Question

Blossom Horizon Corp had the following items, all of which were outstanding throughout the entire fiscal year ending September 30, 2024: 800,000 common shares

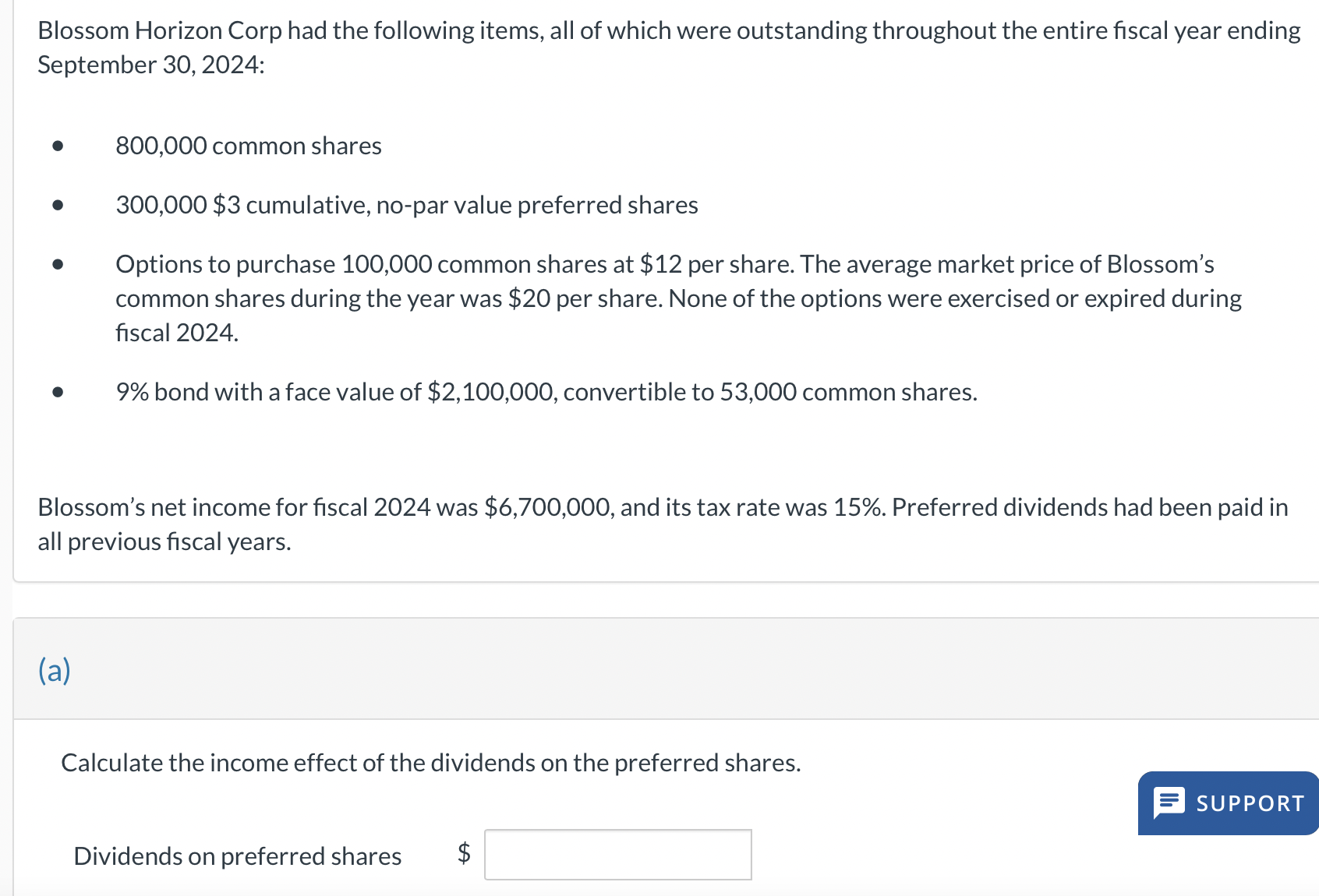

Blossom Horizon Corp had the following items, all of which were outstanding throughout the entire fiscal year ending September 30, 2024: 800,000 common shares 300,000 $3 cumulative, no-par value preferred shares Options to purchase 100,000 common shares at $12 per share. The average market price of Blossom's common shares during the year was $20 per share. None of the options were exercised or expired during fiscal 2024. 9% bond with a face value of $2,100,000, convertible to 53,000 common shares. Blossom's net income for fiscal 2024 was $6,700,000, and its tax rate was 15%. Preferred dividends had been paid in all previous fiscal years. (a) Calculate the income effect of the dividends on the preferred shares. Dividends on preferred shares $ SUPPORT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Susan S. Hamlen, Ronald J. Huefner, James A. Largay III

2nd edition

1934319309, 978-1934319307

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App