Answered step by step

Verified Expert Solution

Question

1 Approved Answer

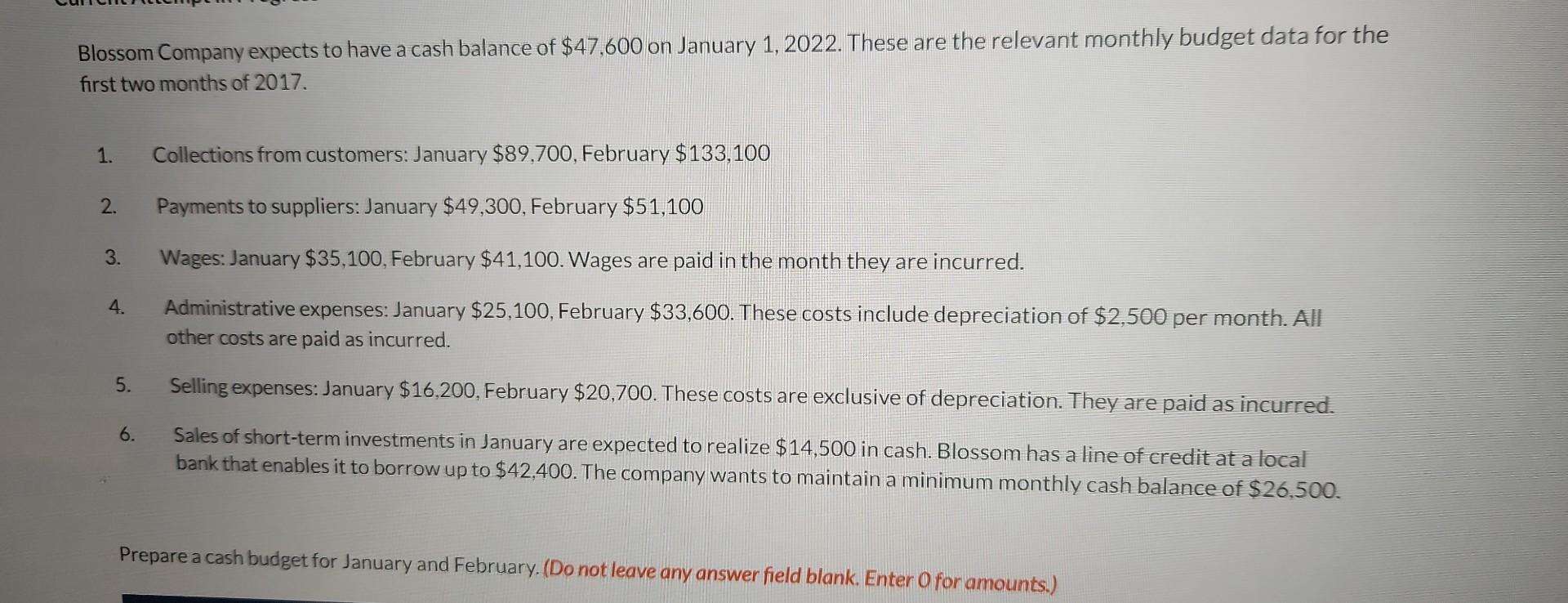

Blossom Company expects to have a cash balance of $47,600 on January 1,2022 . These are the relevant monthly budget data for the first two

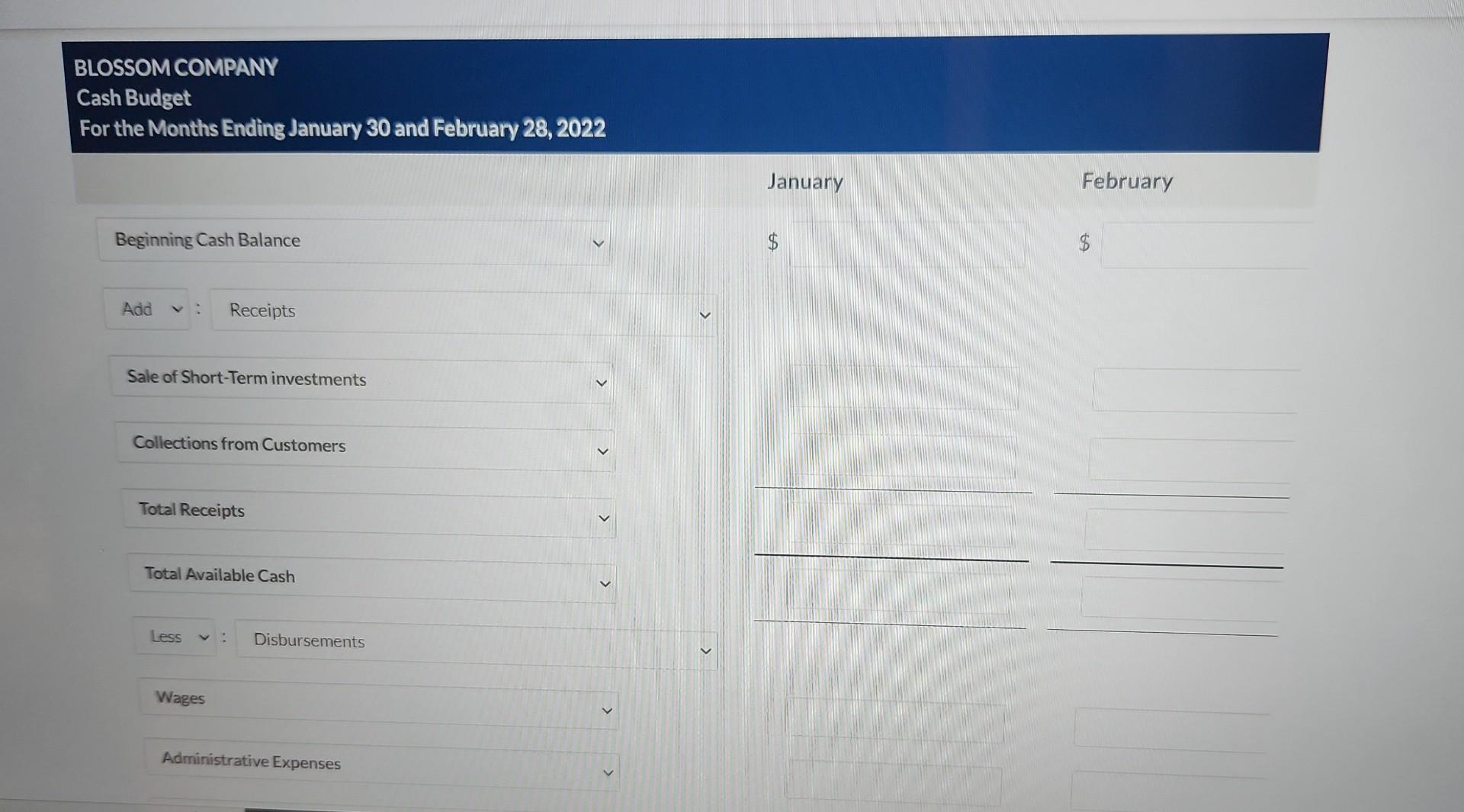

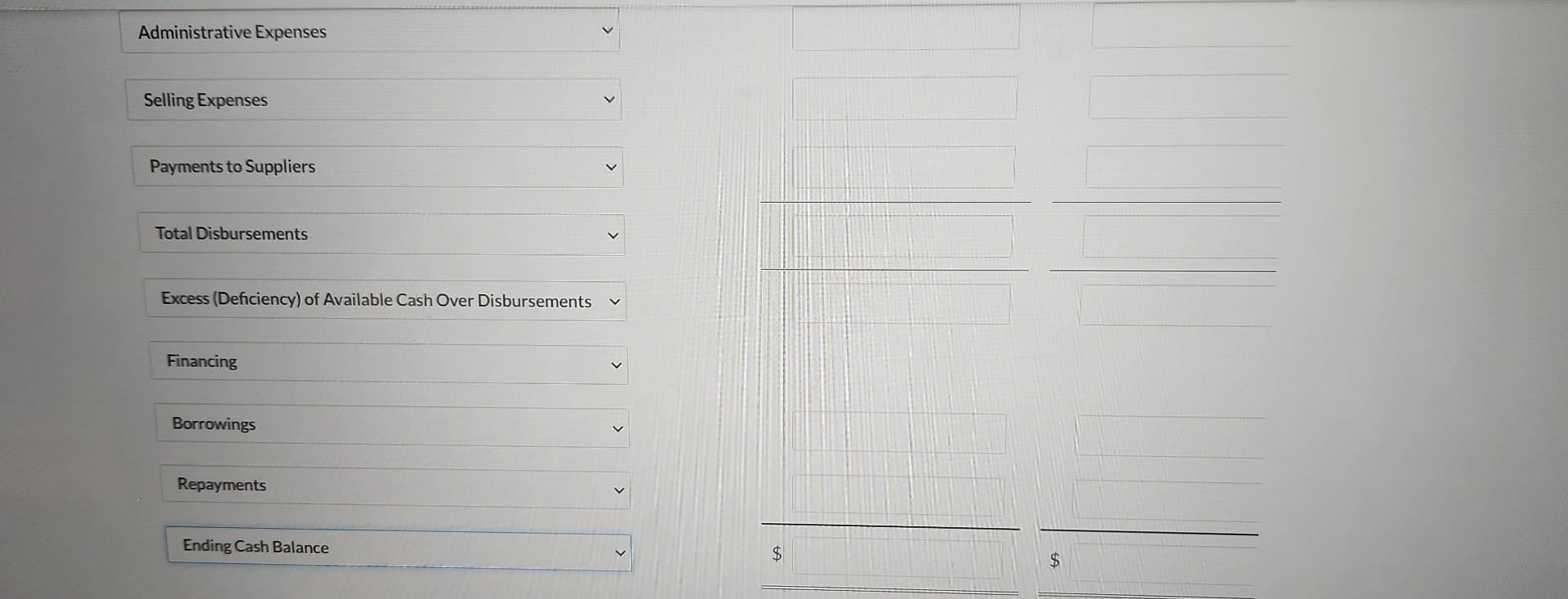

Blossom Company expects to have a cash balance of $47,600 on January 1,2022 . These are the relevant monthly budget data for the first two months of 2017. 1. Collections from customers: January $89,700, February $133,100 2. Payments to suppliers: January $49,300, February $51,100 3. Wages: January $35,100, February $41,100. Wages are paid in the month they are incurred. 4. Administrative expenses: January $25,100, February $33,600. These costs include depreciation of $2,500 per month. All other costs are paid as incurred. 5. Selling expenses: January $16,200, February $20,700. These costs are exclusive of depreciation. They are paid as incurred. 6. Sales of short-term investments in January are expected to realize $14,500 in cash. Blossom has a line of credit at a local bank that enables it to borrow up to $42,400. The company wants to maintain a minimum monthly cash balance of $26,500. Prepare a cash budget for January and February. (Do not leave any answer field blank. Enter O for amounts.) BLOSSOM COMPANY Cash Budget For the Months Ending January 30 and February 28, 2022 \begin{tabular}{l} Beginning Cash Balance \\ \hline Add : Receipts \\ Sale of Short-Term investments \\ Collections from Customers \\ Total Receipts \end{tabular} Administrative Expenses Selling Expenses Payments to Suppliers Total Disbursements Excess (Deficiency) of Available Cash Over Disbursements Financing Borrowings Repayments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started