Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blue Oyster is considering investing in a project whose risk is greater than the firm's current risk level based on any method for assessing risk.

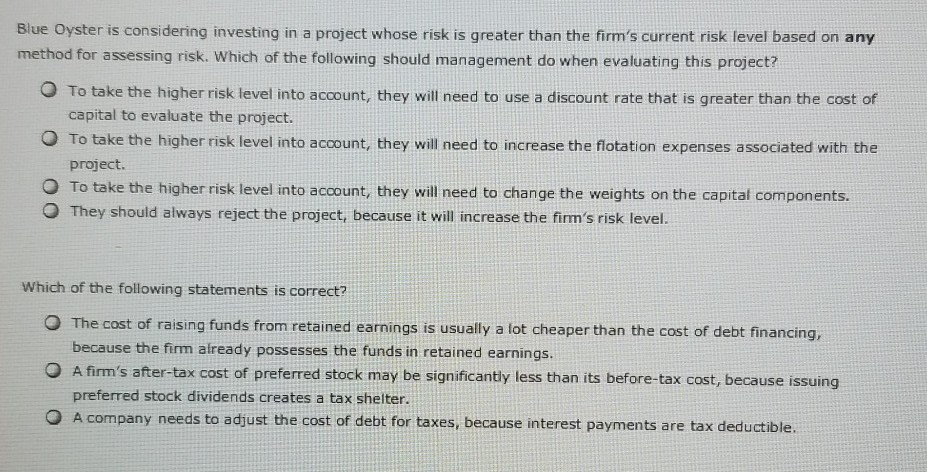

Blue Oyster is considering investing in a project whose risk is greater than the firm's current risk level based on any method for assessing risk. Which of the following should management do when evaluating this project? To take the higher risk level into account, they will need to use a discount rate that is greater than the cost of capital to evaluate the project. To take the higher risk level into account, they will need to increase the flotation expenses associated with the project. To take the higher risk level into account, they will need to change the weights on the capital components. They should always reject the project, because it will increase the firm's risk level. Which of the following statements is correct? O The cost of raising funds from retained earnings is usually a lot cheaper than the cost of debt financing, because the firm already possesses the funds in retained earnings. A firm's after-tax cost of preferred stock may be significantly less than its before-tax cost, because issuing preferred stock dividends creates a tax shelter. A company needs to adjust the cost of debt for taxes, because interest payments are tax deductible. O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started