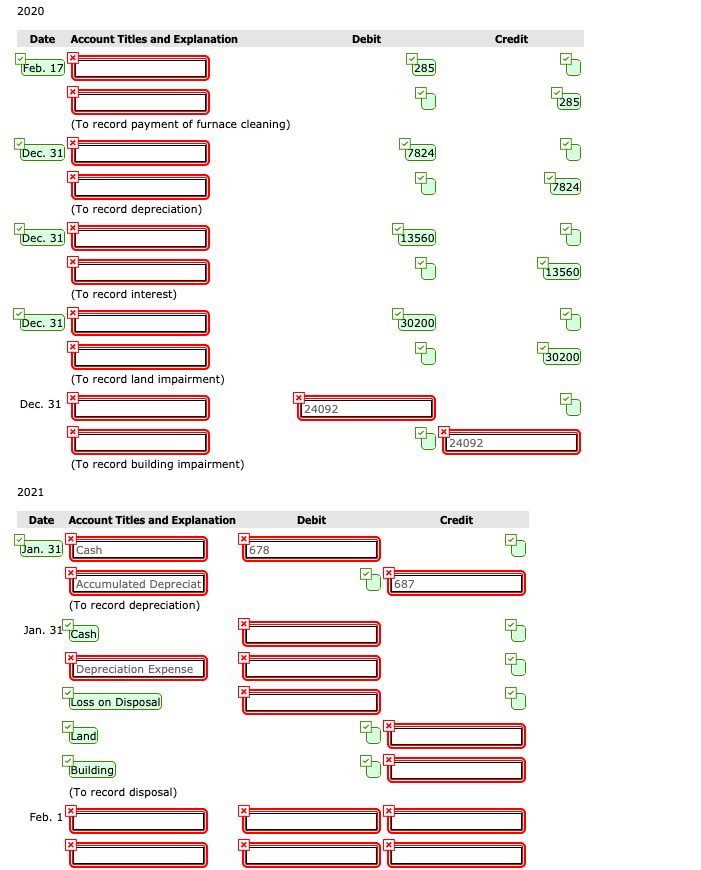

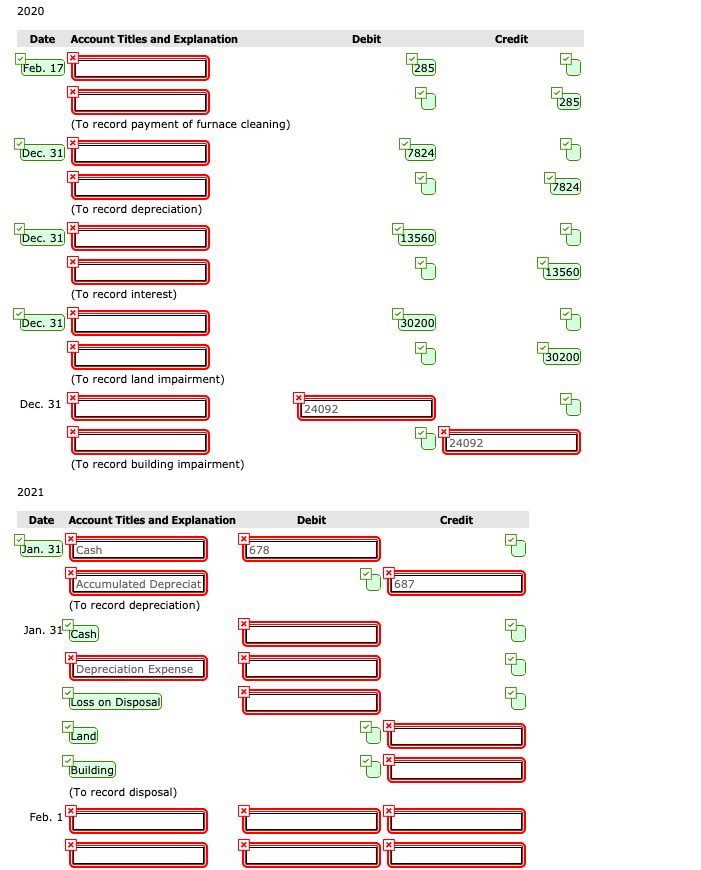

Blossom Company purchased land and a building on April 1, 2019, for $393,600. The company paid $122,400 in cash and signed a 5% note payable for the balance. At that time, it was estimated that the land was worth $157,000 and the building, $236,600. The building was estimated to have a 25-year useful life with a $41,000 residual value. The company has a December 31 year end, prepares adjusting entries annually, and uses the straight-line method for buildings; depreciation is calculated to the nearest month. The following are related transactions and adjustments during the next three years.

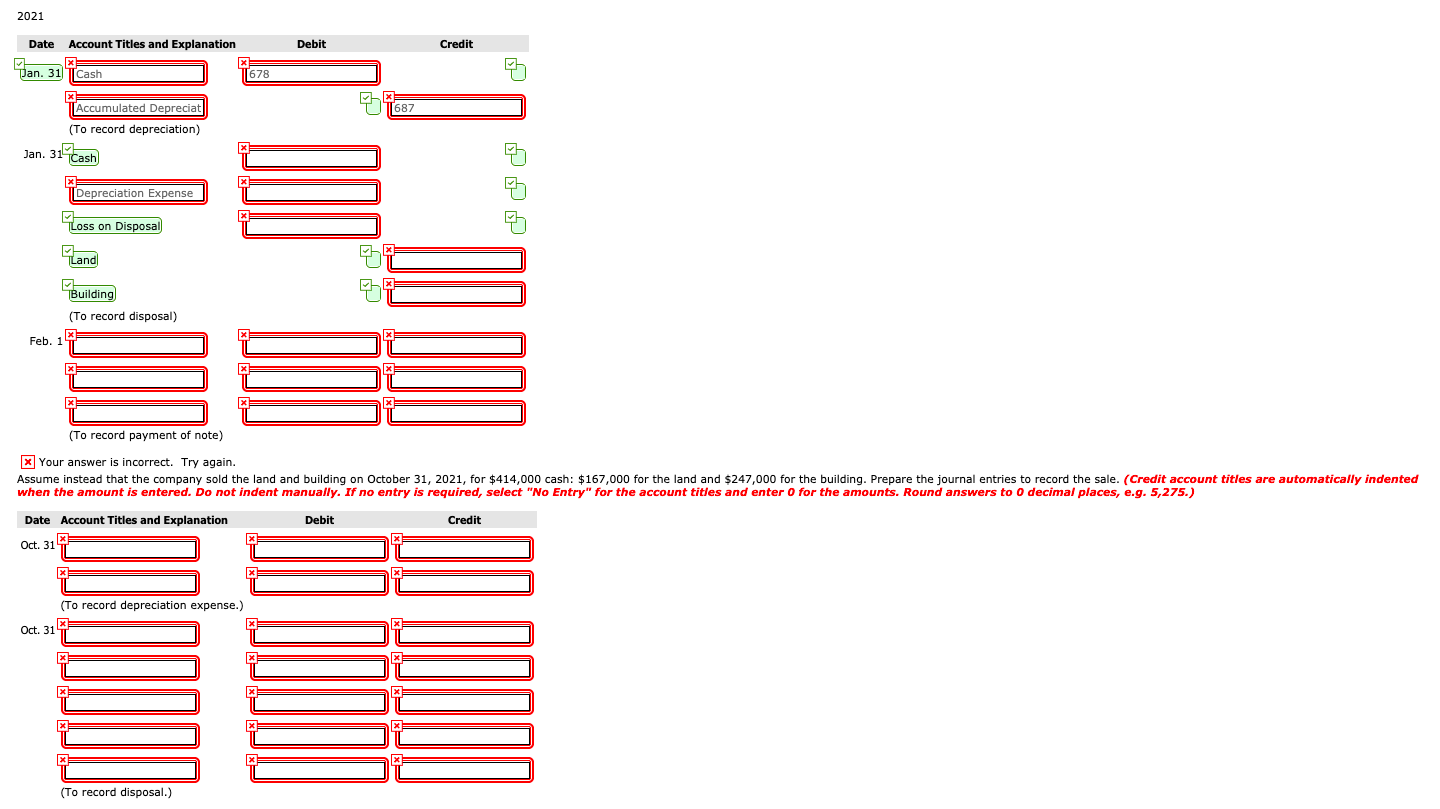

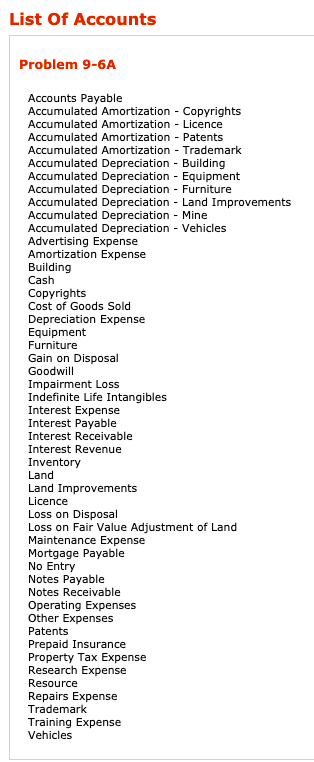

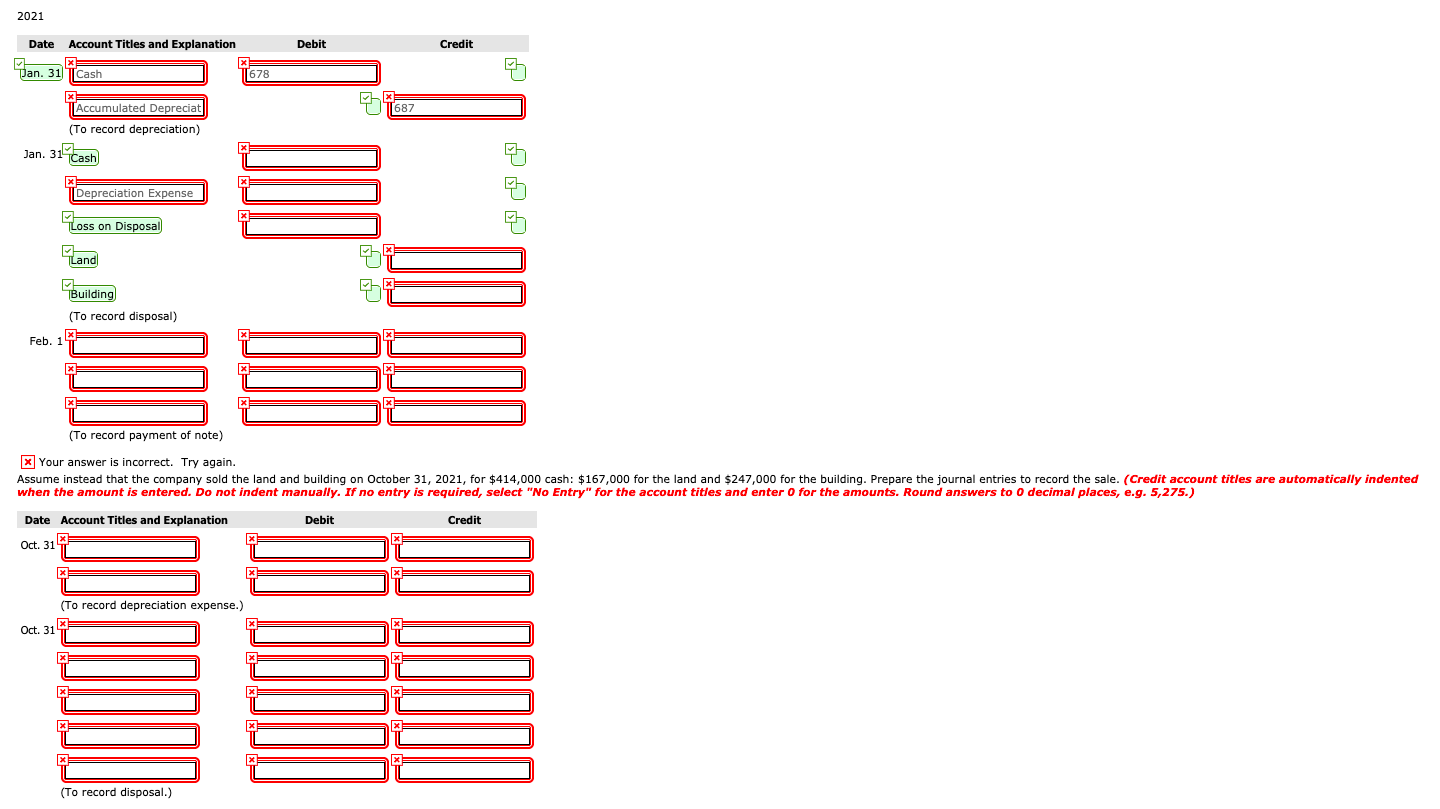

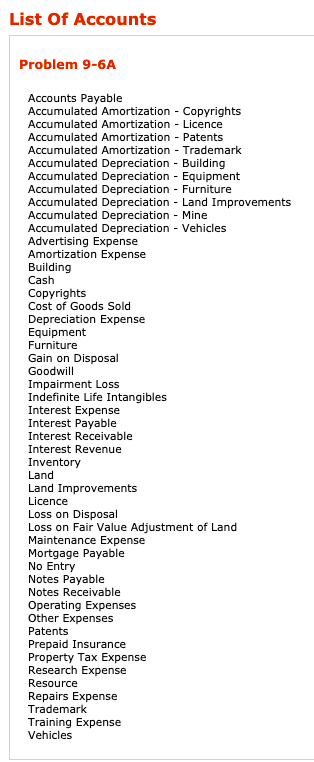

2020 Date Account Titles and Explanation Debit Credit Feb. 17 T285 12851 (To record payment of furnace cleaning) Dec. 31 17824 7824 00:00 (To record depreciation) bec. 31 [13560 T13560 (To record interest) Dec. 31 130200 130200 (To record land impairment) Dec. 31 24092 24092 (To record building impairment) 2021 Date Account Titles and Explanation Debit Credit Jan. 31 T Cash X 678 8 687 [Accumulated Depreciat (To record depreciation) Jan. 31 Cash X Depreciation Expense E Loss on Disposal Land G Building (To record disposal) DU DU Feb. 1 x 2021 Debit Credit Date Account Titles and Explanation X X Jan. 31 TCash 678 T687 Accumulated Depreciat (To record depreciation) Jan. 31 Cash X x Depreciation Expense Loss on Disposal TLand Building (To record disposal) x x Feb. 1 X x X (To record payment of note) x Your answer is incorrect. Try again. Assume instead that the company sold the land and building on October 31, 2021, for $414,000 cash: $167,000 for the land and $247,000 for the building. Prepare the journal entries to record the sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to o decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Oct. 31 X (To record depreciation expense.) Oct. 31 X x x (To record disposal.) List Of Accounts Problem 9-6A Accounts Payable Accumulated Amortization - Copyrights Accumulated Amortization - Licence Accumulated Amortization - Patents Accumulated Amortization - Trademark Accumulated Depreciation - Building Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture Accumulated Depreciation - Land Improvements Accumulated Depreciation - Mine Accumulated Depreciation - Vehicles Advertising Expense Amortization Expense Building Cash Copyrights Cost of Goods Sold Depreciation Expense Equipment Furniture Gain on Disposal Goodwill Impairment Loss Indefinite Life Intangibles Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Land Improvements Licence Loss on Disposal Loss on Fair Value Adjustment of Land Maintenance Expense Mortgage Payable No Entry Notes Payable Notes Receivable Operating Expenses Other Expenses Patents Prepaid Insurance Property Tax Expense Research Expense Resource Repairs Expense Trademark Training Expense Vehicles