Answered step by step

Verified Expert Solution

Question

1 Approved Answer

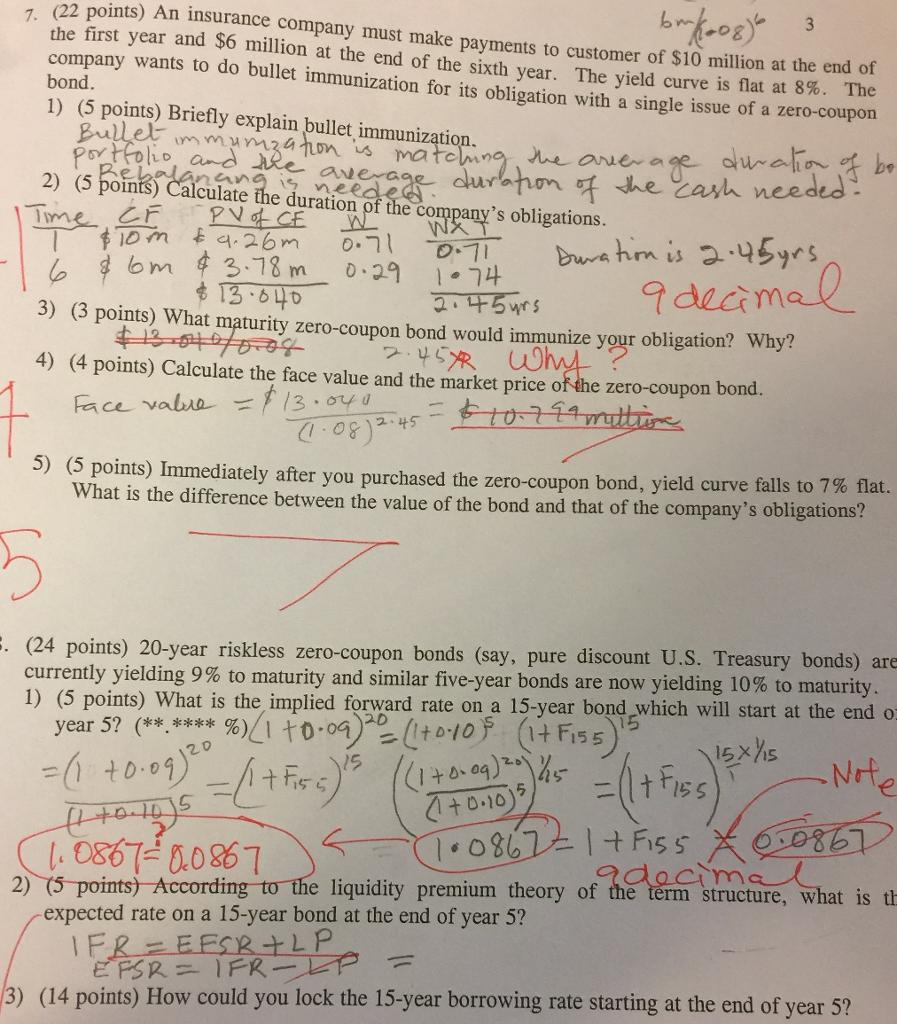

bm (08) 6 3 7. (22 points) An insurance company must make payments to customer of $10 million at the end of the first

bm (08) 6 3 7. (22 points) An insurance company must make payments to customer of $10 million at the end of the first year and $6 million at the end of the sixth year. The yield curve is flat at 8%. The company wants to do bullet immunization for its obligation with a single issue of a zero-coupon bond. 1) (5 points) Briefly explain bullet immunization. be Bullet portfolio and the immunization is matching the average duration of 2) (5 points) Calculate the duration of the company's obligations. Bekalan ang is average duration of the cash needed- Time CF PV of CE $10m & 4.26m WXT 0.71 6 & bm $ 3.78 m $13.040 1.74 2.45yrs 3) (3 points) What maturity zero-coupon bond would immunize your obligation? Why? $13.01/0.08 2.45XR why 4) (4 points) Calculate the face value and the market price of the zero-coupon bond. Face value = $13.040 $10.799 million 0.71 0.29 (108) 2.45 Duration is 2.45yrs 9 decimal 5) (5 points) Immediately after you purchased the zero-coupon bond, yield curve falls to 7% flat. What is the difference between the value of the bond and that of the company's obligations? 5 E. (24 points) 20-year riskless zero-coupon bonds (say, pure discount U.S. Treasury bonds) are currently yielding 9% to maturity and similar five-year bonds are now yielding 10% to maturity. 1) (5 points) What is the implied forward rate on a 15-year bond which will start at the end o year 5? (****** 120 20 %) t-na (0-105 (FI55) (1+0+09) 20) 11/25 (1+0.10) 5 15 = (1 +0.09) = (1 + Fix=;) '5 (1+0+10)5 15 x/15 -Note 1.0867 -0.0867 2) (5 points) According to the liquidity premium theory of the term structure, what is th expected rate on a 15-year bond at the end of year 5? IFR = EFSR +LP EFSR= IFR-LP = 3) (14 points) How could you lock the 15-year borrowing rate starting at the end of year 5? = tiss 10867 = 1 + F155 X 0.0867 adecimal

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1A bullet immunization is an immunization strategy in which an investor buys a bond with a single payment at the beginning of the investment period The investor holds the bond until it matures at whic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started