Question

Blossom Productions Corp. purchased equipment on March 1, 2021, for $46,000. The company estimated the equipment would have a useful life of three years and

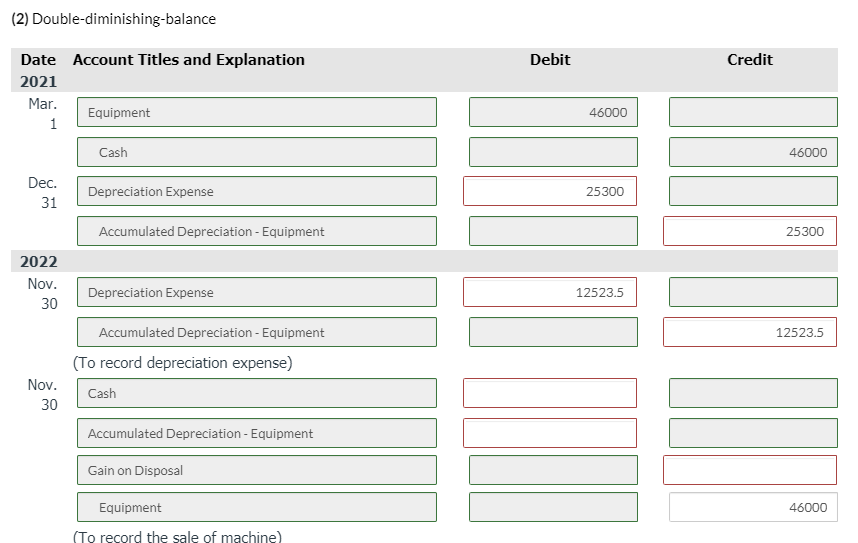

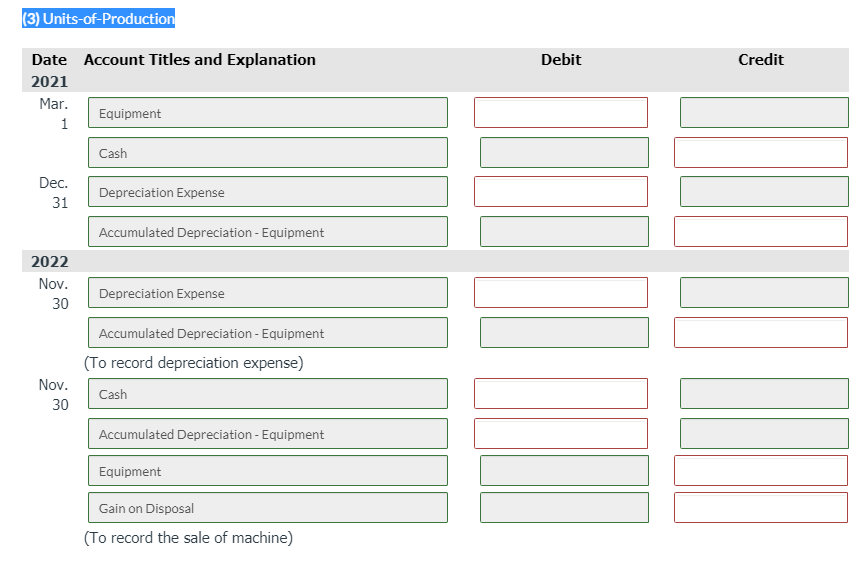

Blossom Productions Corp. purchased equipment on March 1, 2021, for $46,000. The company estimated the equipment would have a useful life of three years and produce 10,000 units, with a residual value of $10,000. During 2021, the equipment produced 4,000 units. On November 30, 2022, the machine was sold for $18,000 and had produced 5,500 units that year.

Record all the necessary journal entries for the years ended December 31, 2021 and 2022, using the following depreciation methods: (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round the depreciation rate in the double-diminishing-balance method to the nearest whole percent, e.g. 43% and round depreciation per unit in the units-of-production depreciation method to 2 decimal places, e.g. 2.25 and final answers to 0 decimal places, e.g. 5,275.) (1) Straight-line

(2) Double-diminishing-balance

(3) Units-of-Production

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started