Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BLUE CORPORATION is a public entity whose shares are traded in the over-the-counter market. At December 31, 2020, BLUE CORPORATION had 3,000,000 authorized ordinary

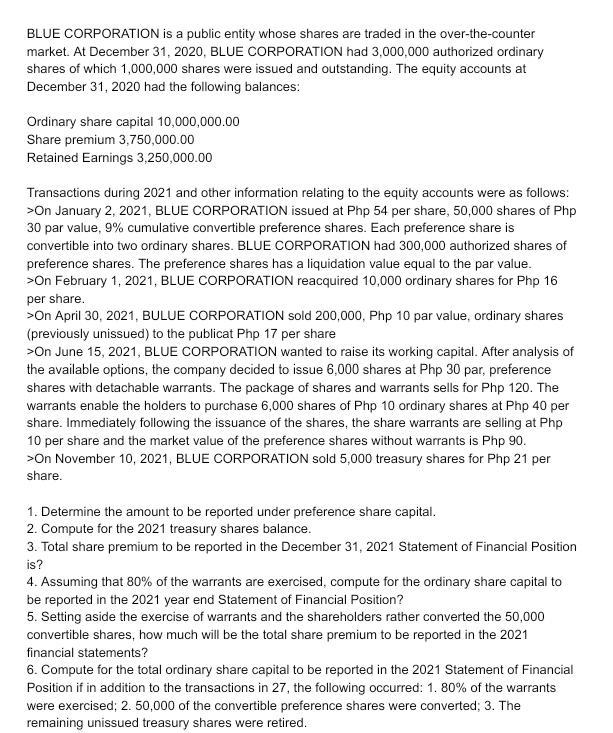

BLUE CORPORATION is a public entity whose shares are traded in the over-the-counter market. At December 31, 2020, BLUE CORPORATION had 3,000,000 authorized ordinary shares of which 1,000,000 shares were issued and outstanding. The equity accounts at December 31, 2020 had the following balances: Ordinary share capital 10,000,000.00 Share premium 3,750,000.00 Retained Earnings 3,250,000.00 Transactions during 2021 and other information relating to the equity accounts were as follows: >On January 2, 2021, BLUE CORPORATION issued at Php 54 per share, 50,000 shares of Php 30 par value, 9% cumulative convertible preference shares. Each preference share is convertible into two ordinary shares. BLUE CORPORATION had 300,000 authorized shares of preference shares. The preference shares has a liquidation value equal to the par value. >On February 1, 2021, BLUE CORPORATION reacquired 10,000 ordinary shares for Php 16 per share. >On April 30, 2021, BULUE CORPORATION sold 200,000, Php 10 par value, ordinary shares (previously unissued) to the publicat Php 17 per share >On June 15, 2021, BLUE CORPORATION wanted to raise its working capital. After analysis of the available options, the company decided to issue 6,000 shares at Php 30 par, preference shares with detachable warrants. The package of shares and warrants sells for Php 120. The warrants enable the holders to purchase 6,000 shares of Php 10 ordinary shares at Php 40 per share. Immediately following the issuance of the shares, the share warrants are selling at Php 10 per share and the market value of the preference shares without warrants is Php 90. >On November 10, 2021, BLUE CORPORATION sold 5,000 treasury shares for Php 21 per share. 1. Determine the amount to be reported under preference share capital. 2. Compute for the 2021 treasury shares balance. 3. Total share premium to be reported in the December 31, 2021 Statement of Financial Position is? 4. Assuming that 80% of the warrants are exercised, compute for the ordinary share capital to be reported in the 2021 year end Statement of Financial Position? 5. Setting aside the exercise of warrants and the shareholders rather converted the 50,000 convertible shares, how much will be the total share premium to be reported in the 2021 financial statements? 6. Compute for the total ordinary share capital to be reported in the 2021 Statement of Financial Position if in addition to the transactions in 27, the following occurred: 1. 80% of the warrants were exercised; 2. 50,000 of the convertible preference shares were converted; 3. The remaining unissued treasury shares were retired.

Step by Step Solution

★★★★★

3.67 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Deter mine the amount to be reported under preference share capital ANS WER Pre ference share capital 50 000 x Ph p 30 Ph p 1 500 000 00 EX PL AN ATION The amount to be reported under preference sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started