Answered step by step

Verified Expert Solution

Question

1 Approved Answer

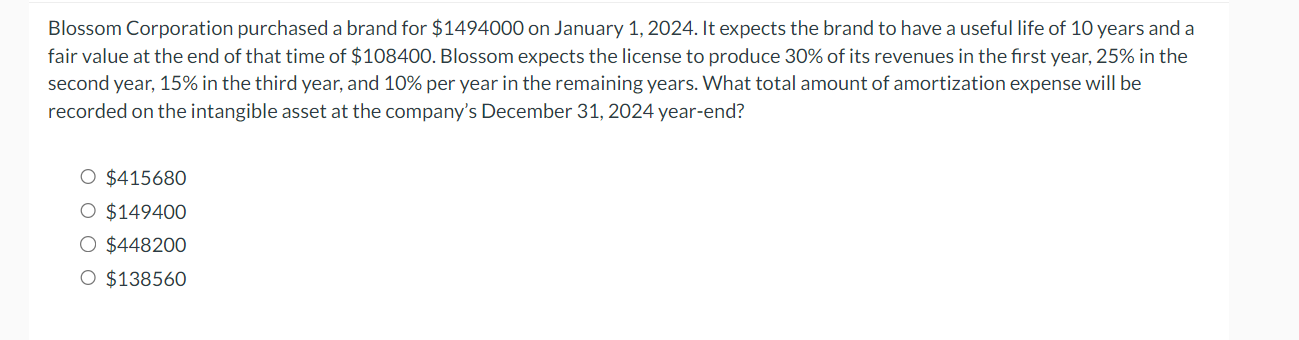

Blossom Corporation purchased a brand for $ 1 4 9 4 0 0 0 on January 1 , 2 0 2 4 . It expects

Blossom Corporation purchased a brand for $ on January It expects the brand to have a useful life of years and a

fair value at the end of that time of $ Blossom expects the license to produce of its revenues in the first year, in the

second year, in the third year, and per year in the remaining years. What total amount of amortization expense will be

recorded on the intangible asset at the company's December yearend?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started