18300 900 6500 6500 460 7200 Jan. 29 Jan. 31 30 Guan Accounts Receivable Service Revenue- Interest Expense Bank Loan Payable Cash Income Tax Payable Cash 18300 210 770 1300 18300 980 1300 Set up T accounts and post the journal entries prepared in (a). (Post entries in the order of journal entries presented in the previous part.) Jan. 2 Jan. 24 < 56700 9500 Cash Jan. 4 Jan. 5 Jan. 8 Jan. 11 Jan. 12 Jan. 17 Jan. 19 Jan. 25 Jan. 26 3000 9000 480 3200 7200 900 6500 460 7200 Jan. 31 Bal. Jan. 15 Jan. 29 Jan. 31 Bal. Jan. 10 25990 16000 18300 Accounts Receivable 21800 Jan. 26 Supplies 1100 Jan. 30 Jan. 31 Jan, 24 Prepaid Insurance 7200 980 1300 6500 Jan. 10 Jan. 19 Jan. 5 Jan. 30 Supplies 1100 Prepaid Insurance 6500 Equipment 39000 Accounts Payable Jan. 10 Bank Loan Payable 770 Jan. 5 Jan. 31 Bal. 1100 30000 29230 Jan. 25 Jan. 8 Jan. 11 Common Shares Dividends Declared 460 Jan. 2 Service Revenue 480 3200 Jan. 15 Jan. 29 Advertising Expense Jan. 31 Bal. V V 56700 16000 18300 34300 Jan. 8 Jan. 11 Jan. 31 Bal. V Jan. 12 Jan. 26 Jan. 31 Bal. Jan. 30 Advertising Expense 480 3200 3680 Salaries Expense 7200 7200 14400 Interest Expense 210 Office Expense Jan. 30 Jan. 17 Jan. 4 Jan. 31 210 Office Expense 900 Rent Expense 3000 Income Tax Expense 1300 43 Prepare a trial balance at January 31. Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Bank Loan Payable Common Shares BLOSSOM ADVISORS LIMITED Trial Balance January 31, 2021 Debit prime 25990 24800 1100 6500 39000 1100 Credit 29230 56700 Bank Loan Payable Common Shares Dividends Declared Service Revenue Advertising Expense Salaries Expense Interest Expense Office Expense Rent Expense Income Tax Expense Totals $ 460 3680 14400 210 900 3000 1300 $ 29230 56700 34300 Prepare a statement of income for January. Revenues Service Revenue Expenses Advertising Expense Interest Expense Office Expense Rent Expense Salaries Expense Total Expenses BLOSSOM ADVISORS LIMITED Statement of Income Month Ended January 31, 2021 v LA $ 3680 210 900 3000 14400 LA 34300 22190 Salaries Expense Total Expenses Income Before Income Tax Income Tax Expense A 14400 $ 22190 12110 1300 10810 Prepare a statement of changes in equity for January. $ tA $ BLOSSOM ADVISORS LIMITED Statement of Changes in Equity Common Shares S $ Retained Earnings $ $ Total Equity Prepare a statement of financial position for January. (List Current Assets in order of liquidity.) BLOSSOM ADVISORS LIMITED Statement of Financial Position Assets Liabilities and Shareholders' Equity $ Liabilities and Shareholders' Equity > LA $ TA

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

All Journal Entry are accounted correctly Except the following trans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started