Answered step by step

Verified Expert Solution

Question

1 Approved Answer

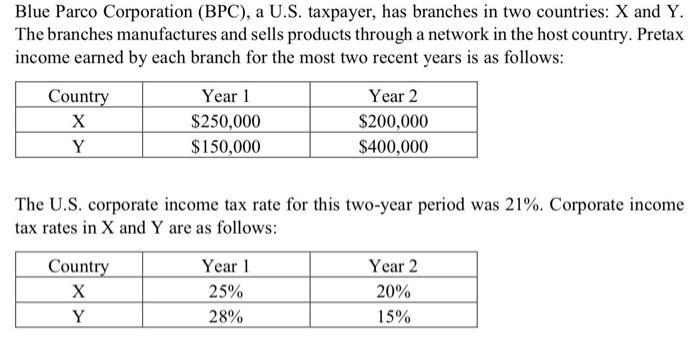

Blue Parco Corporation (BPC), a U.S. taxpayer, has branches in two countries: X and Y. The branches manufactures and sells products through a network

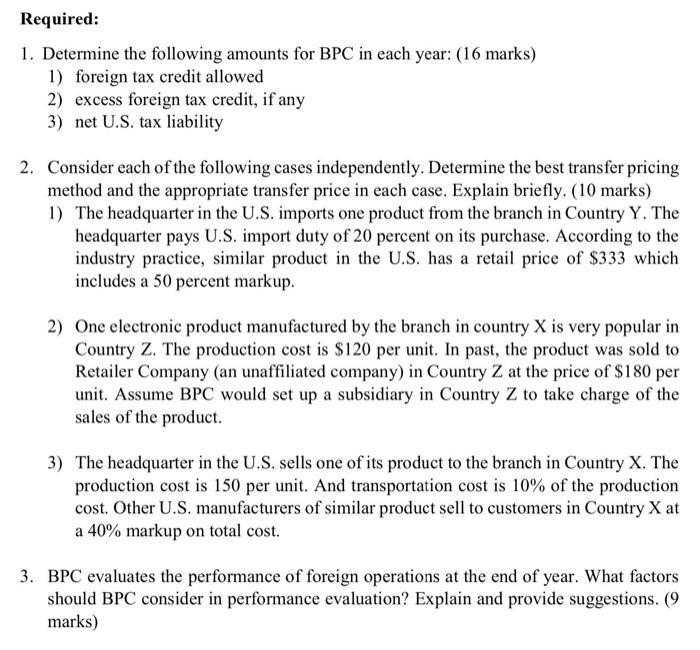

Blue Parco Corporation (BPC), a U.S. taxpayer, has branches in two countries: X and Y. The branches manufactures and sells products through a network in the host country. Pretax income earned by each branch for the most two recent years is as follows: Year 1 $250,000 Country X Y $150,000 Year 2 $200,000 $400,000 The U.S. corporate income tax rate for this two-year period was 21%. Corporate income tax rates in X and Y are as follows: Country X Year 1 25% Y 28% Year 2 20% 15% Required: 1. Determine the following amounts for BPC in each year: (16 marks) 1) foreign tax credit allowed 2) excess foreign tax credit, if any 3) net U.S. tax liability 2. Consider each of the following cases independently. Determine the best transfer pricing method and the appropriate transfer price in each case. Explain briefly. (10 marks) 1) The headquarter in the U.S. imports one product from the branch in Country Y. The headquarter pays U.S. import duty of 20 percent on its purchase. According to the industry practice, similar product in the U.S. has a retail price of $333 which includes a 50 percent markup. 2) One electronic product manufactured by the branch in country X is very popular in Country Z. The production cost is $120 per unit. In past, the product was sold to Retailer Company (an unaffiliated company) in Country Z at the price of $180 per unit. Assume BPC would set up a subsidiary in Country Z to take charge of the sales of the product. 3) The headquarter in the U.S. sells one of its product to the branch in Country X. The production cost is 150 per unit. And transportation cost is 10% of the production cost. Other U.S. manufacturers of similar product sell to customers in Country X at a 40% markup on total cost. 3. BPC evaluates the performance of foreign operations at the end of year. What factors should BPC consider in performance evaluation? Explain and provide suggestions. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started