Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blue Thunder was formed many years ago. It had acquired a number of subsidiaries and associates locally, including an 80 percent interest in subsidiary

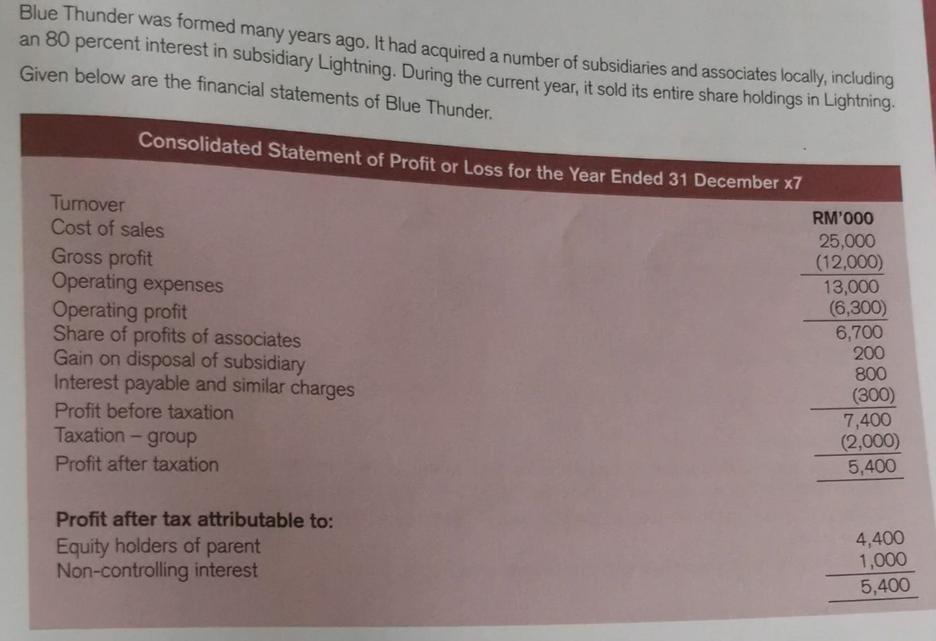

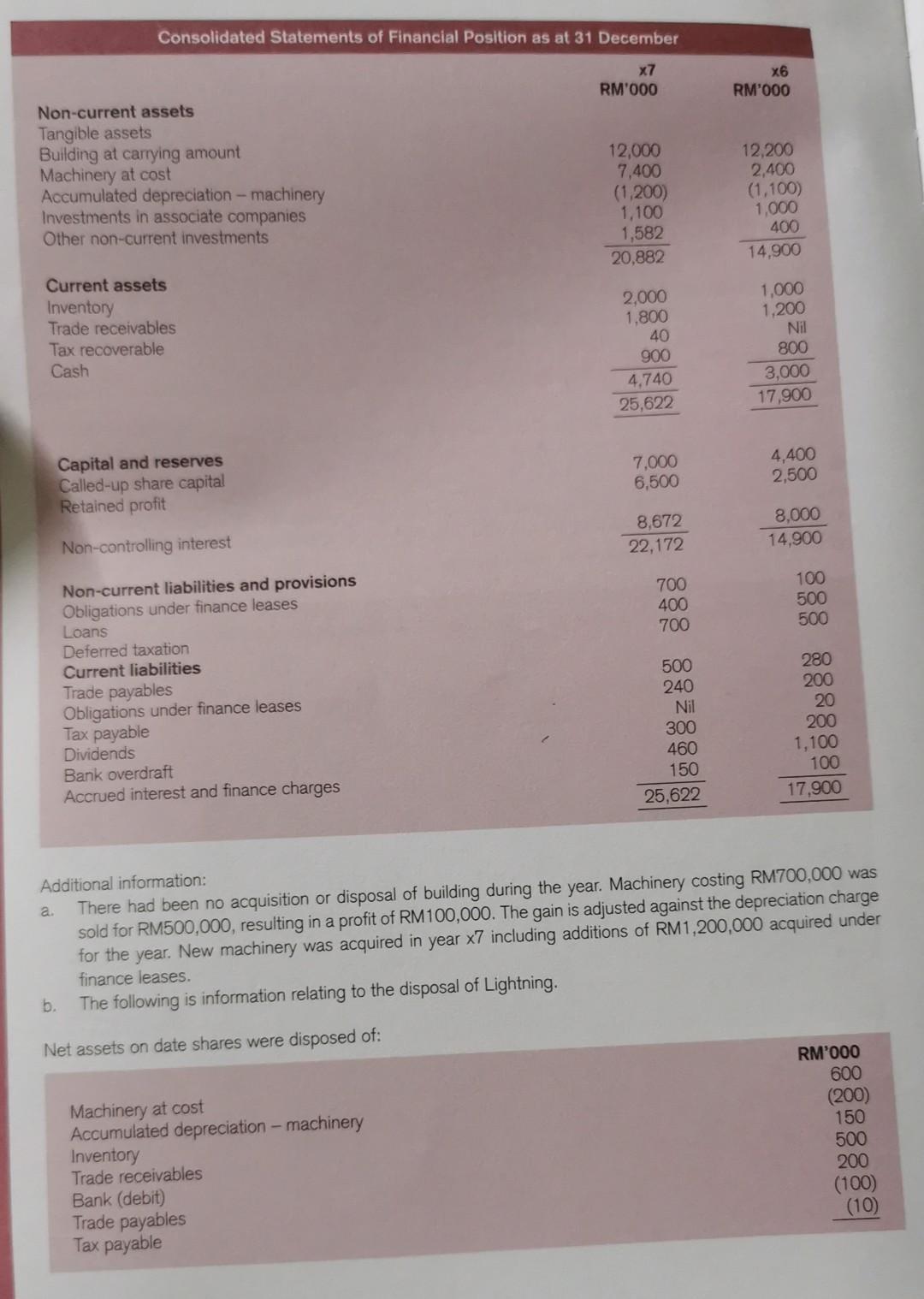

Blue Thunder was formed many years ago. It had acquired a number of subsidiaries and associates locally, including an 80 percent interest in subsidiary Lightning. During the current year, it sold its entire share holdings in Lightning. Given below are the financial statements of Blue Thunder. Consolidated Statement of Profit or Loss for the Year Ended 31 December x7 Turnover Cost of sales Gross profit Operating expenses Operating profit Share of profits of associates Gain on disposal of subsidiary Interest payable and similar charges Profit before taxation Taxation-group Profit after taxation Profit after tax attributable to: Equity holders of parent Non-controlling interest RM'000 25,000 (12,000) 13,000 (6,300) 6,700 200 800 (300) 7,400 (2,000) 5,400 4,400 1,000 5,400 Non-current assets Tangible assets Building at carrying amount Machinery at cost Accumulated depreciation - machinery Investments in associate companies Other non-current investments Consolidated Statements of Financial Position as at 31 December x7 RM'000 Current assets Inventory Trade receivables Tax recoverable Cash a. b. Capital and reserves Called-up share capital Retained profit Non-controlling interest Non-current liabilities and provisions Obligations under finance leases Loans Deferred taxation Current liabilities Trade payables Obligations under finance leases Tax payable Dividends Bank overdraft Accrued interest and finance charges Machinery at cost Accumulated depreciation - machinery 12,000 7,400 (1,200) 1,100 1,582 20,882 Inventory Trade receivables Bank (debit) Trade payables Tax payable 2,000 1,800 40 900 4,740 25,622 7,000 6,500 8,672 22,172 700 400 700 500 240 Nil 300 460 150 25,622 x6 RM'000 12,200 2,400 (1,100) 1,000 400 14,900 1,000 1,200 Nil 800 3,000 17,900 4,400 2,500 Additional information: There had been no acquisition or disposal of building during the year. Machinery costing RM700,000 was sold for RM500,000, resulting in a profit of RM100,000. The gain is adjusted against the depreciation charge for the year. New machinery was acquired in year x7 including additions of RM1,200,000 acquired under finance leases. The following is information relating to the disposal of Lightning. Net assets on date shares were disposed of: 8,000 14,900 100 500 500 280 200 20 200 1,100 100 17,900 RM'000 600 (200) 150 500 200 (100) (10) Consolidated Statement of Cash Flows 725 The purchase consideration was all in cash. All goodwill on consolidation for associates and subsidiaries have been fully written off prior to year x7. Required: Prepare the consolidated statement of cash flows for Blue Thunder.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here are the workings to extract information from the consolidated financial statements of Blue Thun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started