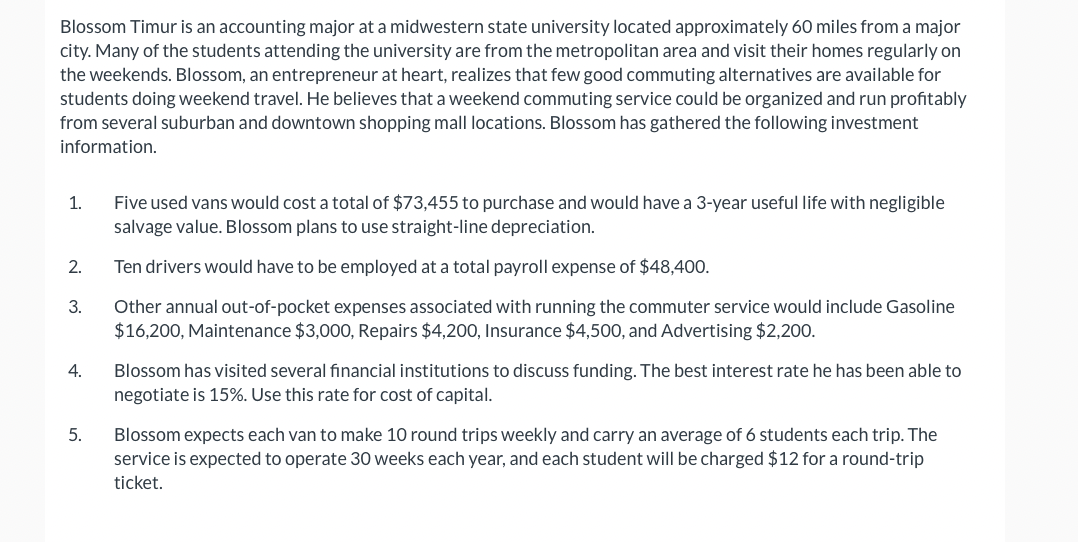

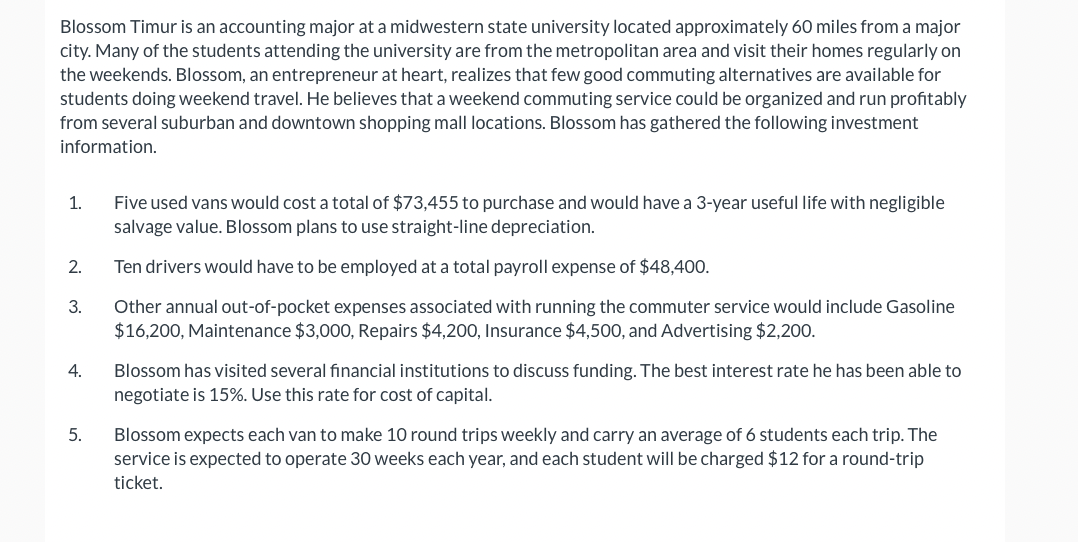

Blossom Timur is an accounting major at a midwestern state university located approximately 60 miles from a major city. Many of the students attending the university are from the metropolitan area and visit their homes regularly on the weekends. Blossom, an entrepreneur at heart, realizes that few good commuting alternatives are available for students doing weekend travel. He believes that a weekend commuting service could be organized and run profitably from several suburban and downtown shopping mall locations. Blossom has gathered the following investment information.

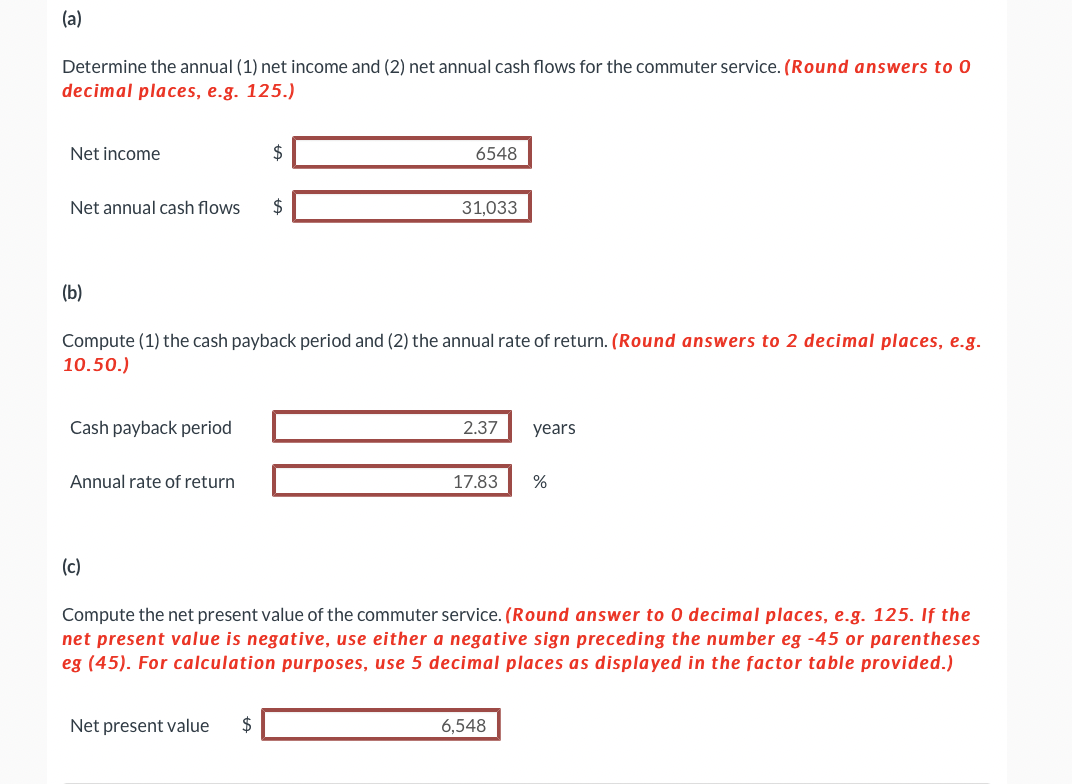

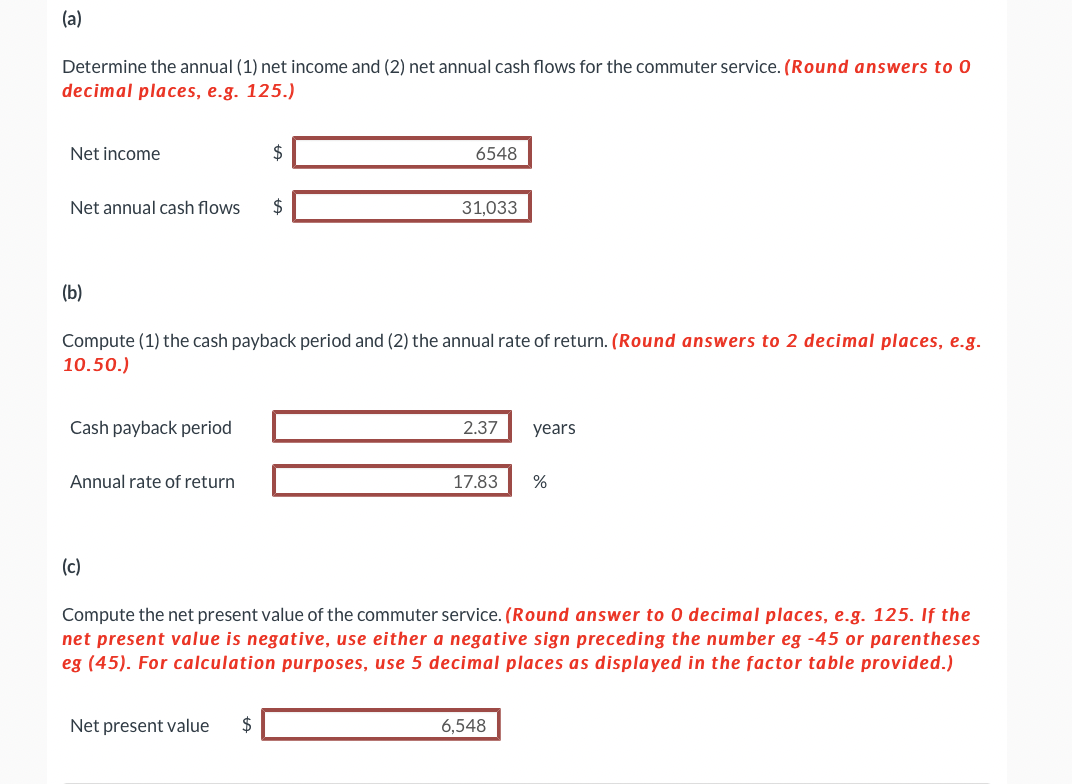

Blossom Timur is an accounting major at a midwestern state university located approximately 60 miles from a major city. Many of the students attending the university are from the metropolitan area and visit their homes regularly on the weekends. Blossom, an entrepreneur at heart, realizes that few good commuting alternatives are available for students doing weekend travel. He believes that a weekend commuting service could be organized and run profitably from several suburban and downtown shopping mall locations. Blossom has gathered the following investment information. 1. Five used vans would cost a total of $73,455 to purchase and would have a 3-year useful life with negligible salvage value. Blossom plans to use straight-line depreciation. 2. Ten drivers would have to be employed at a total payroll expense of $48,400. 3. Other annual out-of-pocket expenses associated with running the commuter service would include Gasoline $16,200, Maintenance $3,000, Repairs $4,200, Insurance $4,500, and Advertising $2,200. 4. Blossom has visited several financial institutions to discuss funding. The best interest rate he has been able to negotiate is 15%. Use this rate for cost of capital. 5. Blossom expects each van to make 10 round trips weekly and carry an average of 6 students each trip. The service is expected to operate 30 weeks each year, and each student will be charged $12 for a round-trip ticket. (a) Determine the annual (1) net income and (2) net annual cash flows for the commuter service. (Round answers to O decimal places, e.g. 125.) Net income $ 6548 Net annual cash flows $ 31,033 (b) Compute (1) the cash payback period and (2) the annual rate of return. (Round answers to 2 decimal places, e.g. 10.50.) Cash payback period 2.37 years Annual rate of return 17.83 % (c) Compute the net present value of the commuter service. (Round answer to 0 decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value $ 6,548