Question

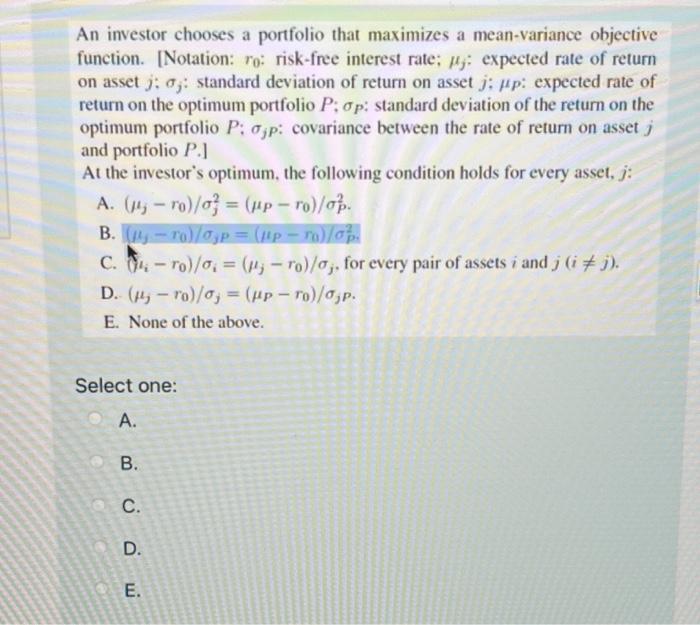

An investor chooses a portfolio that maximizes a mean-variance objective function. [Notation: ro: risk-free interest rate; : expected rate of return on asset j;

An investor chooses a portfolio that maximizes a mean-variance objective function. [Notation: ro: risk-free interest rate; : expected rate of return on asset j; o;: standard deviation of return on asset j: up: expected rate of return on the optimum portfolio P; op: standard deviation of the return on the optimum portfolio P: 0p: covariance between the rate of return on asset j and portfolio P.] At the investor's optimum, the following condition holds for every asset, j: A. (-ro)/3 = (up-ro)/op. B. (1y-To)/0p= (p - To)/0. C. -To)/0,= (-ro)/a,, for every pair of assets i and j (i j). D. (ro)/0,= (p - To)/0p. E. None of the above. Select one: A. --- B. C. D. E.

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 Question An investor chooses a portfolio that maximizes a meanva...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managing Supply Chain and Operations An Integrative Approach

Authors: Thomas Foster, Scott E. Sampson, Cynthia Wallin, Scott W Webb

1st edition

132832402, 978-0132832403

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App