blue outlines are the fill ins

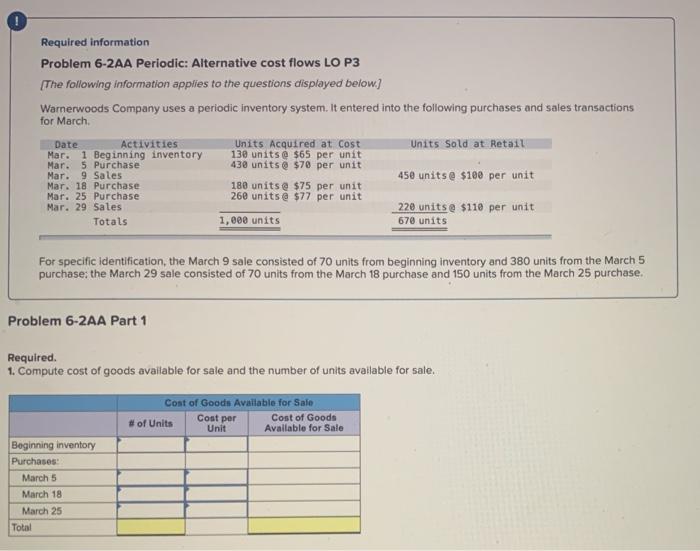

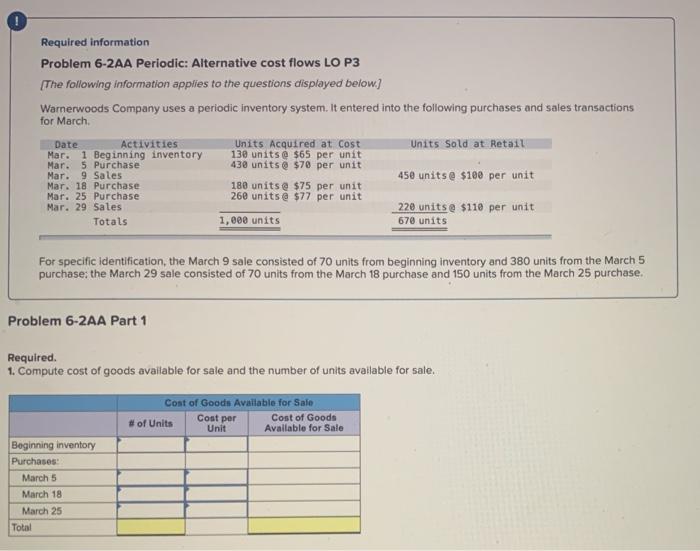

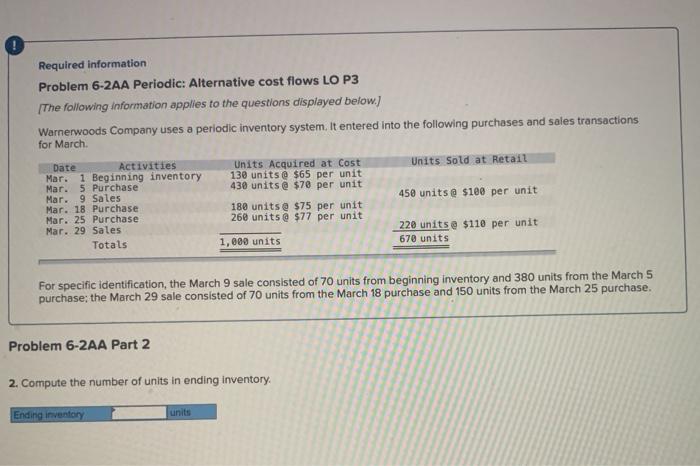

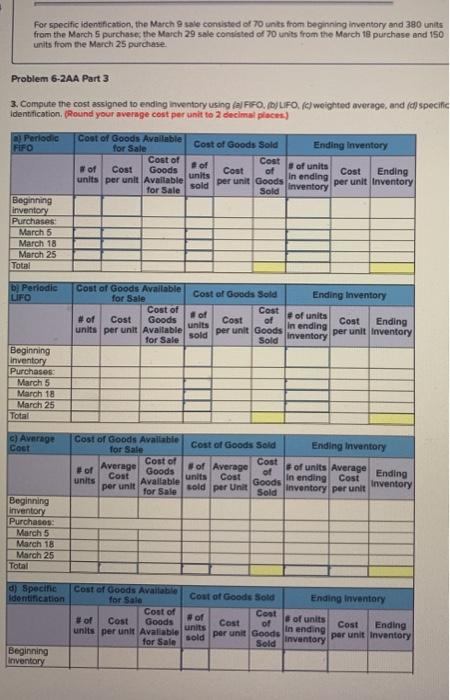

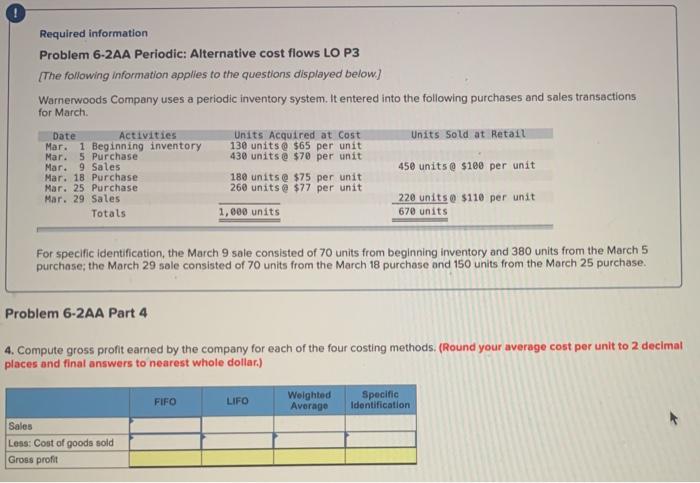

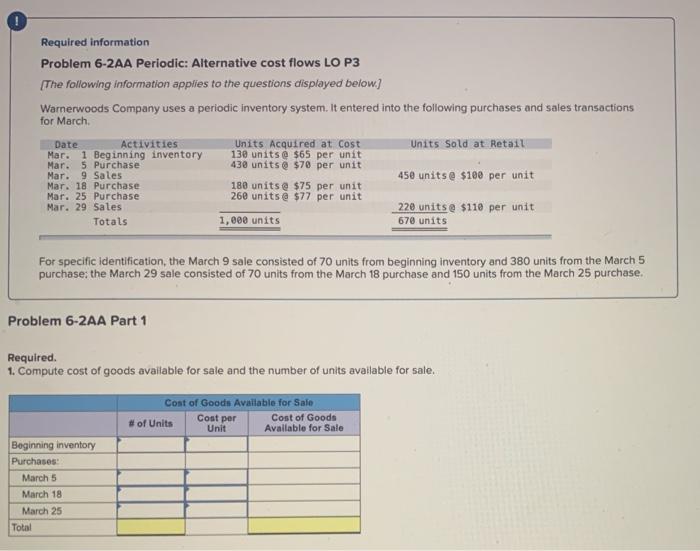

Required information Problem 6-2AA Periodic: Alternative cost flows LO P3 [The following information applies to the questions displayed below.) Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March Date Activities Units Acquired at cost Units sold at Retail Mar. 1 Beginning inventory 130 units@ $65 per unit Mar. 5 Purchase 438 units @ $70 per unit Mar. 9 Sales 450 units@ $100 per unit Mar. 18 Purchase 180 units@ $75 per unit Mar. 25 Purchase 260 units@ $77 per unit Mar. 29 Sales 220 units @ $110 per unit Totals 1,000 units 670 units For specific identification, the March 9 sale consisted of 70 units from beginning inventory and 380 units from the March 5 purchase the March 29 sale consisted of 70 units from the March 18 purchase and 150 units from the March 25 purchase. Problem 6-2AA Part 1 Required 1. Compute cost of goods available for sale and the number of units available for sale. Cost of Goods Available for Sale # of Units Cost per Cost of Goods Unit Available for Sale Beginning inventory Purchases March 5 March 18 March 25 Total Required information Problem 6-2AA Periodic: Alternative cost flows LO P3 The following information applies to the questions displayed below.) Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March Date Activities Units Acquired at Cost Units Sold at Retail Mar. 1 Beginning inventory 130 units @ $65 per unit Mar. 5 Purchase 430 units @ $70 per unit Mar. 9 Sales 450 units @ $100 per unit Mar. 18 Purchase 180 units@ $75 per unit Mar. 25 Purchase 260 units @ $77 per unit Mar. 29 Sales 220 units @ $110 per unit Totals 1,000 units 670 units For specific identification, the March 9 sale consisted of 70 units from beginning inventory and 380 units from the March 5 purchase; the March 29 sale consisted of 70 units from the March 18 purchase and 150 units from the March 25 purchase. Problem 6-2AA Part 2 2. Compute the number of units in ending inventory. Ending inventory For specific identification, the March 9 sale consisted of 70 units from beginning inventory and 380 units from the March Spurchase the March 29 sale consisted of 70 units from the March to purchase and 150 units from the March 25 purchase Problem 6-2AA Part 3 3. Compute the cost assigned to ending inventory usingfal FFO. DUFO. () weighted average and (d) specific Identification (Round your average cost per unit to 2 decimal places) Periodic FIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of # of of Cost Cost Goods Cost of of units Cost Ending units per unit Available units in ending per unit Goods sold per unit Inventory for Sale Sold inventory Beginning Inventory Purchases March 5 March 18 March 25 Total b) Periodic LIFO Gost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Cost # of Cost of Goods Cost of units units of Cost Ending units per unit Available in ending per unit Goods sold per unit Inventory for Sale Sold Inventory Beginning Inventory Purchases: March 5 March 18 March 25 Total c) Average Cost Cost of Goods Available Cost of Goods Sold for Sale Ending Inventory Cost of Cost #of Average of Average of of units Average Goods Cont units Cost units Ending Available In ending Cost Goods per unit sold per Unit for Sale Inventory Inventory per unit Sold Beginning inventory Purchases: March 5 March 18 March 25 Total d) Specine Identification Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Cost #of Cost #of Goods Cost of of units units Cost units per unit Avaliable in ending Ending sold per unit Goods per unit Inventory for Sale Inventory Sold Beginning Inventory Required information Problem 6-2AA Periodic: Alternative cost flows LO P3 [The following information applies to the questions displayed below) Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March Date Activities Units Acquired at Cost Units Sold at Retail Mar. 1 Beginning inventory 130 units @ $65 per unit Mar. 5 Purchase 430 units @ $70 per unit Mar. 9 Sales 450 units @ $100 per unit Mar. 18 Purchase 180 units@ $75 per unit Mar. 25 Purchase 260 units @ $77 per unit Mar. 29 Sales 220 units @ $110 per unit Totals 1,000 units 670 units For specific identification, the March 9 sale consisted of 70 units from beginning inventory and 380 units from the March 5 purchase; the March 29 sole consisted of 70 units from the March 18 purchase and 150 units from the March 25 purchase. Problem 6-2AA Part 4 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places and final answers to nearest whole dollar) FIFO LIFO Weighted Average Specific Identification Sales Less: Cost of goods sold Gross profit