Answered step by step

Verified Expert Solution

Question

1 Approved Answer

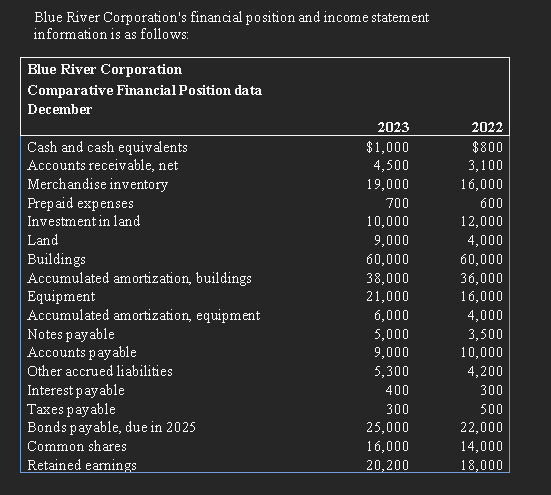

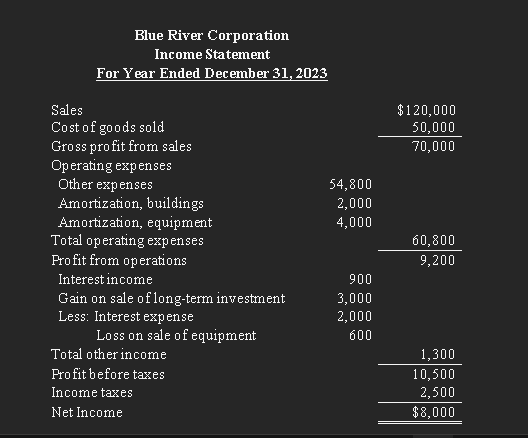

Blue River Cornoration's financial nosition and income statement. Blue River Corporation Income Statement For Year Ended December 31, 2023 Sales Cost of goods sold Gross

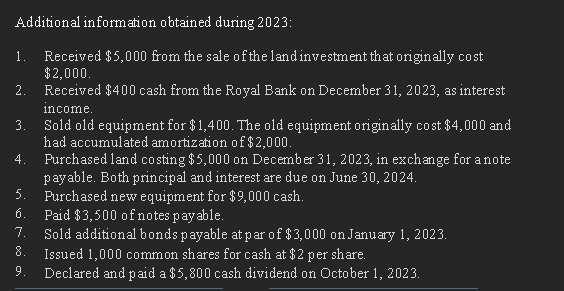

Blue River Cornoration's financial nosition and income statement. Blue River Corporation Income Statement For Year Ended December 31, 2023 Sales Cost of goods sold Gross profit from sales Operating expenses Other expenses Amortization, buildings Amortization, equipment Total operating expenses Frofit from operations Interest income Gain on sale of long-term investment Less: Interest expense Loss on sale of equipment Total other income Frofit before taxes Income taxes Net Income $120,00050,00070,000 54,800 2,000 4,000 9,20060,800 900 3,000 2,000 600 1,30010,5002,500$8,000 Frepare a statement of cash flows for Blue River Corporation. \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Blue River Corporation } \\ \hline \multicolumn{2}{|c|}{ For the Year Ended December 31,2023 } \\ \hline Cash flows from operating activities: & \\ \hline & \\ \hline Insert your answers in the excel templ ate provided & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline Cash flows from investing activities: & \\ \hline & \\ \hline & \\ \hline & \\ \hline Cash flows from financing activities: & \\ \hline & \\ \hline & \\ \hline & \\ \hline Cash balance beginning of year & \\ \hline Cash balance end of year & \\ \hline \end{tabular} Additional information obtained during 2023 : 1. Received $5,000 from the sale of the land investment that originally cost $2,000. 2. Received $400 cash from the Royal Bank on December 31,2023 , as interest income. 3. Sold old equipment for $1,400. The old equipment originally cost $4,000 and had accumulated amortization of $2,000. 4. Purchased land costing $5,000 on December 31,2023 , in exchange for a note payable. Both principal and interest are due on June 30, 2024. 5. Purchased new equipment for $9,000 cash. 6. Paid $3,500 of notes payable. 7. Sold additional bonds payable at par of $3,000 on January 1,2023 . 8. Issued 1,000 common shares for cash at $2 per share. 9. Declared and paid a $5,800 cash dividend on October 1,2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started