Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blossom Ltd. has these transactions related to intangible assets and goodwill in 2024 , its first year of operations: Jan. 2 Paid for a patent

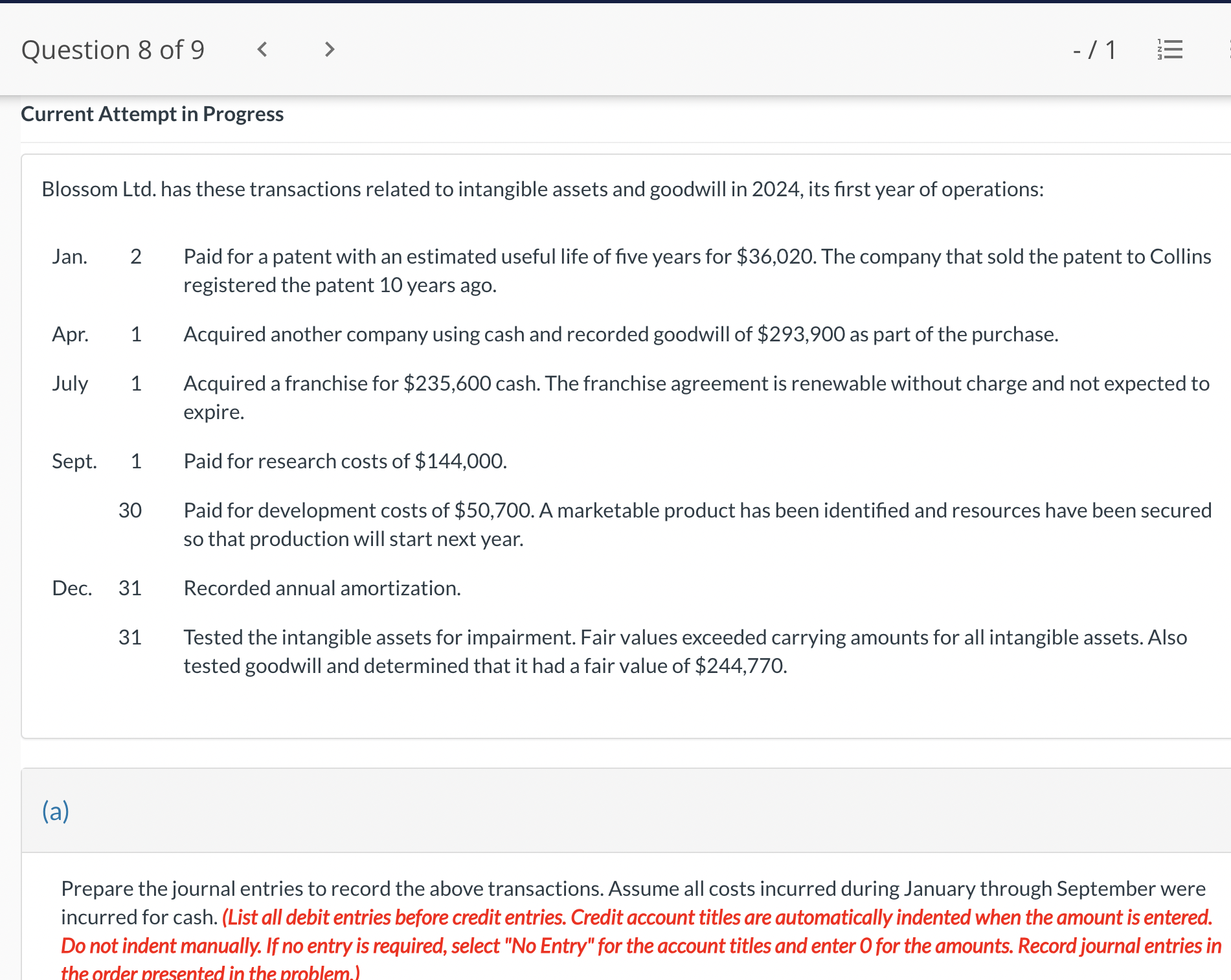

Blossom Ltd. has these transactions related to intangible assets and goodwill in 2024 , its first year of operations: Jan. 2 Paid for a patent with an estimated useful life of five years for $36,020. The company that sold the patent to Collins registered the patent 10 years ago. Apr. 1 Acquired another company using cash and recorded goodwill of $293,900 as part of the purchase. July 1 Acquired a franchise for $235,600 cash. The franchise agreement is renewable without charge and not expected to expire. Sept. 1 Paid for research costs of $144,000. 30 Paid for development costs of $50,700. A marketable product has been identified and resources have been secured so that production will start next year. Dec. 31 Recorded annual amortization. 31 Tested the intangible assets for impairment. Fair values exceeded carrying amounts for all intangible assets. Also tested goodwill and determined that it had a fair value of $244,770. (a) Prepare the journal entries to record the above transactions. Assume all costs incurred during January through September were incurred for cash. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)

Blossom Ltd. has these transactions related to intangible assets and goodwill in 2024 , its first year of operations: Jan. 2 Paid for a patent with an estimated useful life of five years for $36,020. The company that sold the patent to Collins registered the patent 10 years ago. Apr. 1 Acquired another company using cash and recorded goodwill of $293,900 as part of the purchase. July 1 Acquired a franchise for $235,600 cash. The franchise agreement is renewable without charge and not expected to expire. Sept. 1 Paid for research costs of $144,000. 30 Paid for development costs of $50,700. A marketable product has been identified and resources have been secured so that production will start next year. Dec. 31 Recorded annual amortization. 31 Tested the intangible assets for impairment. Fair values exceeded carrying amounts for all intangible assets. Also tested goodwill and determined that it had a fair value of $244,770. (a) Prepare the journal entries to record the above transactions. Assume all costs incurred during January through September were incurred for cash. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started