Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blossom Company purchased a large piece of equipment on October 1, 2023. The following information relating to the equipment was gathered at the end

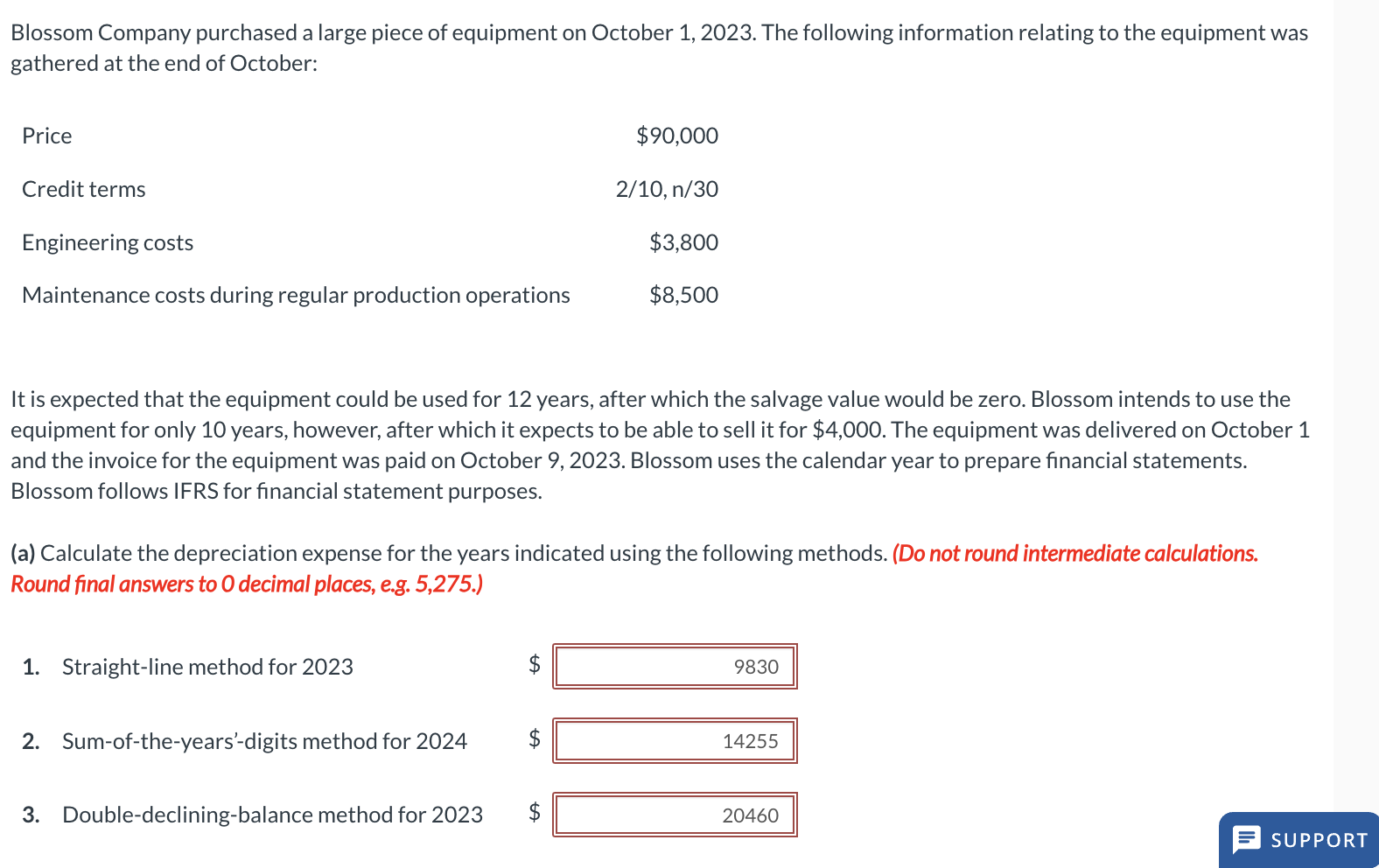

Blossom Company purchased a large piece of equipment on October 1, 2023. The following information relating to the equipment was gathered at the end of October: Price Credit terms $90,000 2/10, n/30 Engineering costs $3,800 Maintenance costs during regular production operations $8,500 It is expected that the equipment could be used for 12 years, after which the salvage value would be zero. Blossom intends to use the equipment for only 10 years, however, after which it expects to be able to sell it for $4,000. The equipment was delivered on October 1 and the invoice for the equipment was paid on October 9, 2023. Blossom uses the calendar year to prepare financial statements. Blossom follows IFRS for financial statement purposes. (a) Calculate the depreciation expense for the years indicated using the following methods. (Do not round intermediate calculations. Round final answers to O decimal places, e.g. 5,275.) 1. Straight-line method for 2023 +A 9830 2. Sum-of-the-years'-digits method for 2024 $ 14255 3. Double-declining-balance method for 2023 20460 SUPPORT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the depreciation expense for the years indicated using the given methods straightline ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66427c44502b7_979891.pdf

180 KBs PDF File

66427c44502b7_979891.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started