Answered step by step

Verified Expert Solution

Question

1 Approved Answer

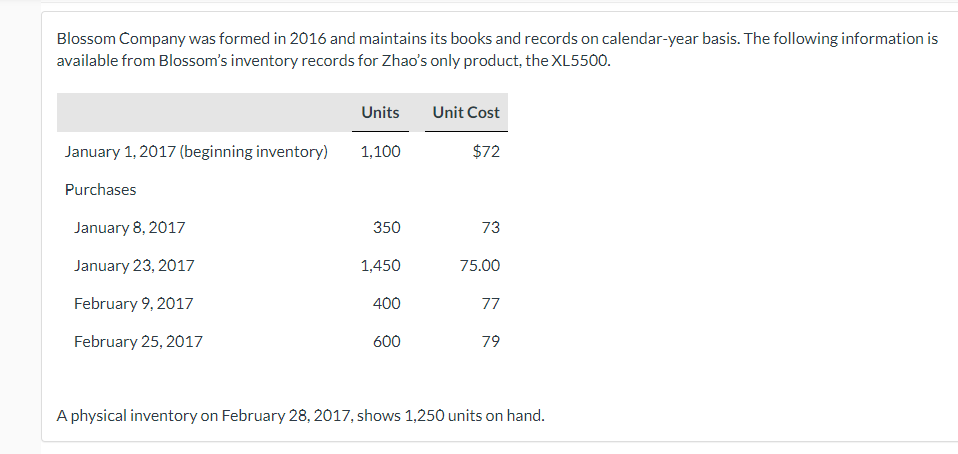

Blossom Company was formed in 2016 and maintains its books and records on calendar-year basis. The following information is available from Blossom's inventory records

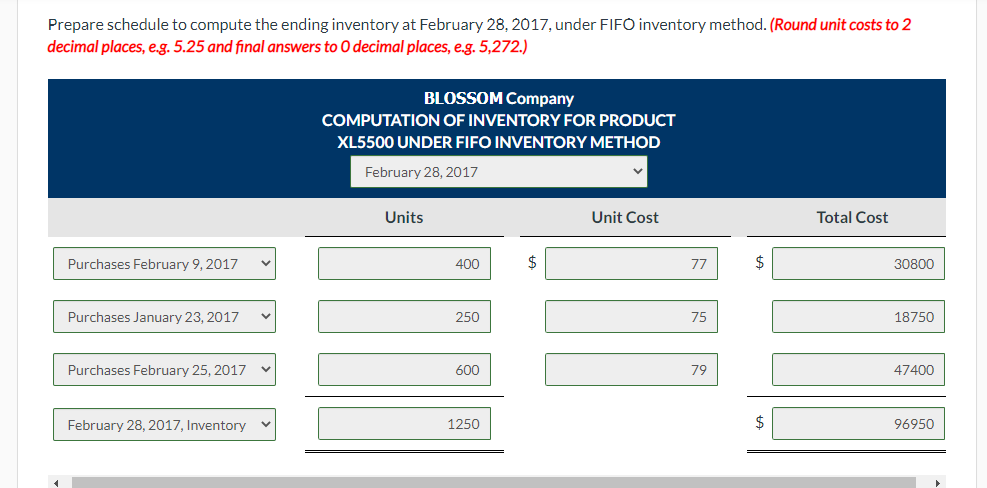

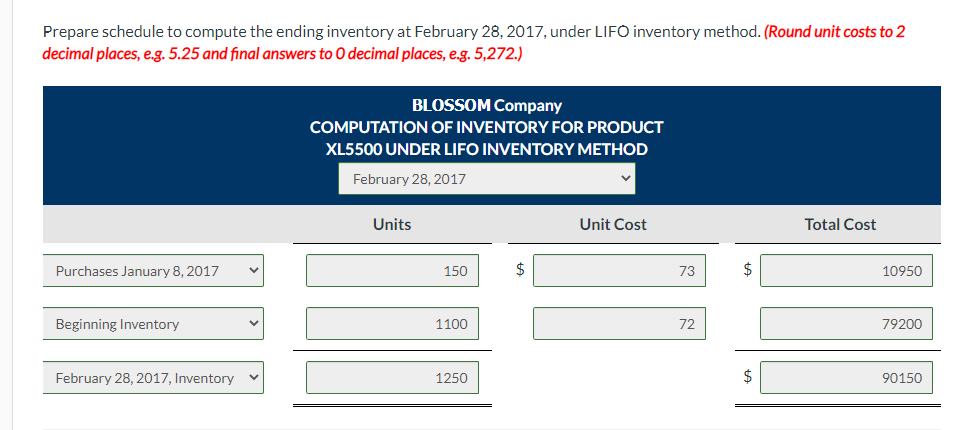

Blossom Company was formed in 2016 and maintains its books and records on calendar-year basis. The following information is available from Blossom's inventory records for Zhao's only product, the XL5500. Units Unit Cost January 1, 2017 (beginning inventory) 1,100 $72 Purchases January 8, 2017 350 73 January 23, 2017 1,450 75.00 February 9, 2017 400 77 February 25, 2017 600 79 A physical inventory on February 28, 2017, shows 1,250 units on hand. Prepare schedule to compute the ending inventory at February 28, 2017, under FIFO inventory method. (Round unit costs to 2 decimal places, e.g. 5.25 and final answers to O decimal places, e.g. 5,272.) BLOSSOM Company COMPUTATION OF INVENTORY FOR PRODUCT XL5500 UNDER FIFO INVENTORY METHOD February 28, 2017 Units Unit Cost Total Cost Purchases February 9, 2017 400 $ 77 2$ 30800 Purchases January 23, 2017 250 75 18750 Purchases February 25, 2017 600 79 47400 February 28, 2017, Inventory 1250 2$ 96950 Prepare schedule to compute the ending inventory at February 28, 2017, under LIFO inventory method. (Round unit costs to 2 decimal places, e.g. 5.25 and final answers to O decimal places, e.g. 5,272.) BLOSSOM Company COMPUTATION OF INVENTORY FOR PRODUCT XL5500 UNDER LIFO INVENTORY METHOD February 28, 2017 Units Unit Cost Total Cost Purchases January 8, 2017 150 73 10950 Beginning Inventory 1100 72 79200 February 28, 2017, Inventory 1250 $ 90150 Calculate weighted average-cost per unit. (Round answer to 2 decimal places, e.g. 2.76.) Weighted average-cost per unit $

Step by Step Solution

★★★★★

3.26 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution PREPARING THE SCHEDULE TO COMPUTE THE ENDING INVENTORY AT FEBRUARY 28 2017 UNDER FIF...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started