Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blossom Company recently signed a lease for a new office building, for a lease period of 11 years. Under the lease agreement, a security

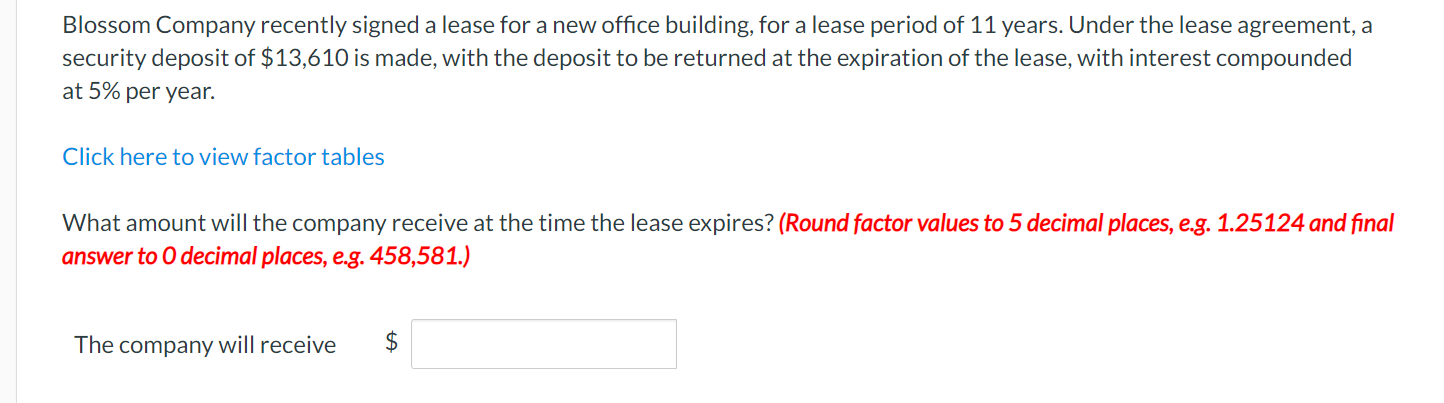

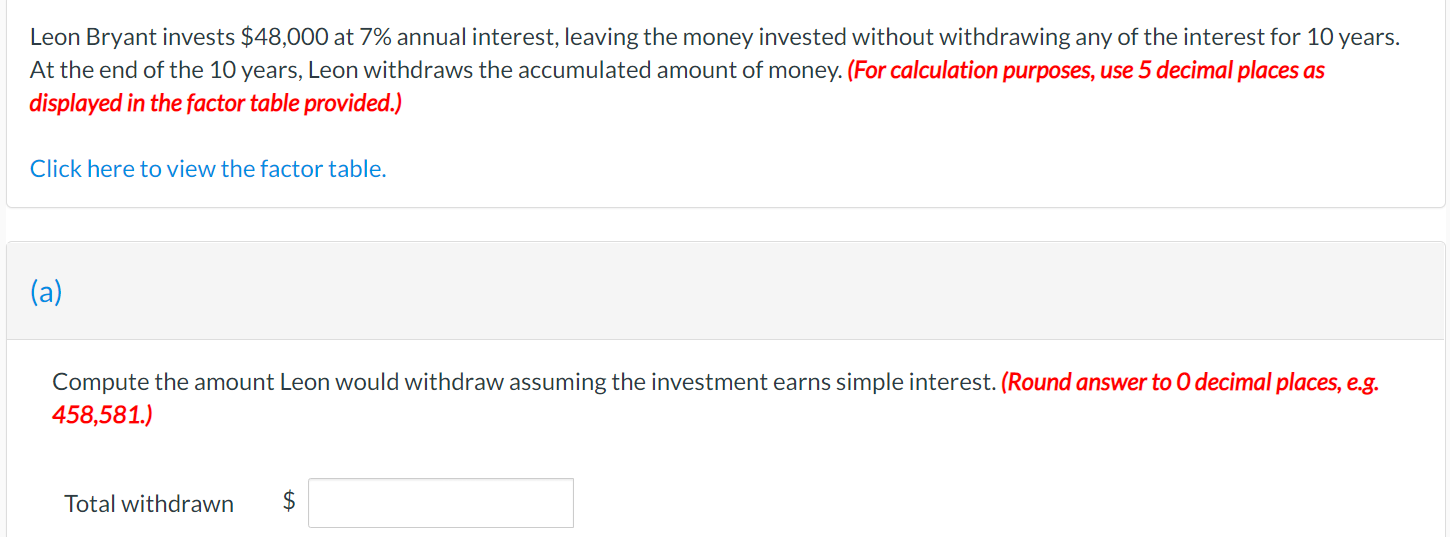

Blossom Company recently signed a lease for a new office building, for a lease period of 11 years. Under the lease agreement, a security deposit of $13,610 is made, with the deposit to be returned at the expiration of the lease, with interest compounded at 5% per year. Click here to view factor tables What amount will the company receive at the time the lease expires? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) The company will receive 2$ Leon Bryant invests $48,000 at 7% annual interest, leaving the money invested without withdrawing any of the interest for 10 years. At the end of the 10 years, Leon withdraws the accumulated amount of money. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Click here to view the factor table. (a) Compute the amount Leon would withdraw assuming the investment earns simple interest. (Round answer to O decimal places, e.g. 458,581.) Total withdrawn $

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution Amount received by Liam Company Amount of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started